2020 resolution: Resolve to let go of your home country bias

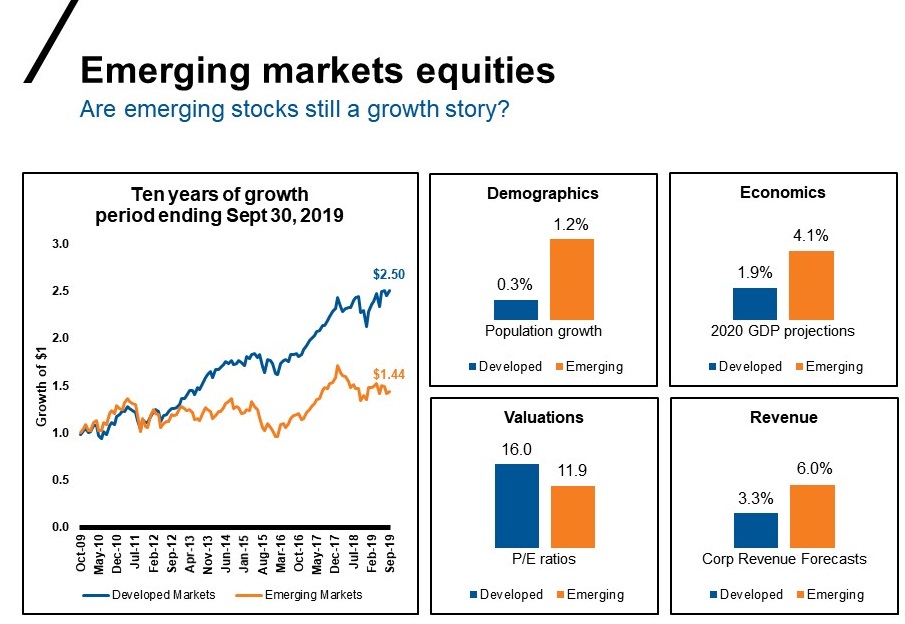

As we begin a new year and a new decade, the time has never been better to look forward and re-invent your investment philosophy and strategy. Often thought of as highly volatile, you may be surprised at how emerging markets have evolved over the past 20 years. At the turn of the century, emerging markets were a niche asset class, but the environment and the opportunity set are very different today. Emerging markets now make up about 40% of the global economy, and according to the International Monetary Fund (IMF), by 2035 they are expected to represent almost 60%.1

Investing in emerging markets used to mean being heavily exposed to commodities. However, they are now more of a technology play—particularly in China and India. Moreover, the divide between developed and developing countries is converging.

After a decade in which U.S. assets have outperformed most other asset classes, and given where we are in the the market cycle, it is not a matter of if but when and how to approach repositioning your book to be forward-looking. As we are constantly reminded, past performance and trends are no indication of future performance and trends: what worked for you over the past 10 years is unlikely to work for the next 10.

Evolving your investment philosophy and positioning in 2020

At Russell Investments, our research and analysis of advisors’ strategic asset allocations indicate that many advisors still struggle with their respective regional and home-country biases, and largely ignore the missed opportunities that global diversification presents. As you think about the evolution of your forward-looking investment philosophy and positioning in 2020, here are four things we believe you should consider:

- Of the nearly 200 countries in the world, more than 160, or 80%, are classified as emerging. The primary tool for such classification is a measurement of wealth, most frequently expressed as gross domestic product (GDP) per capita.2

- Total wealth in emerging-market stocks and bonds now exceeds $25 trillion, bigger than the economies of the U.S. and Germany combined.3

- Many developing countries do not have the same challenges with updating legacy technologies, infrastructure or platforms that developed countries face—so they can intentionally leapfrog over investment in outdated technology, such as snail mail, printing currencies, bank machines, traditional phonelines and other old economy infrastructure.

Click image to enlarge

Sources: MSCI Indexes, Developed Markets: MSCI World ex-US Index, Emerging Markets: MSCI Emerging Markets Index, GDP Data from International Monetary Fund, Demographics: worldmeters. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

- Country matters – Emerging markets are not a homogenous zone4: they are very diverse. We suggest you have exposure exposure in countries that have the potential to be relative outperformers over time. Here are some countries we think you may want to consider having on your radar in 2020:

- Brazil – A newly elected government is pursuing business and tax reforms, which signals that opportunities for investment may lie in energy, infrastructure and financial services.5

- Vietnam – The trade war between China and the U.S. has hurt China’s economy and caused some producers to move their manufacturing operations to Vietnam, Indonesia and Thailand.6

- NIMPTs – Nigeria, Indonesia, Mexico, Philippines and Turkey are collectively expected to provide exciting growth opportunities for consumer goods and manufacturing. While smaller than their BRICS counterparts (Brazil, Russia, India, China, South Africa), the NIMPT countries have similar levels of purchasing power on a per capita basis.

Global growth driven by emerging economies

You may be wondering, ok so, what should my exposure to emerging markets be?

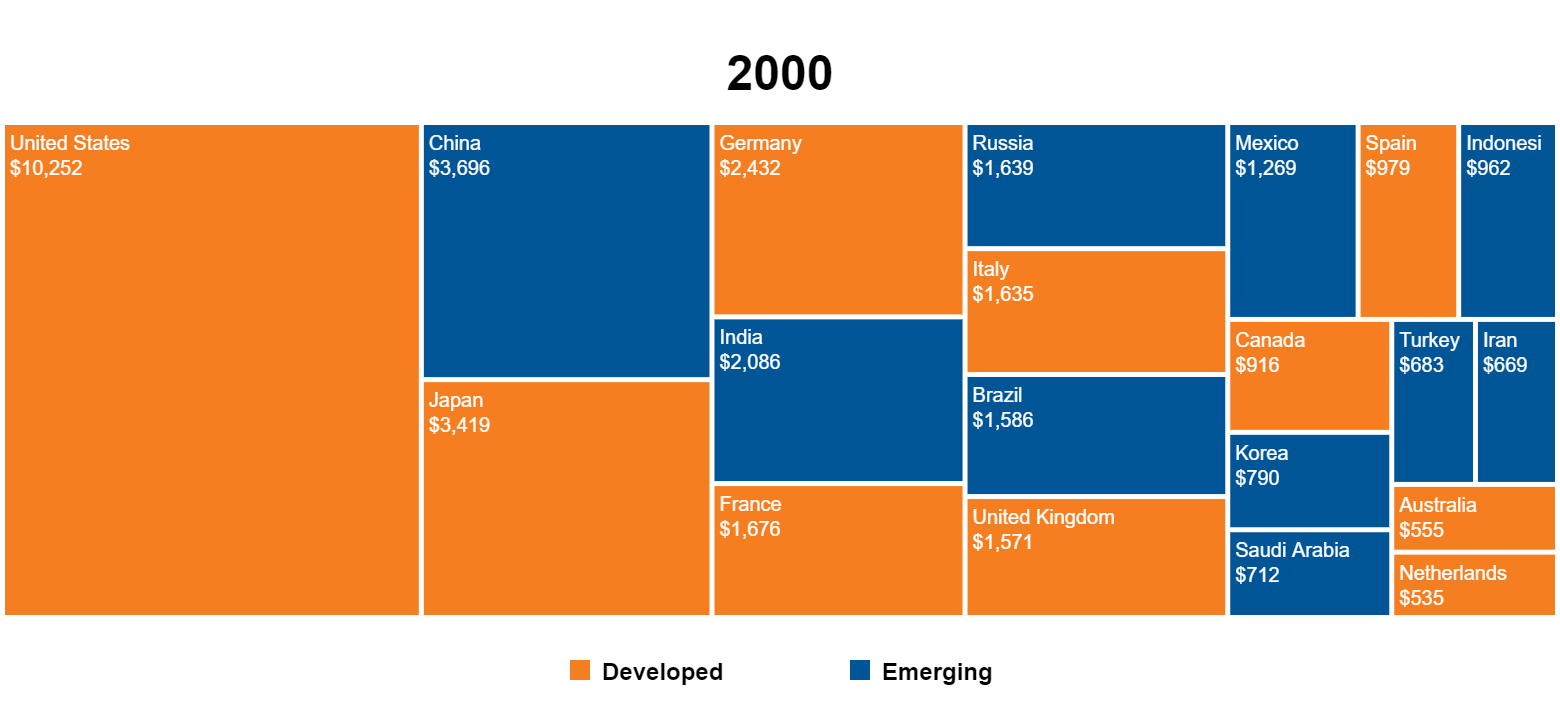

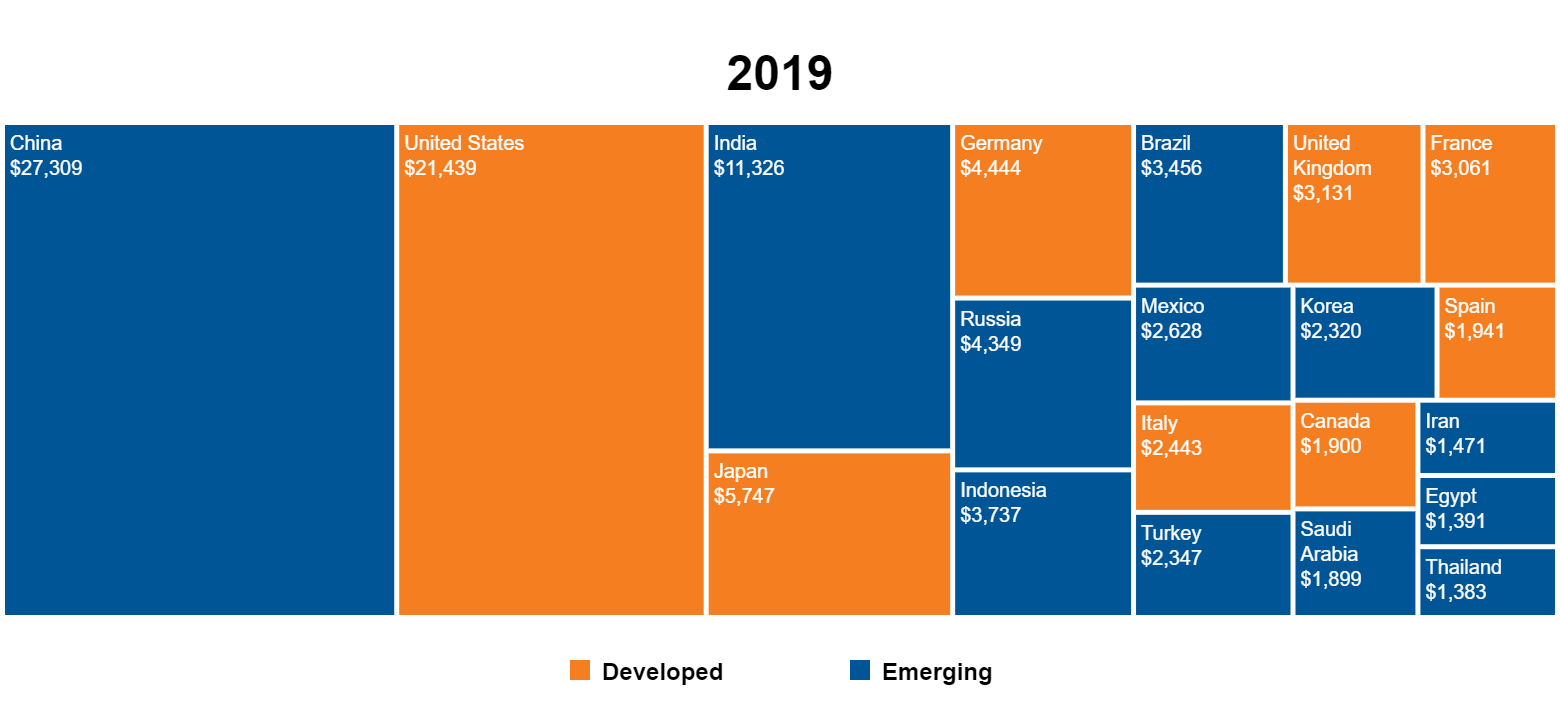

Consider the charts below, which illustrate past (2000) vs. current (2019) country GDP, based on PPP (purchasing power parity).

Click images to enlarge

Source: Russell Investments, International Monetary Fund, as of October 31, 2019. In USD.

Many institutional and pension portfolio managers are shifting the percentage of their portfolios allocated to emerging markets to a range in the high teens to low 20s.8

The portfolio role of investing outside your borders

At Russell Investments we believe that investing outside your borders can help diversify a portfolio and smooth out returns. Although some critics of international diversification assert that it does not protect investors from short-term market shocks, according to a 2018 study by Asness, Isrealov & Liew in Financial Analysts Journal, over longer time horizons, “underlying economic growth matters more than short-lived panics with respect to returns, and international diversification does an excellent job of protecting investors.”9

The bottom line

The important thing is to recognize that you potentially have a home-country bias and accept that it’s normal to feel safer close to home. Realize though, in our view, that excluding international exposures may weaken the long-term performance of your clients’ portfolios.

As with most investing biases, overcoming your home-country bias requires intention, discipline and a curiosity about the world and how it is evolving around us. Welcome to a new decade, and with it, the opportunity to redesign and construct your new forward-looking investment philosophy that incorporates the global opportunity set.

1 https://www.imf.org/external/datamapper/PPPSH@WEO/OEMDC/ADVEC/WEOWORLD

2 https://www.ashmoregroup.com/sites/default/files/article-docs/MC_10%20May18_2.pdf

4 https://www.agf.com/us/insights/podcasts/

5 https://www.robeco.com/en/insights/

6 https://www.agf.com/us/insights/podcasts/

8 https://www.cppinvestments.com/about-us & https://www.agf.com/us/insights/podcasts/