Going Global: Finding Opportunities in a World of Uncertainty

If your clients are nervous about what’s happening in the U.S. and Canadian markets, have you considered suggesting they increase their international exposure? If you haven’t, we think you should. It’s a safe bet that few Canadian investors are looking to increase their non-domestic allocation right now. Between conflict in Europe, soaring inflation, and supply-chain issues, investor perception of the benefits of global diversification may be in flux. The recent bout of increased volatility in financial markets may have made clients even more uncertain about investing at all, let alone in unfamiliar asset classes.

But in the face of uncertainty, we continue to believe in the opportunities available beyond Canada’s borders. Diversification remains an invaluable strategy to protect client portfolios from inflation, reduce home-country bias and gain exposure to new industries. More importantly, diversifying a portfolio globally may help reduce risk while potentially enhancing total returns by ensuring all your clients’ “eggs” aren’t in one basket.

To help your clients see the benefits of “going global”, keep reading! Below, I’ve included some stories that illustrate the potential benefits of global investing by drawing parallels to one of my passions- fantasy football. Each of these stories contains proof points for those clients who may need a little extra convincing. When it comes to uncertainty, a good story can be worth a thousand words.

The Past Isn’t the Future

I’m crazy about Fantasy Football – to the point where it consumes more of my time than I’m willing to admit! Before the start of every season, I analyze data focusing on each player’s past performance, and when I draft my team, I tend to select the highest-scoring players from previous years. This past year, I got the first pick and true to form, I chose last year’s top-performing player. Big mistake. Just two weeks into the season, he suffered an injury and was out for the rest of the year. I quickly realized that my strategy for selecting a team wasn’t foolproof as other players were injured during the season, affected by coaching, trades, or team dynamics. When all the dust settled, I finished in last place.

Lesson learned? When selecting a winning team, there is so much more that needs to be considered than just what worked last year.

Football is a game of uncertainty, much like financial markets. Consider Canadian Large Cap Equities – This asset class finished as the top performer in 2021, but that is no indication it will perform similarly this year. The harsh lesson I learned from Fantasy Football can also be applied to financial markets. Asset class performance, much like players’ stats, fluctuates each year due to factors out of your control. Consider the quilt chart below: It illustrates the continuous change of market leadership and reinforces the notion that just because it worked last year, doesn’t mean it will work this year.

Click image to enlarge

Annual Total Returns (%) for Key Market Indexes (2001 - 2021)

Source: Morningstar Direct, Russell Investments. Annualized return in CAD. Canadian equity=S&P/TSX Composite Index, US Equity=S&P 500 Index, International Equity=MSCI EAFE Index, Emerging Markets=MSCI Emerging Markets Index, Canada Bonds=S&P Canada Aggregate Bond Index, Emerging Markets Debt= JP Morgan Emerging Market Bond Index, Global High Yield=Bloomberg Global High Yield Index, Global Infrastructure=S&P Global Infrastructure Index, Global Real Estate Investment Trusts (REITs)=FTSE EPRA NAREIT Developed REITS Index, Commodities= S&P Goldman Sachs Commodities Index, Indexes are unmanaged and cannot be invested in directly. Past performance is not indicative of future results. Index performance does not include fees and expenses an investor would normally incur when investing in a mutual fund. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets.

Hedge Your Bets

In all my years playing Fantasy Football, I have yet to see a season go undisrupted in one way or another. Disruptions are a source of stress, but if handled correctly, they can also create opportunities. Each week during the season, managers attempt to pick up players across various positions, hoping to add depth to their team to protect from uncontrollable factors. Without a crystal ball, it is impossible to know what will happen week to week, so I hedge risk by adding player depth across multiple positions to hopefully improve the outcome.

The Canadian economy continues to be driven by the performance of several key sectors. Energy, Financials, Industrials, and Materials represent nearly 75% of the S&P/TSX Composite Index and have historically demonstrated some degree of correlation.1 The small weights to sectors such as information technology (5.4%) and healthcare (0.4%) are dominated by a few key players.2

Advisors who seek to build “all-season” portfolios know the best recipe for success continues to be strategic hedging through diversification. For Canadian investors, that means looking outside our borders to obtain geographic, industry, manager, and style differentiation. For example, the biggest companies in Germany’s DAX index are carmakers and software solutions, while the UK’s FTSE index heavyweights are a mix of energy, consumer goods, banking, and pharmaceuticals. Japan’s Nikkei 225, meanwhile, is dominated by car companies and consumer electronics3.

Just as you can’t win Fantasy Football with only one player or position, investment teams require distinct capabilities across diverse axes. By diversifying globally, investors can avoid a single-country bias while also eliminating industry sector bias and concentration.

Run Where the Ball is Going

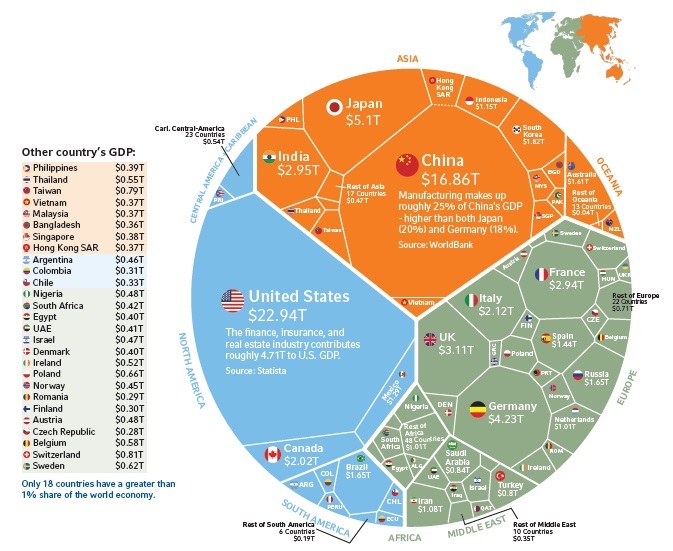

Today’s world is drastically different from that of years past. Emerging Markets (EM) now make up almost 50% of the global economy but still represent only a small part of investor portfolios in Canada4. According to the International Monetary Fund, by 2035 emerging markets are expected to represent almost 60% of the global economy – a significant potential for growth. With Canada representing a mere 3.3% of global market capitalization5, there is a strong case to be made for investing abroad in geographic regions experiencing rapid industrialization and strong demographic growth. Given increased volatility and unfamiliarity, it can be challenging to get clients onside with exposure to emerging markets. Try putting things in perspective with the visual below: it’s designed to articulate the opportunity set that is missed when developed markets are favored. Being a thought leader to your clients by both constructing and rationalizing a strategic asset allocation can help frame future conversations for success.

Click image to enlarge

Global GDP

Gross Domestic Product (GDP) serves as a barometer for a country's economic health. It measures the total market value of final goods and services produced in a country during a given year.

Together, the U.S. and China account for 42% of global GDP. Here is GDP by country, according to International Monetary Fund (IMF) estimates (in USD).

Source: IMF (2021)

1Source: World stocks represented by MSCI World Stocks Index; Canada represents 3.3% of this index as of December 31, 2021.

Bottom Line

We know it can be difficult to venture into unknown territory. As humans, we prefer the familiar. That’s why most of us generally buy the same brand of pizza or beer. We feel the same way when we invest. It’s comforting to recognize the names of the companies we hold or the players we draft. But the world is changing, and perceptions of the opportunities available may need to change too.

Russell Investments has long advocated a multi-asset approach that invests across a wide range of global asset classes (e.g., equities, fixed income, infrastructure companies, real estate, and commodities) taking into account factors, such as valuation, business cycle and sentiment to increase the likelihood of achieving one's desired outcomes. Including a global allocation is integral to that approach.

It’s a big world; investors who are willing to go global may do their portfolios a big favor.

1Source: S&P/Dow Jones Indices. As of May 31, 2022. https://www.spglobal.com/spdji/en/indices/equity/sp-tsx-composite-index/#overview

2S&P/Dow Jones Indices.

3Source: https://companiesmarketcap.com/

4Source: World Economics. https://www.worldeconomics.com/Regions/Emerging-Markets/

5Source: World stocks represented by MSCI World Stocks Index; Canada represents 3.3% of this index as of December 31, 2021