The coronavirus market selloff: 3 watchpoints for markets

Is the current rout in markets the beginning of an extended pullback?

Shaken by fears of an expanding coronavirus outbreak, financial markets—which already came under pressure late last week—sold off aggressively in last Monday’s trading session, with the Dow Jones Industrial Average plunging over 1,000 points. The S&P 500® Index tumbled 3.4% by last Monday’s close, while the yield on the benchmark 10-year U.S. Treasury note neared an all-time of low of 1.356%. The S&P/TSX Composite Index lost 1.6% on the day. Markets continued to sell off last week but have recovered slightly this week*.

It goes without saying that pandemics pose a downside risk to the global business cycle. Quite simply, they disrupt economic activity and corporate profits through a number of channels. For example:

- Containment efforts – Closed factories means no output is produced

- Supply chains – The reliance on an impacted area, such as the Wuhan region of China, for intermediate inputs can delay deliveries

- Tourism – Travel controls and fear can slow dependent service industries

- Spending – Consumers may defer discretionary purchases by avoiding busy retail centers

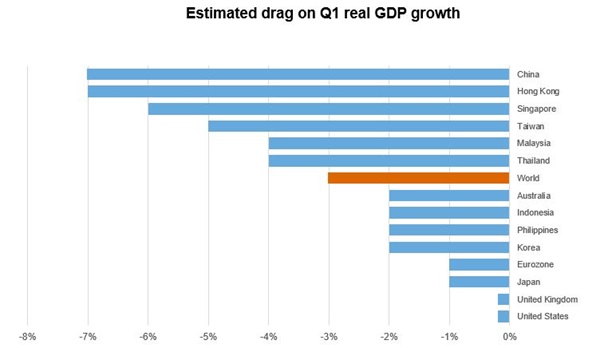

It’s clear from the high frequency data coming out of China that we are on track for a rather large hit to economic growth in the first quarter of 2020. These economic impacts should be felt the strongest in China (the epicenter), emerging Asia, Japan, Europe, and—to a lesser degree—the United States.

Click chart to expand

Source: Bridgewater Associates estimates as of February 19th 2020. The estimates for the world are based on these estimates and GDP (PPP) weights from the International Monetary Fund.

GDP (PPP) refers to Gross Domestic Product at purchasing power parity. Purchasing power parity compares different countries' currencies by measuring the cost of a similar basket of goods in each."

History suggests that, if/when this virus is ultimately contained, we should expect to see a normalization in economic growth rates and corporate fundamentals.

Key watch points for markets

In the days and weeks ahead, markets will be focused on three key things:

- The duration and breadth of the epidemic – If it accelerates into April and drags down Q2 data or spreads more prominently to other countries

- Random effects – If companies fail, creating negative ripple effects (e.g. the closure of Chinese movie theaters). Given the interrelated nature of global supply chains, this is a risk we are closely watching

- Policy response – If fiscal and monetary authorities step in with ample liquidity to prevent the above.

Global market outlook: Mini-cycle delayed, not derailed

The phase 1 China-U.S. trade deal and three U.S. Federal Reserve (the Fed) rate cuts in 2019 had seemingly set the stage for a reacceleration in global economic and earnings fundamentals this year—a positive mini cycle in the eleventh year of the global expansion. The coronavirus is clearly a setback to this outlook. Based on what we know now, it appears to have delayed our mini cycle thesis until at least the second quarter of 2020.

However, there is some good news. With inflationary pressures currently muted around the world, there’s a very low bar for central banks to inject liquidity and smooth the experience around the coronavirus. We’ve already seen easing measures announced this year from China, Hong Kong, Singapore, Taiwan, Thailand, Malaysia, and the Philippines.

The Fed cut interest rates by 50 basis points Tuesday March 3rd, to help fight the potential negative impact of the virus on investor sentiment. On the fiscal policy side, we have already seen measures being announced in a number of Asian economies, including China, Hong Kong, Singapore and Taiwan.

Investment strategy: Looking for evidence of a panic

We ultimately view COVID-19 as an unforecastable downside risk to the global business cycle. Yet we aren’t changing our investment strategy on the whims of the daily news cycle. We believe much of this repricing in markets is appropriate.

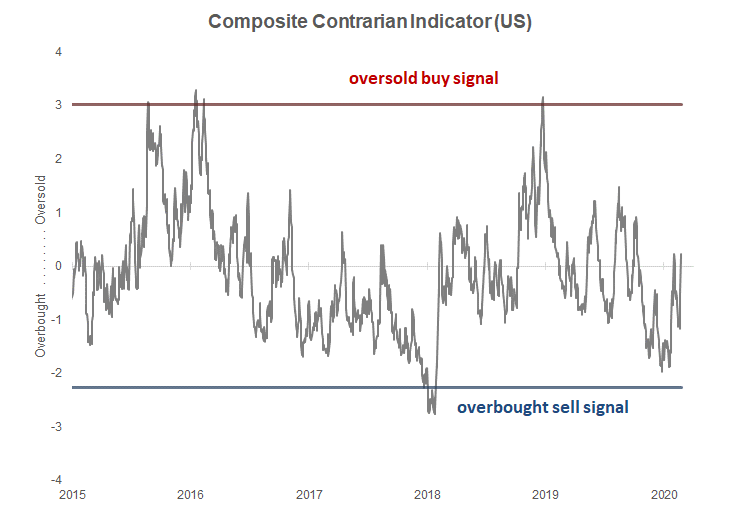

Most of the time, financial markets are reasonably efficient pricing vehicles. But at certain moments the collective market psychology can swing to an unsustainable extreme of panic or euphoria. Our proprietary blend of technical, survey and positioning data does not suggest that global market sentiment has reached an extreme of panic yet.

Click chart to expand

Source: Russell Investments. Data as of Feb. 24, 2020.

The Composite Contrarian Indicator is a proprietary Russell Investments index that aggregates approximately a dozen technical, positioning and survey indicators.

Recent days have emphasized all-too well the important role that a well-constructed and well-diversified multi asset portfolio can play to help investors still meet their objectives while weathering unforecastable events like this virus.

*Source for market data: Refinitiv Datastream