Will all of this stimulus cause runaway inflation? Not so fast.

With trillions of dollars of fiscal and monetary policy support being injected to fight the coronavirus crisis, we are fielding a lot of questions from clients about the inflationary consequences of these massive government interventions.

Low inflation likely next 1-2 years

Time horizon is important here. Over the next one to two years, inflation is likely to remain very subdued, if not dangerously low. We know global labor markets have been getting hit hard in the short-term as temporary business closures from government containment efforts have led to mass layoffs. In the United States, for example, the unemployment rate now appears to be approaching 20%, based on the weekly initial jobless claims reported through last Thursday. That would mark its highest level since the Great Depression, where U.S. unemployment peaked at 25%.

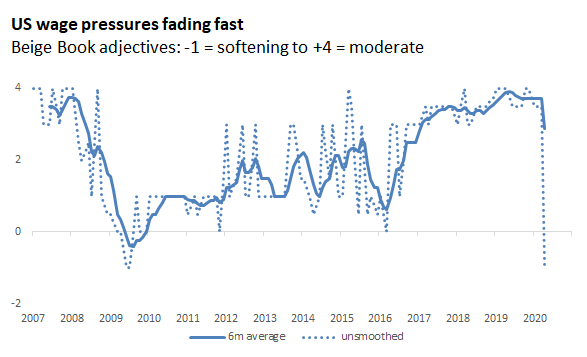

This development is important, as it has completely wiped out the wage pressures that had been building over the prior expansion. The chart below is our own quantification of commentary the U.S. Federal Reserve (the Fed) collects from its local business contacts. The Fed’s latest report for April mentioned that “no district reported upward wage pressures” and that “most cited general wage softening and salary cuts.” That’s a huge change from where we were just a month ago, and it resets U.S. wage dynamics back to where they were in the depths of the 2009 recession.

Click image to enlarge

Source: Russell Investments quantification of underlying data from the Federal Reserve Board. As of April 2020.

Lower commodity prices and, in the specific case of the United States, currency strength are also likely to be disinflationary in coming months.

In Canada, the Bank of Canada (BoC) noted in its recent Monetary Policy Report1 that there was a high degree of uncertainty about inflation over the near term. However, the BoC estimated that inflation could dip close to 0% by the second quarter of 2020, with a gradual recovery towards the 2% target taking some time and dependent upon the recovery.

But what about all of the money printing?

Here, it’s useful to separate the implications of monetary policy (including quantitative easing, or QE) from fiscal policy. Starting with monetary policy, many of our readers will recall similar concerns were floated about the inflationary consequences of QE during and immediately after the financial crisis. Those concerns never materialized. If anything, developed markets struggled with the problem of inflation that was too low for too long.

Why? The answer is a bit complicated. But in short, when a central bank buys a 10-year government bond, that money shows up in the system as new bank reserves. Many of us were taught in undergraduate economics that this new money should be inflationary. The critical nuance, however, is that these reserves do not and did not flow into the real economy. U.S. banks have not been reserve constrained in over a decade. Giving them more reserves does next to nothing to their lending behavior. At the margin, QE can help stabilize prices through positive wealth effects, and a compression of risk premia, etc., but the effects on asset price inflation naturally turn out to be much larger than those on goods markets.

Fiscal stimulus and inflation

Fiscal stimulus if sustained, however, can be inflationary over the medium-term. Handing out checks to consumers (underway in the United States and Canada) or money for direct spending on highways, bridges, etc., flows more immediately into the real economy.

Thus far, most of these initiatives have only been an attempt to try to make impacted households and businesses whole again. Again, in a recession, that’s not particularly troubling, and is arguably the optimal policy. But will politicians get addicted to low borrowing costs and continue spending well after the current crisis has run its course? That, in our opinion, is where the real threat lies. Add to that the strategic policy reviews underway at the Fed, European Central Bank and elsewhere in which those policymakers may be willing to accept higher inflation in coming years to make up for the undershoots that will in all likelihood be realized in the months ahead.

The bottom line

There is a wide range of potential macroeconomic outcomes here, but medium-term inflation risks, in our view, do appear to be skewed to the upside. Meanwhile, inflation swaps and the inflation pricing embedded in Treasury inflation-protected securities reflect a secularly weak inflation outlook for many years to come.