ESG and executive compensation: Why the right metrics matter

Setting the scene: Active ownership and executive compensation

Executive compensation is one of the most powerful instruments companies have to align directors’ interests to company performance, to hold them accountable for their executive decisions, and to communicate strategic priorities to stakeholders. The inclusion of the say on pay vote in many markets globally has forced investors to take a more active role in tackling remuneration concerns, such as overly complex remuneration structures, inadequate performance metrics and excessive pay-outs. As such, executive compensation is a top agenda item for those who are advocates for good corporate governance and seek to foster changes in pay structure through active ownership.

The pressures from environmental challenges and social injustices are also mounting. Amid the increased emphasis on responsible investing, investors are more focused on companies’ accountability for environmental, social and governance (ESG) matters, and companies are encouraged to incorporate the management of ESG risks into their remuneration structures.

As the popularity of incorporating ESG key performance indicators (KPIs) in compensation grows, we’ve become concerned that the chosen metrics are too difficult to measure, poorly defined, or could be used for executives to win easy pay-outs. In other words, there is a risk of hitting the target but missing the point.

Which ESG metrics are incorporated most into compensation packages?

According to Glass Lewis research1, the percentage of US companies that include some type of ESG metrics in compensation in recent years has climbed to approximately half of all S&P 500 companies in 2021, compared to 39% in 2020. Interestingly, while sustainability issues focus on the long term, these metrics are more often tied to the annual bonus, rather than the long-term incentive plan.

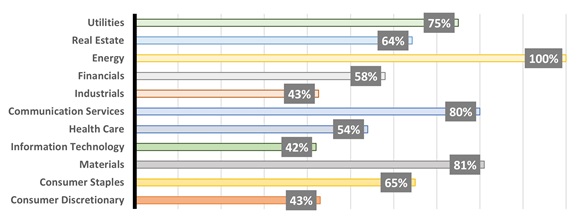

S&P 500 – ESG-linked compensation packages per sector

Click image to enlarge

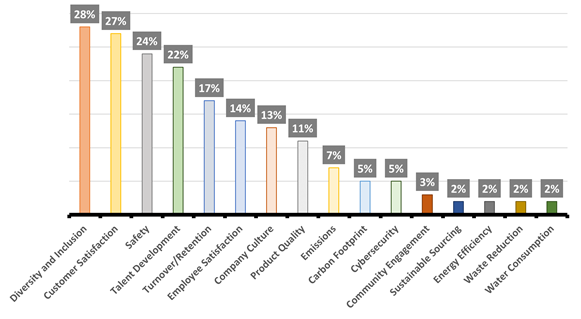

Of all ESG metrics, social metrics are most often included in compensation plans; human capital metrics are found at 41% of the S&P500 companies. This aligns with the increasing scrutiny of social impact, and the fact that these metrics can be quantified in a consistent and easier manner. Environmental metrics are at the bottom of the list with only 14% of companies including metrics2 of this nature. This contrast is unexpected, given shareholders’ attention to climate change.

S&P 500 – Nature of ESG Metrics Used

Click image to enlarge

We believe that performance metrics in incentive plans are most effective when they underpin strategic business priorities, and this is no different for ESG metrics. Yes, we agree that one-size-fits-all doesn’t work, but selecting appropriate metrics is the key decision in effectively linking ESG factors to pay.

How can investors choose the right ESG metrics?

The focus on better stewardship has pushed investors to expand the scope of their evaluation from pure financials to include ESG-related topics. Executive compensation is no exception. In fact, two-thirds of institutional investors say they want to see executive compensation linked to ESG performance, according to a survey released by Edelman3 that polled 600 institutions with US$20 trillion assets under management.

Choosing meaningful metrics is critical, however. For example, we believe that linking pay to a third party’s ESG ratings is troublesome because of the low correlation among ESG methodologies and ratings, and the low level of connection between overall ESG risk scores and specific business purposes.

Investors generally encourage companies to have quantifiable and measurable ESG targets. Companies are expected to provide the rationale behind the chosen metrics and an appropriate level of transparency about the targets set. Although this is a general view of the investors’ approach, in some cases more stringent measures have been implemented. For example, Allianz GI in a press release4 has communicated that they expect European large-caps to include ESG KPIs in executive remuneration policies and will vote against pay policies in 2023, if this is not included.

The bottom line

There is a significant amount of pressure on companies to incorporate ESG and stakeholder metrics into performance compensation. However, no single set of metrics is universally applicable. These will differ by company, industry, geographies, and most importantly, by business purpose and strategies.

Companies should not rush this decision. The nature of the metrics chosen must be material for the business, and the targets need to be specific enough to guide actions, measurable enough to show performance improvement, and sufficiently challenging to avoid perverse consequences (such as leading to higher executive pay rather than a greater incorporation of ESG factors).

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.