UK autumn budget statement: Election on my mind

Executive summary:

- Conversative government announce tax reductions ahead of general elections in 2024

- We anticipate Jeremy Hunt has saved further spending and tax measures for the Spring Budget in March 2024

- Financial market reaction is muted, with 10 year gilt-yields rising modestly

What a difference a year makes. Last November, Chancellor Jeremy Hunt presented a belt-tightening autumn budget statement with a total of £55 billion in spending cuts and tax increases. In today’s statement, a slightly improved fiscal outlook and inflation falling below 5% gave the Conservative government a narrative to start with tax reductions, ahead of general elections in 2024.

Key measures announced today include:

- Increase in benefits and pensions: Benefits like universal credit rise in line with September inflation of 6.7% after an uplift by the lower October figure of 4.6% had been mooted. State pensions rise by 8.5%, in line with earnings and adhering to the pensions triple lock.

- National Insurance: National Insurance contributions are cut by 2 percentage points from 12% to 10%, saving the average worker £450 per year. Class 2 National Insurance for self employed will be abolished, Class 4 National Insurance will be cut by 1 percentage point.

- Income tax: All income tax thresholds – the personal allowance, 20p rate, 40p rate and 45p rate – remain frozen until 2028. With the currently high rate of nominal wage inflation, keeping the pound thresholds unchanged is a significant stealth tax increase. By 2028-29, the Office for Budget Responsibility estimates that the freeze will have raised an extra £45bn for the Treasury.

- Business tax: Mr Hunt extended the full expensing of capital allowances whereby businesses can get back 25p for every £1 they invest. This was due to expire in 2026 and extending it has no short-term economic impact, but could raise capital investment and the UK’s long-term growth potential.

- Minimum wage: As announced yesterday, the National Living Wage (NLW) will increase from the current level of £10.42 to £11.44 an hour for over-21s from April 2024. The age threshold for the NLW was previously 23 years.

Prime Minister Rishi Sunak had urged the chancellor to cut personal tax, arguing that the halving of inflation was a turning point for the economy and an opportunity to cut the tax burden on middle-income families. In contrast, Mr Hunt had cautioned against any expectation of tax cuts in recent weeks, arguing that it would put upward pressure on inflation. It looks like the Prime Minister prevailed in that tug of war given the cut in National Insurance contributions announced today.

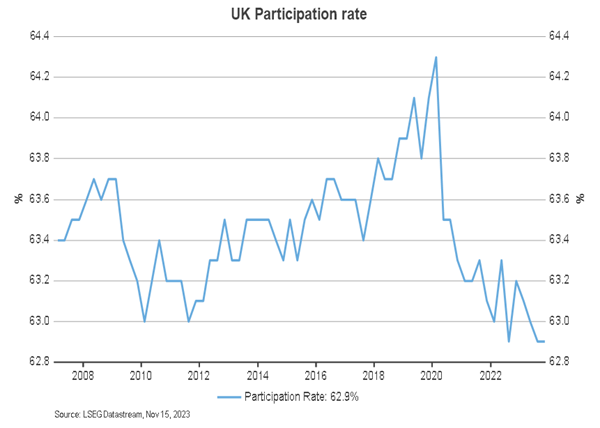

The budget also included measures to force some benefit claimants to look for work through a stricter work capability assessment. Together with the rise in the minimum wage, this tightening of benefit conditions is a carrot-and-stick approach intended to increase the supply of labour. Since the start of the Covid pandemic, the UK labour force participation rate has plummeted to a record low of 62.9% (see chart), leading to shortages of workers in many occupations, including in healthcare, scientists, engineering, information technology and construction.1 Given the high level of skill required for these occupations, it is doubtful whether changes to the minimum wage and benefit conditions will make much difference.

What it means for the Bank of England, gilts, and sterling

For the 12-month economic outlook, the significant uplift in the state pension, benefits, and the National Insurance contribution cuts, were key from today’s statement. With inflation now falling, these measures will modestly support aggregate demand and economic growth. About 22 million people are in receipt of the state pension or other benefits and about 20 million people pay National Insurance taxes. However, headwinds facing the UK economy are strong. The sharp rise in the bank rate over the last 15 months has not taken full effect. About two-thirds of mortgages are due to reset to much higher interest rates over the coming years and drag down household spending.

At the time of writing, the financial market reaction to the budget was modest. The yield on 10-year UK gilts rose by 5 basis points to 4.16% and GBP/USD dropped below 1.25. We think the Bank of England has reached the peak of its rate hike campaign and the gilt yields have passed their zenith for the cycle. Sterling is supported by attractive valuations2 and the high bank rate, but the latter could wane in the second half of 2024.

The bottom line

1 See a list of shortage occupations here: https://www.gov.uk/government/publications/skilled-worker-visa-shortage-occupations/skilled-worker-visa-shortage-occupations

2 The purchasing power parity exchange rate for GBP/USD is around 1.48. Source: Organisation for Economic Cooperation and Development.

3 Source: Office for Budget Responsibility. https://obr.uk/efo/economic-and-fiscal-outlook-november-2023/

4 Source: House of Commons Library. https://researchbriefings.files.parliament.uk/documents/CBP-8513/CBP-8513.pdf

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.