How tax-healthy are your clients’ portfolios? The Form 1099-DIV can tell you

Executive summary:

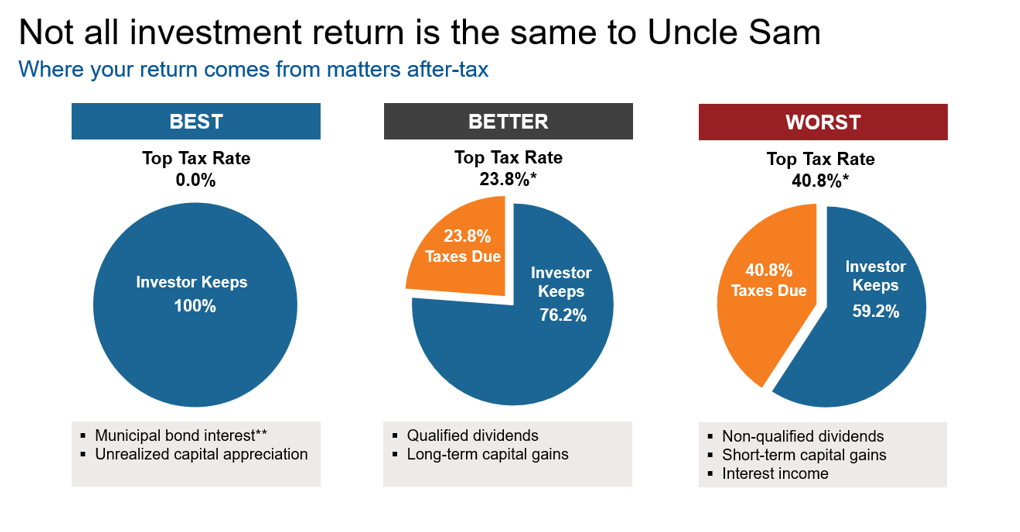

- Not all investment returns are the same. Some are taxed at a higher rate than others.

- The Form 1099-DIV can help you analyze the Investment Tax Health of your clients. By looking at how much the investor received in different investment returns, you can calculate how much federal tax they will need to pay.

- A tax-healthy Form 1099-DIV will reflect a tax-healthy portfolio. A tax-healthy portfolio can help your clients receive a better after-tax investment outcome.

Exciting news – just got the green light from my doctor after a thorough health check! No major concerns, just the typical age-related issues. But it got me thinking – we diligently monitor our physical health; shouldn't we do the same for our financial health, particularly when it comes to taxes? Just as an annual physical reveals potential health risks, a comprehensive examination of your financial well-being can uncover signs of "Investment Tax Disease." Let's explore why it matters and how financial advisors can guide their clients to maintain robust financial health.

The first place to check for “Investment Tax Disease” is in an investor’s Form 1099-DIV. This tax document, among others, can be a treasure trove of facts and figures that help analyze the investor’s tax health. How do you know if your client has Investment Tax Disease? It’s when their tax costs are higher than they could be – and should be. Let's take a deeper dive into the Form 1099-DIV and see what we should be looking for.

The Form 1099-DIV and Tax Implications

To make informed decisions about taxes, let’s first look at what investment outcomes and distributions get taxed and how. Not all is equal when it comes to taxes. Simplifying it into three categories – Best, Better, and Worst – provides clarity. Strive for the “Best” outcomes while steering clear of the pitfalls labeled as “Worst”. Take a look at the graph below and see what I mean:

Applies to federal taxes only.

Source: Internal Revenue Service. Tax rates as reported by Internal Revenue Service as of 2023.

*Assumes addition of 3.8% Net Investment Income Tax to tax rate.

**Generally, for municipal bonds, only interest from bonds issued within the state is exempt from that state’s income taxes. Municipal bond interest income may impact taxation of Social Security benefits.

Do you know what my FAVORITE tax rate is? 0.00%! Who wouldn’t want to pay a zero percent tax rate on investment returns and income? If you think this is impossible, it’s not. There are two things that can help generate a 0.00% Federal tax rate: tax free municipal bond interest and unrealized capital gains.

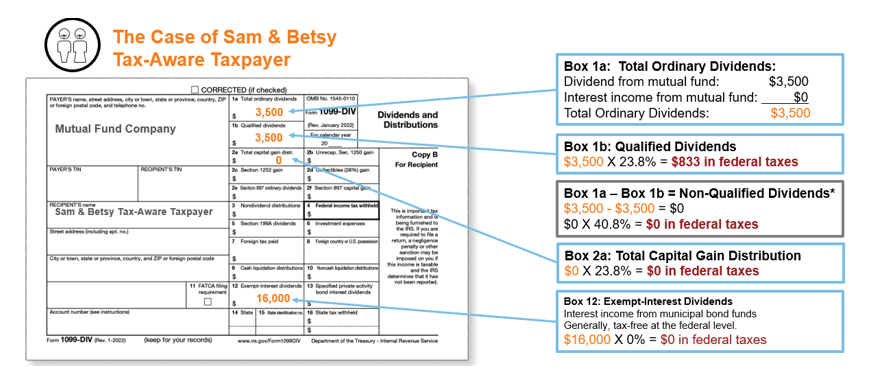

Returning to Form 1099-DIV and assessing your clients’ financial tax health, what should we be looking for?

The “Best” Tax Outcomes

Let’s start simply with Box 12 on the Form 1099 – the space for interest from Tax Free Municipal Bond Funds. First off, there should be a number here for the sake of your clients’ Financial Tax Health (too often, I see forms with nothing in this box!) Frankly, I believe the majority of your interest income should ideally be Tax Free Municipal Bond interest.

Moreover, there should be a concerted effort to minimize realized capital gains to the fullest extent possible. Unrealized gains are not subject to taxation. I repeat, unrealized gains are not taxed. Why get taxed on your capital when you aren’t using it? That’s like getting taxed annually on the increase in your home’s value. Let's look at what a healthy Form 1099-DIV looks like:

Take immediate notice of Box 12 (Tax Free Interest) and Box 2a (Long Term Capital Gains). As you can see, both of those boxes have generated zero in federal taxes. This reflects a tax-healthy investment portfolio.

A Tax Outcome Better than Worst

What else should you be looking for? Well, the “Better” tax rate is not as good as “Best” but is better than “Worst”. Begin with Box 1b – this is where you will find Qualified Dividends (these are dividends that get the preferential tax treatment). The number here should closely align (if not be identical to) the number in Box 1a. Box 1b carves out dividends receiving better tax treatment, providing a clearer picture of your overall dividend scenario. The IRS doesn’t say it like that (like a doctor with bad bedside manners) but that’s what it is.

The other item enjoying the “Better” tax rate is Long Term Capital Gains, residing in Box 2a. Despite the IRS’s labeling, Box 2a doesn’t present a total capital gains figure; rather, it highlights the better-taxed segment of your capital gains (excluding unrealized gains, of course!). While my strong preference leans towards having a zero in Box 2a in most years, if gains must be realized, aim for them to be long-term, and you will find them in this box on the Form 1099-DIV.

After exploring the best and better outcomes, it’s time to examine the worst tax scenarios, marked by the highest federal marginal income tax rates and unfavorable Investment Tax Health results. What triggers these undesired situations? While several factors contribute, let me highlight three significant ones: Taxable Interest, Non-Qualified Dividends, and Short-Term Capital Gains. While the complexities of these aspects are beyond the scope here (discussed in my other blogs), it’s important to note these are elements you’ll want to steer clear of.

Locate these culprits in Box 1a (excluding Box 1b from 1a) of the Form 1099-DIV. If Box 1a is greater than Box 1b, this will generate a larger than necessary tax bill. Look out for items that result in an unnecessarily hefty tax bill. This includes taxable bond interest (or interest from money market funds or Certificates of Deposit). As a taxable investor, you should consider avoiding this type of interest. Non-Qualified Dividends including non-equity securities like partnerships and trusts such as MLPs and REITS, as well as foreign dividends from jurisdictions where the U.S. doesn’t have full tax treaties are just some of the sources of these types of dividends. Lastly, but also importantly, it’s best not to have any Short-Term Capital Gains. For taxable investors, strong consideration should be given to sidestepping these elements whenever possible. Investors are generally focused on the long term, such as saving for retirement. Most people avoid short-term events that can have a massively detrimental long-term impact on their health (threats like 1st degree burns, diving off a cliff or skydiving without a parachute, etc). Investments that get taxed at the “Worst” rate are like that – they need to be capped and controlled or else the short and long-term financial pain could be severe.

Form 1099-DIV: Your Review Opportunity

Need more information on how to use the Form 1099-DIV to check the health of your client portfolios? Take a look at our 1099 Tax Form Guide , just one of the many tax resources available from your regional Russell Investments team. It can help you calculate the tax bill for your client – and that may make it easier to understand the impact taxes are having on their investment returns.

You can also access our Tax Season Essentials flyer, which is chock-full of tips and tactics you can use to help your clients navigate tax season—and hopefully help improve the tax health of their investment portfolios. Helping your clients improve their after-tax wealth can be a great way to reinforce your value and potentially gain new business.

An annual financial check-up can be just as important as a medical one. “Investment Tax Disease” can quickly impact financial health, and the Form 1099-DIV acts as a powerful diagnostic tool. By utilizing this tool effectively, you can proactively address potential tax complications, potentially providing a healthier financial future for your clients.