The capital markets narrative heading into 2017 was one of modest expectations. Interest rates were low and expected to increase, suggesting

meager bond returns.

Equity valuations were high and the cycle was getting long in the tooth, indicating that equity returns could be muted with increased risk of downside. In addition to the fundamentals, there appeared to be a high level of

geopolitical uncertainty heading into the year. Some investors questioned whether the return opportunities were worth the potential risks of staying invested. In hindsight, the short answer was “Yes.”

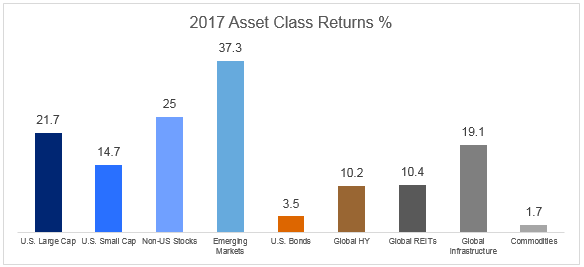

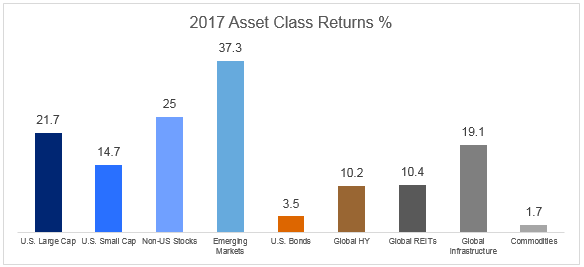

2017 was a strong year for many investors. It was difficult to find segments of the capital markets that disappointed during the year. Those that did, tended to represent small segments of the market and typically small allocations within an investor’s portfolio. Most investors holding diversified global portfolios with meaningful allocations to growth assets should be pleased with 2017 returns.

Following is a recap of how 2017 played out.

Sources: U.S. Large Cap: Russell 1000 Index; U.S. Small Cap: Russell 2000 Index; Non-US Stocks: MSCI EAFE Index; Emerging Markets: MSCI Emerging Markets Index; U.S. Bonds: Bloomberg U.S. Aggregate Bond Index; Global HY: ICE BofA Global High Yield Index; Global REITs: FTSE EPRA/NAREIT Developed Real Estate Index NET; Global Infrastructure: S&P Global Infrastructure Index (Net TR); Commodities: Bloomberg Commodity Index Total Return

Sources: U.S. Large Cap: Russell 1000 Index; U.S. Small Cap: Russell 2000 Index; Non-US Stocks: MSCI EAFE Index; Emerging Markets: MSCI Emerging Markets Index; U.S. Bonds: Bloomberg U.S. Aggregate Bond Index; Global HY: ICE BofA Global High Yield Index; Global REITs: FTSE EPRA/NAREIT Developed Real Estate Index NET; Global Infrastructure: S&P Global Infrastructure Index (Net TR); Commodities: Bloomberg Commodity Index Total Return

First Quarter

The year got off to a great start, with

emerging markets and

growth stocks leading the charge.

Emerging market stocks (MSCI Emerging Markets Index) were up 11.7% during the quarter, bouncing back from a difficult 4

th quarter of 2016, and in recognition of positive global economic momentum. Within the

U.S. market (Russell 3000® Index), stocks were up 5.7%, primarily driven by the strength of

growth stocks. The Russell 1000

® Technology Index was up 13.1% and the Russell 1000

® Health Care Index was up 8.6% during the quarter.

The Bloomberg U.S. Aggregate Bond Index finished the quarter in positive territory (+0.8%) despite

a late-quarter rate hike by the Federal Reserve. Investors taking credit risk did even better as

the ICE BofA Global High Yield Index returned 3.2%. High yield bonds could have performed even better if they hadn’t been burdened by one segment of the capital markets that struggled mightily during the quarter: Energy. The Russell 1000

® Energy Index was down -6.6% during the quarter, the worst performing equity sector. In addition, commodity prices reflected the energy challenges, with the Bloomberg Commodity Index down -2.3% during the quarter, pulled down by the -17% return of the natural gas sector.

Second Quarter

While not quite as strong as the first quarter, the positive momentum of the markets continued into the second quarter.

Emerging markets (MSCI EM Index) and

non-U.S. developed stocks (MSCI EAFE Index), were the clear winners. Both markets were up over 6% during the period. Strong global demand and a weaker

U.S. dollar helped emerging markets performance, and reduced political risk post

the French election combined with strong economic data, contributed to the rising

European market returns (MSCI Europe Index +7.4%). The U.S. stock market (Russell 3000® Index) was also solid at +3.0%, although that represented only half the return international equity markets (MSCI EM and MSCI EAFE Indexes) delivered.

Like in the first quarter,

growth stocks led the way: The Russell 1000

® Growth Index finished the quarter up 4.7%. In the bond markets, investment grade bonds (Bloomberg U.S. Aggregate Bond Index) almost doubled their first quarter results at +1.5%, influenced by healthy economic data and low inflation numbers.

Credit markets sustained leadership within fixed income, (

Global High Yield bonds ICE BofA Global High Yield Index) essentially repeated their first quarter results: +3.2%.

Real assets continued to lag relative to

global equity, hurt by concerns about higher interest rates or lagging energy prices.

Infrastructure was the one segment that bucked this trend: The S&P Global Infrastructure Index was up 6.5%, almost matching its first quarter return of 7.2%. These strong results reflected the ongoing optimism about global economies and the recognized need for capital investment in this sector.

Third Quarter

The third quarter carried on the strong performance trend of the first half of the year. Even the Bloomberg Commodity Index the laggard of the first six months, posted a positive return (+2.5%), reflecting improving energy prices. Equity sustained its strength, again led by the emerging markets (MSCI EM Index), up 7.9% as improving economic indicators continued to fuel returns. Three of the four “BRIC” countries—Brazil, Russia, and China—posted returns of 15% or greater. The fourth, India, did not fare as well, but still posted positive results. In the developed markets,

non-U.S. stocks (MSCI EAFE) topped

U.S. stocks (Russell 3000 Index) due to anticipation of stronger earnings, with both markets having solid quarters, +5.4% and +4.6%. In the U.S.,

growth maintained its lead over

value as the Russell 1000

® Growth Index returned 5.9% propelled along by Technology stocks and their 8.2% return.

Two segments of the U.S. market experienced turnarounds during the quarter.

Energy stocks rebounded as energy prices improved. The Russell 1000 Energy Index returned 6.8% during the quarter. From a capitalization perspective,

small stocks had trailed

large cap for the first six months, but third quarter saw the Russell 2000® Index top the Russell 1000 Index, 5.7% vs 4.5%.

Bonds sustained their steady gains, with the Bloomberg U.S. Aggregate Bond Index finishing up +0.8%. Credit remained the most rewarded sector within the fixed income market as ICE BofA global High Yield Index posted the third straight quarterly return over 2% at 2.8%.

Among

real assets, infrastructure (S&P Global Infrastructure Index), real estate securities (FTSE EPRA/NAREIT Developed Real Estate Index) and commodities (Bloomberg Commodity Index) all provided investors with positive results.

Infrastructure maintained its 2017 leadership position with the highest return among the three, +2.9%.

Fourth Quarter

While fourth quarter didn’t finish as strongly as first quarter started the year, it did a very respectable job of wrapping up a strong 2017. The U.S. equity market played catch-up to the non-U.S. markets for most of the year and made up some ground during fourth quarter.

The Russell 3000 Index returned 6.3% during the quarter, again led by

large cap growth stocks. The Russell 1000

® Growth Index returned 7.9% during the period compared to only 3.3% for the

small cap stocks of the Russell 2000

® Index. Keeping pace with their U.S. counterparts in the fourth quarter, non-U.S. stocks posted strong results to wrap the year:

Emerging markets (MSCI EM Index) added to their spectacular 2017 with another 7.4% return to post +37.3% for the year.

Non-U.S. developed stocks (MSCI EAFE Index) did not quite keep pace, but still finished the quarter with a positive 4.2%, reflecting positive contributions from both European and Asian markets.

Bonds markets kept up the positive gains seen during the first three quarters, posting a return of 0.5% for

investment grade fixed income (Bloomberg U.S. Aggregate Index). Tighter credit spreads caught up with

Global High Yield returns (ICE BofA Global High Yield Index), as they trailed results from earlier in the year, but still posted a positive return of 0.8%.

Real assets closed the year strong.

Commodities (Bloomberg Commodity Index) sustained their 3Q rally by posting a return of 4.7% during the quarter.

Real estate securities (FTSE EPRA/NAREIT Developed Real Estate Index)) also wrapped up well, posting a 3.6% return.

Infrastructure (S&P Global Infrastructure Index) was the laggard in the group, but still returned 1.6%.

The bottom line

2017 proved to be a strong year. Global equity markets (MSCI World) finished up over 20%, led by emerging markets (MSCI Emerging Markets) up over 37%; and investment grade bonds (Bloomberg U.S. Aggregate Index) returned 3.5%. Given modest expectations coming into the year, these returns were a pleasant surprise for many investors and a good

reminder of the potential benefits of sticking to long-term investment plans.

Entering 2018, many of the same market conditions that existed heading into 2017, remain: Equity valuations still appear on the high side and interest rates remain historically low. Like last year,

few are projecting strong equity returns and speculation is leaning towards modest capital market results at best. If 2017 taught us anything, the difficulty in predicting short-term market direction should be near the top of the list. Thus, steering investors back towards the long-held principles of portfolio diversification can be beneficial. We believe that investors taking a global, multi-asset approach should be well positioned to capture the upside of another strong run by the equity markets, while providing adequate exposures to other asset segments to navigate market challenges.

Sources: U.S. Large Cap: Russell 1000 Index; U.S. Small Cap: Russell 2000 Index; Non-US Stocks: MSCI EAFE Index; Emerging Markets: MSCI Emerging Markets Index; U.S. Bonds: Bloomberg U.S. Aggregate Bond Index; Global HY: ICE BofA Global High Yield Index; Global REITs: FTSE EPRA/NAREIT Developed Real Estate Index NET; Global Infrastructure: S&P Global Infrastructure Index (Net TR); Commodities: Bloomberg Commodity Index Total Return

Sources: U.S. Large Cap: Russell 1000 Index; U.S. Small Cap: Russell 2000 Index; Non-US Stocks: MSCI EAFE Index; Emerging Markets: MSCI Emerging Markets Index; U.S. Bonds: Bloomberg U.S. Aggregate Bond Index; Global HY: ICE BofA Global High Yield Index; Global REITs: FTSE EPRA/NAREIT Developed Real Estate Index NET; Global Infrastructure: S&P Global Infrastructure Index (Net TR); Commodities: Bloomberg Commodity Index Total Return