Back to the 1990s? Bank of England rate hikes may pinch London's first-time homebuyers

Executive summary:

- Bank of England raises interest rates again as expected

- Rate hike likely to hurt first-time homebuyers in London

- UK gilt curve appears to be pricing in "higher rates for longer" scenario

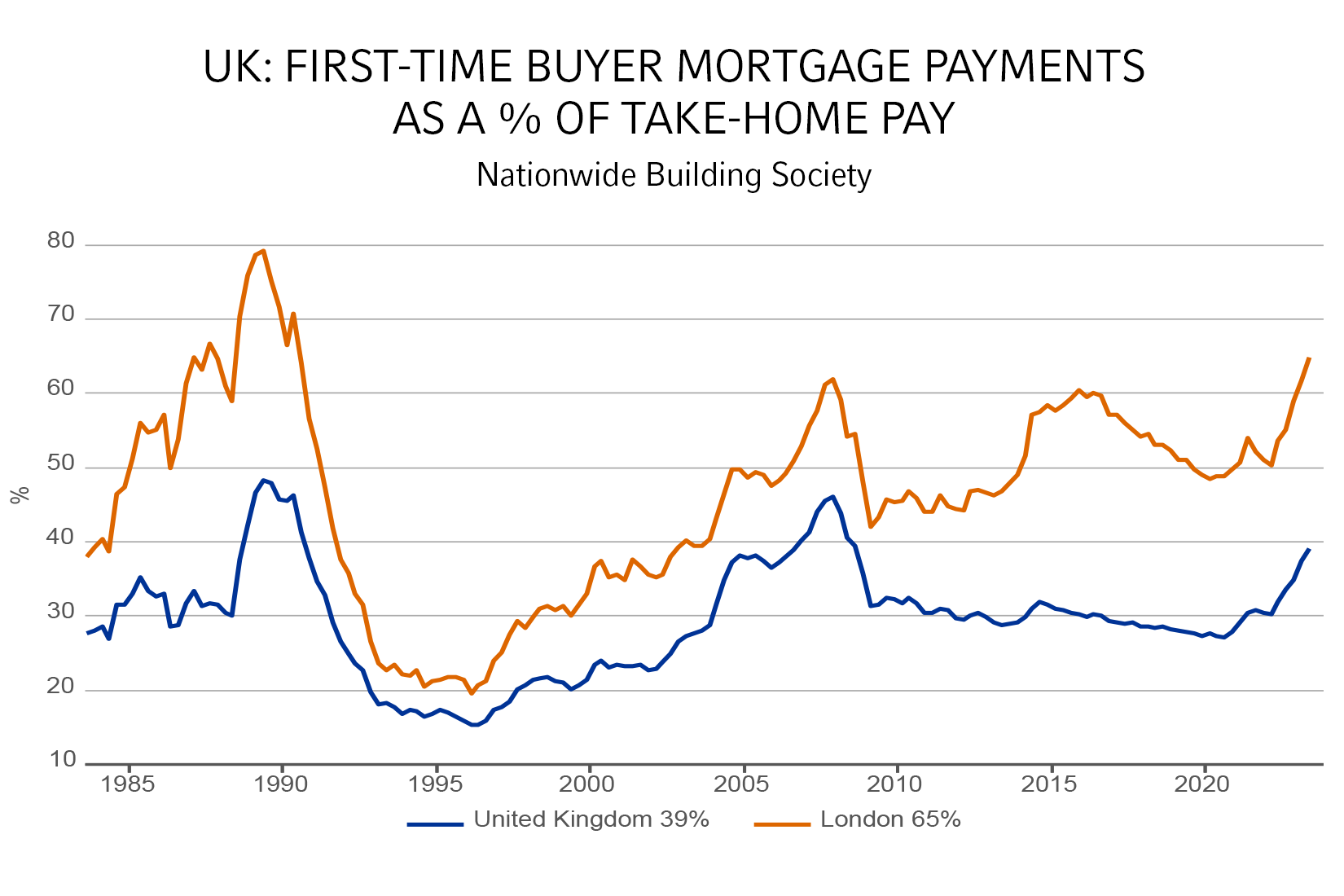

A veteran UK economist loves to tell me the anecdote of how they had to take a second job in retail in the early 1990s to keep paying their mortgage. First-time house buyers, especially in Britain's capital London, may face similar challenges after the Bank of England (BoE) raised its key policy rate for the 14th time today from 5% to 5.25%. Whilst the current interest rate is not nearly as high as back then (when it reached 15%), house prices have risen to such a high level that first-time buyers in London spend 65% of their take-home pay on mortgage payments.

According to data from the Nationwide Building Society, this is the highest level since the second quarter of 1990 (see chart below). In the UK overall, the situation is not quite so dire: first-time buyers' mortgage payments make up 39% of their net income.

Source: Refinitiv Datastream, Q2 2023

Unlike the central bank's previous decision in June, today's hike was not a surprise to market participants. Money markets had priced a 62% chance of 25 basis points (bps) and a 38% likelihood of a 50 bps move. The Monetary Policy Committee voted by a majority of 6–3 for the 25-bps increase. Two members, Jonathan Haskel and Catherine Mann, preferred a larger 50 bps move, whilst Swati Dhingra favoured an unchanged base rate. Whilst there was still a slightly hawkish tilt in the tally of votes, the BoE acknowledged that it may be getting close to the end of its hiking cycle. The committee noted in its statement: "Given the significant increase in Bank Rate since the start of this tightening cycle, the current monetary policy stance is restrictive."

The UK gilt curve reacted in an unusual way to today's rate announcement. Two-year bond yields fell whilst 10-year yields rose, i.e., the curve "twisted" around the five-year point. This may partly be due to higher risk premiums for long-term bonds globally after the credit ratings downgrade for the United States. It may also reflect gilt markets pricing in expectations the BoE will be done with rate hikes soon but will not be able to cut rates even in the face of economic weakness. We disagree with that "higher rates for longer" narrative and expect central banks globally to pivot to significantly lower rates when their respective economies slide into recession.

The bottom line

As we had argued in our last blog, the BoE is already in overtightening mode. It is trying to re-establish perceived lost credibility at the cost of higher mortgage borrowing costs and a likely recession in the UK. In our view, the bank's inflation-fighting resolve bodes well for longer-term UK government bonds.

After the last BoE policy meeting, we expected the pound would struggle to appreciate further despite rising UK interest rates. Against the U.S. dollar, the pound has dropped from a high of 1.31 this year to 1.27. Since it is still cheaply valued1 against the greenback, we do not see much downside from current levels.

1 The purchasing power parity exchange rate for GBP/USD is around 1.48. Source: Organisation for Economic Cooperation and Development.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.