Adding an ESG option to a DC plan menu: A success story

How can a DC plan add ESG to its menu? What are the risks and complications? And how can the plan feel confident they made the right choice?

Amid universal recognition in the financial industry of the importance of integrating ESG (environmental, social and governance) factors into investment processes, a growing number of defined-contribution (DC) plan sponsors are exploring adding ESG options to their plan menus. At Russell Investments, we’re particularly pleased by this trend, as we’ve long held that ESG risks are investment risks, due to our core belief that ESG factors impact security prices. As such, we’re committed to developing portfolios that generate long-term sustainable value while recognizing the increasing investment risk associated with climate change—a pledge we recently doubled down on by committing to achieve net-zero carbon emissions in our portfolios by 2050 or sooner.

We recently helped a large, multinational corporation expand its U.S. DC plan menu to including an ESG investment-themed option. Below, we take a look at the challenges the organization faced in adding this option, and the solution we provided to bring this option to fruition.

The organization

The organization we worked with was a global consumer goods company with significant business operations in the U.S. One of the company’s core missions was increasing sustainability across the globe. Its investment committee also believed strongly in sustainable-asset investing—importantly, from a financial risk-versus-return standpoint, rather than from a purely ethical, it’s-the-right-thing-to-do point of view. This was due to the committee’s belief that sustainable business practices have become so essential in today’s world that they are likely to become subject to future government regulation and enforcement. Because of this, the committee viewed investing in organizations that weren’t moving toward the adoption of sustainable business practices as increasingly risky. On the other side of the coin, the committee believed that organizations that placed a higher emphasis on sustainability were more likely to improve their bottom lines.

This also meant that the committee generally preferred not to enact blanket exclusions of specific securities or industries when constructing an ESG-themed option. Instead, the committee placed greater emphasis on finding investment managers that understood how to incorporate sustainability factors into a stock-selection process.

The challenge

With an uptick in demand for ESG products in its retirement plans—an increase bolstered by the company’s recent acquisition of brands with large, sustainability-driven workforces—the investment committee decided to explore adding an ESG option to its U.S. DC plan menu. This was an onerous undertaking rife with several challenges, including:

- Finding a one-size-fits-most option to satisfy most participants seeking an ESG option, given the wide range of opinions on what the term entails.

- Navigating the legal and regulatory landscape for ESG-themed investing in the U.S., which was and continues to be generally more prohibitive than the other countries the company did business in.

- Lack of ESG funds in the market. This was due in large part to the prohibitive regulatory environment in the U.S.

Finally, all of these challenges had to be dealt with amid the constraint of keeping the cost of the ESG equity option comparable to the costs of other equity options in the plan. This was especially challenging given that the other options were white-label multi-manager funds that offered competitive fees over standard options on the menu. Due to this fund being a brand new investment option, the plan wouldn’t be able to guarantee any assets upon fund creation.

This made it difficult to keep the cost of the ESG option in line with other options. But the committee was especially concerned about how a higher cost for the ESG option could be perceived among those who selected it due to its alignment with their personal views. These participants, the committee worried, may view a higher cost as a tax on doing the right thing—even though the purpose of adding the ESG option was strictly being done from a return-risk standpoint.

The solution

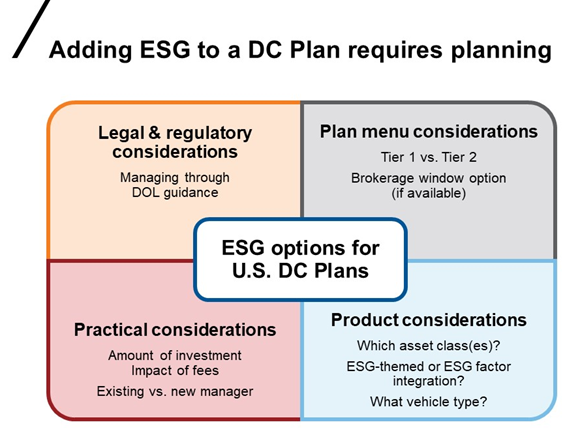

Given participant and committee interest, we worked with the company on a solution to these challenges. Our first step was to identify all the considerations that would need to be taken into account when deciding on an ESG option. As the chart below indicates, these included legal and regulatory considerations, plan menu considerations, practical considerations (including fees and existing versus new investment managers) and product considerations (such as asset class and vehicle type).

Click image to enlarge

From there, we conducted a thorough, rigorous assessment of how each consideration could impact the type of ESG option the company planned to offer, including potential enhancements and limitations. The legal and regulatory challenges were of particular concern to committee members, who were understandably apprehensive about the litigation risks in the U.S. To overcome this obstacle, the client enlisted outside counsel to provide extensive training and education on the U.S. regulatory environment, and we worked with the investment committee to diligently assess the pros and cons of the different types of ESG funds. We also worked diligently with the committee to document the entire process of building out an ESG option, making it extremely clear that any integration of ESG factors into a fund would be strictly aligned with improving the plan’s financial performance.

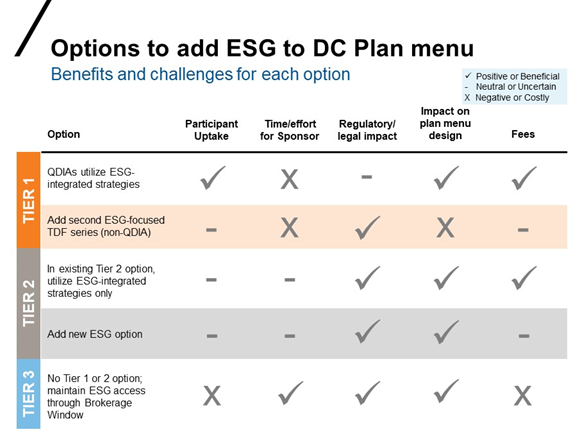

This also included conducting a careful analysis of which tier in the company’s DC plan menu the ESG option should be added to. The company’s plan menu was comprised of three tiers—which we believe is a best-practices approach for all DC plans—including a brokerage window as Tier 3. We assessed the benefits and challenges of including the option in each of the different tiers by five factors: participant uptake, time/effort by sponsor, the regulatory/legal impact, the impact on the plan menu design and fees. Ultimately, we advised the investment committee to limit its ESG option to the Tier 2 core menu at launch, with the potential to also offer the option as a building block in the Tier 1 custom target date funds further down the road if the regulatory environment permits, as we expect it may. As the chart below shows, our analysis determined that there were no negative or costly repercussions associated with placing the ESG option in Tier 2 of the plan menu. Our analysis also showed that adding the option to this tier would be a plus when considering the potential regulatory and legal impacts, as well as the plan menu design.

Click image to enlarge

Drawing on our extensive manager research capabilities, we thoroughly vetted and ultimately selected what we believed to be best-of-breed managers for the ESG fund. The creation of the fund was an extensive process that played out over several months, as we discovered that there were many managers who felt that it was too early in the game to be building an ESG fund. We disagreed, and pressed on until we located managers that utilized a fully integrated ESG approach. Importantly, these managers were also able to offer a fund at a suitable price, addressing one of the key challenges the company was facing in the construction of the fund: keeping costs comparable to the other equity options.

The results

Our custom-built, ESG-themed option for the company’s DC plan menu was approved by the investment committee earlier this year, and will be available to all of its U.S. plan participants in June. The white-label fund naming convention embraced by the plan meant that a name needed to be determined for the new option. Diversified Equity Sustainability Fund was ultimately selected. Despite this fund addition taking longer than usual, the company is elated to be on the doorstep of fulfilling a goal to include an ESG option that aligns with its goal of bettering the financial performance of its DC plans. As an investment solutions provider dedicated to improving the financial security of individuals across the globe, we’re proud to stand alongside them.