Get smart or die trying: 4 steps for advisors to consider when working with clients in 2020

It’s the beginning of a new decade, and if you do an internet search for market predictions or market outlook, there's no shortage of opinions of what's to come in 2020 and beyond. The problem with these market prognostications is they're almost always wrong.

Sure, you can find one or two bold predictions that may come true, but even a broken clock is right twice a day. After the very volatile (and negative) Q4 in 2018, how many predicted a nearly 30% return in U.S. equities for 2019? If you look now, you’ll see plenty of market gurus forecasting a great 2020.

What do you think will happen in 2020?

In wrapping up 2019 with many year-end meetings with both advisors and end-investors, I was asked countless times what my and my firm’s views for 2020 were. Of course, we have our opinions, but after sharing them I usually follow up with a simple question—who cares? It makes for great conversation fodder, but in the end, it doesn’t mean all that much.

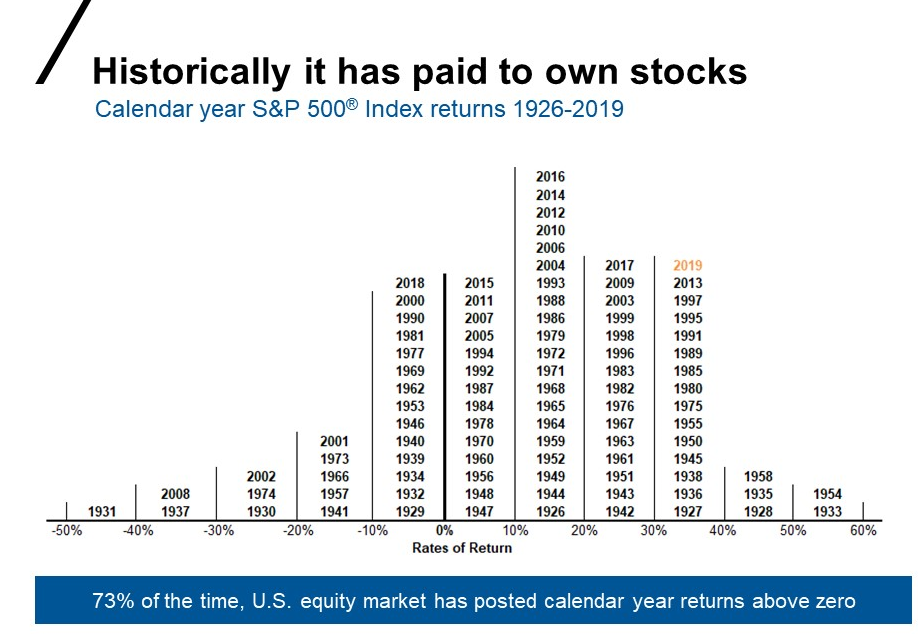

Markets will do what markets will do—regardless of anyone’s opinion. It is hard, if not impossible, to predict. So why worry about something you can’t control? Will we have another recession? Absolutely. The question is when. Most prognosticators said we would have had one by now. But that was so 2018. Will U.S. equity markets be positive this year? Sure, why not. The S&P 500 Index has been positive 73% of the time going back to its inception in 1926, so odds are in your favor:

Click image to enlarge

Represented by the S&P 500® Index from 1926-2019.

Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

So, what’s smart money doing?

The next most common question I get asked is, what is the ‘smart’ money doing? When people refer to smart money they are usually referring to institutional clients—pensions, endowments and non-profits. How come we can’t invest like them? Do they have access to special investment vehicles or asset classes?Do they get better information? My answer is underwhelming and not very sexy. The success these investors enjoy is due to one simple fact: they are outcome-oriented. Here’s what that means:

- They determine what their need is. In the case of a pension, they estimate their long-term liability based on several factors (number of retirees, number of current employees, inflation, costs to administer the plan, etc.) and manage their investments toward that. They don’t concern themselves with what the pension plan down the street is doing, as it has little bearing on their outcome needs.

- They diversify—a lot. They use more, not fewer, asset classes. Each asset class comes with its own risk and return pattern. Diversification helps smooth out the bumps and rough patches. They back into their allocation by determining the proper asset classes and assessing the risk and return of each. Their final asset allocation is the combination of asset classes that best meets their return objective with the highest degree of probability.

- They are long-term investors—no, seriously. They don’t say they’re long-term and then switch strategies after two quarters when things aren’t going well. They truly do look out at least 10 years, if not decades, into the future. They're realistic in their expectations of what markets can do for—and to—them.

- They have an Investment Policy Statement (IPS) to help guide their decisions. These investors don’t have a lone decision maker. They have boards of people—many with different investing backgrounds, risk tolerances and expertise—who have a say in the decisions that are made. The IPS helps determine boundaries for the portfolio, sets rules and guides the board in the decision-making process when it comes to changing the asset allocation or investments. It helps the committee avoid being swayed by emotions, and rather remain rational.

Act smart: 4 simple steps

What does this mean for the average investor? What is the big take-away? It’s simple—act like an institution. By adjusting your language and your client’s thinking, you can boil this act down to four simple steps:

- Performance is personal. Everyone’s situation is different, and their outcome needed is unique. Estimate your client’s long-term liability based on their individual needs—retirement income, education funding, vacation home, legacy and philanthropic goals, etc. If the liability means your client needs an average 6% annual return to make this happen, take only the risk needed to achieve that outcome at the highest probability. Let go of arbitrary benchmarks that, while helpful to reference at times, likely have no impact on your client’s success.

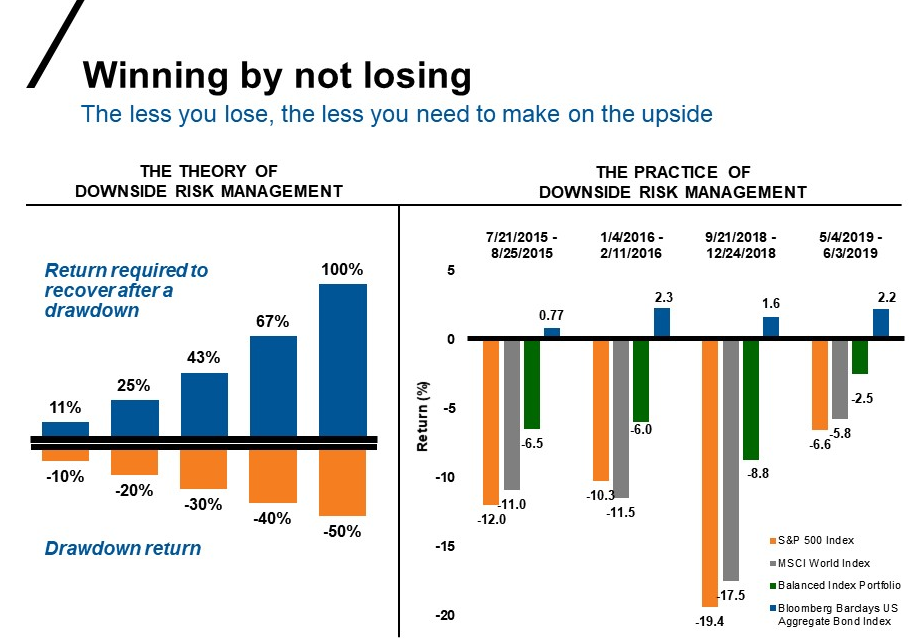

- Don’t try to be a hero. In baseball, the players who hit the most home runs also strike out the most. While that might be acceptable in the big leagues, it’s not likely a strategy you want in your client’s portfolio. Taking too much risk by trying to hit investment home runs can result in your clients missing out on their desired outcome. Diversification is a fundamental principle of investing for a reason—because it works! We like to believe that we can handle what comes with taking on big risks, but history tells us otherwise. Remember: you can win by not losing.

- Put the statements away. We all tell our clients to focus on the long-term, but then we send them quarterly or even (gasp) monthly statements. Why are we then surprised when they second-guess our strategies after only two or three quarters? We believe reviewing statements annually, at most, is likely enough. It keeps you and your clients sane and it gives the investments time to do their thing. Markets are fluid. Don’t encourage your clients to judge the portfolio based on arbitrary statement dates determined by the Gregorian calendar established over 400 years ago!

- Create a personal IPS. While a financial plan can be a comprehensive roadmap to long-term success, sometimes it’s helpful to have a quick investment pocket guide for when times are tough, everyone’s stress levels are high and all your clients want to do is make a change—any change. I often joke that the personal IPS should start with the phrase I, being of sound mind and body. I'm serious here: It's helpful to have a reference guide to reinforce the decisions you and your client made, why you made them and the circumstances in which you will adjust them, in order to hold yourself accountable.

Click image to enlarge

Time periods shown represent calendar year max drawdowns of the S&P 500 Index. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly. S&P 500 Index.

Bottom line

While everyone is putting out predictions for the year to come, my advice is to keep it simple and act smart.