Open season: Capital gains

As the days grow shorter, it signals that summer is nearing its end and fall is around the corner. While this year’s move from summer to fall will likely be different than most in recent memory, one topic that will remain the same this fall for investors will be capital gains. Investors are likely to see many stories on why 2020 could be a record year for taxable distributions tied to capital gains. Yes, 2020 just keeps getting better and better. Let’s discuss why it's open season on capital gains.

Definition of open season: A time during which someone or something is the object of sustained attack or criticism.

Why are there capital gains tied to mutual funds?

Within a mutual fund, the fund must add up all realized gains and losses recognized during their fiscal year (typically October-September). If the realized losses are greater than the realized gains, the fund will have a capital loss carryforward (CLCF). The fund will not distribute these losses to shareholders, but instead will carry forward into future years to be used to offset against future realized gains. If done correctly, this can be a good thing. If the recognized gains are greater than the losses, the fund will distribute the gains to shareholders at year end—typically in December. For taxable investors, this distribution shows up on the IRS Form 1099 and will likely flow through as a taxable event on the IRS Form 1040.

Remember that even if you reinvest this capital distribution (or dividend), the investor is still taxed on the distribution via the Form 1099.

How much money are we talking about?

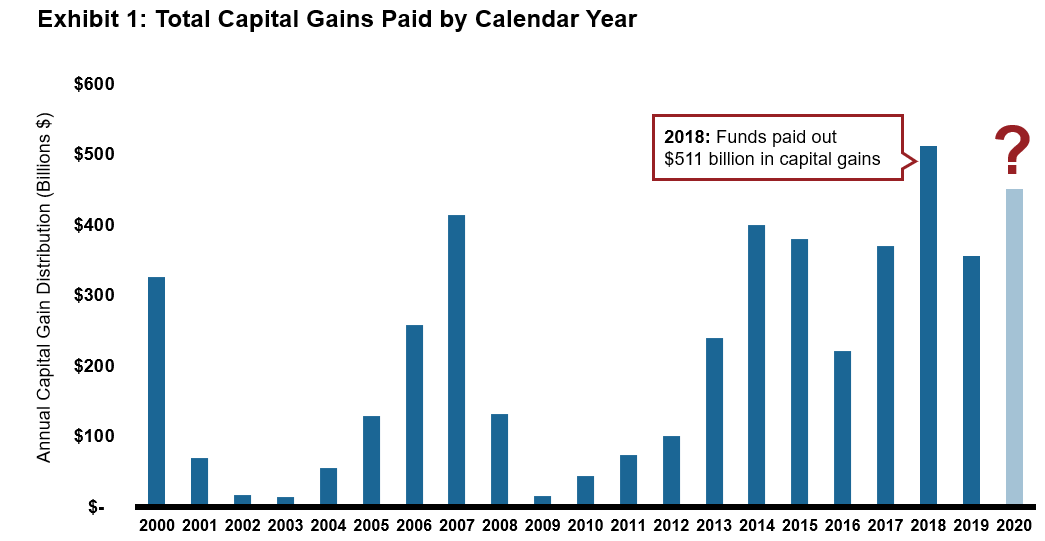

A lot. While we don’t know how much will be distributed in 2020, a few data points give insight into how the year may play out. The stock market volatility we witnessed in 2018 and in the first quarter of this year helps inform why 2020 may be above historical averages.

- According to data from the Investment Company Institute (ICI), mutual funds paid out total capital gains of $511 billion and $355 billion in 2018 and 2019, respectively. Why was 2018 over 40% greater than 2019? One reason was selling pressure on many funds due to the volatility during the year. Recall that the S&P 500 Index finished down -4% for the year.

Click image to enlarge

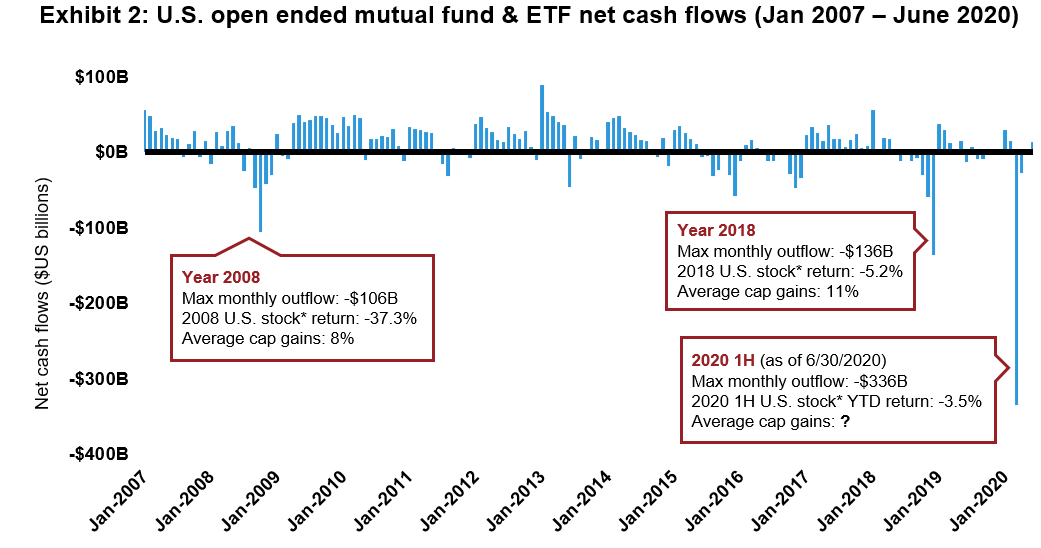

- Investor behavior impacts capital gains. Heightened market volatility often causes investors to shed risk assets and move to cash. While we can debate the merits of this move, Exhibit 2 shows the net flows for investors from June 2007 through June 2020.

Click image to enlarge

* Russell 3000® Index. Sources: Morningstar Direct, Russell Index. Data shown is historical and not an indicator of future results. Indexes are not managed and may not be invested in directly.

Note that in 2018, investors collectively shed -$136 billion in net outflows. This outflow corresponds with the larger 2018 capital gains seen in Exhibit 1. Seeing the magnitude of the net outflow in March of 2020 of $336 billion, one can infer that 2020 may be another record (not in a good way) for total capital gains. These negative cash flows force portfolio managers to sell stocks to meet cash redemptions. Given the strong stock market returns (S&P 500) since 2009, much of this forced selling will cause funds to recognize capital gains because they sell stocks with embedded capital gains.

What can advisors be doing now to help clients where tax management really matters?

- Figure out what distributions might look like in 2020

As the year progresses, all mutual fund companies can and should provide updates on what they see as projected capital gains for their fund. Many share this information in September and October. While these are estimates, they will at least give you an idea as to what to possibly expect. At the very least, advisors who are focused on helping investors with their tax burdens likely need to be contacting fund companies now to learn what these funds could possibly be paying in capital gains, so they can begin to plan for ways in which to possibly reduce these upcoming taxes. - Consider harvesting losses

If an advisor finds that there are funds that are in fact due to pay excessive capital gains, it may be wise to look to see if the client has losses from other investments to offset these gains—or to even consider an outright sale of that fund before the gains are realized and paid out to the client. This should only be done after assessing what the gain on sale and taxes due might be, and if it makes sense for that client. My colleagues have written extensively on this process of turning lemons into lemonade. - Know your client’s CPA (Certified Public Accountant)

Probably the one person who cares more about taxes than your client is their CPA. Tax-managed investing helps you get on the same side of the table as the CPA, helping you to potentially build a closer partnership with both your client and your client’s CPA. We believe it would be wise for advisors to proactively contact their client’s accountant to see if they are aware of these taxes, and to discuss ways in which they can work together to assist their mutual client. For these clients, thinking about how tax-smart and tax-managed solutions could help them in the future should be part of this process. - When you find yourself in a hole, stop digging (and transition … to a tax-managed solution)

If you are automatically reinvesting capital gains and dividends into a tax inefficient fund, turn this OFF for all portfolios that are making the tax problem worse. Consider using these distributions instead to fund a tax-managed solution—one designed to better help mitigate these issues going forward.

The bottom line

2020 has the making for a painful year for capital gains. The volatile first quarter of 2020 and generally strong equity markets since 2009 are coming together to create the (im)perfect storm of tax headwinds across client accounts. The predictable open season on capital gains this fall can be reduced with improved investment approaches. Now is the time for advisors to understand the impact across their practice and look to make changes to be in front of this repeating performance headwind.

Related articles

Be opportunistic: Tips on transitioning to tax-managed investing from a legacy mutual fund portfolio

Tax-loss harvesting: When life gives you lemons, does it matter WHEN you need to make lemonade?

Grasp the opportunity: Tax-loss harvest your legacy mutual fund portfolio