The function of the form: What advisors need to know about the new form 1040

Are investors paying too much in investment taxes? Can you help them create better after-tax outcome? Without a basic understanding of the individual tax forms, it can be challenging to critically analyze. Given this is the first tax year to reflect the Tax Cut and Jobs Act, there are a few changes advisors should understand to better prepare for reviewing clients and prospects tax situations relative to their investments. Understanding these changes will allow you to identify problem areas or opportunities that can add meaningful value to your practice.

What changed?

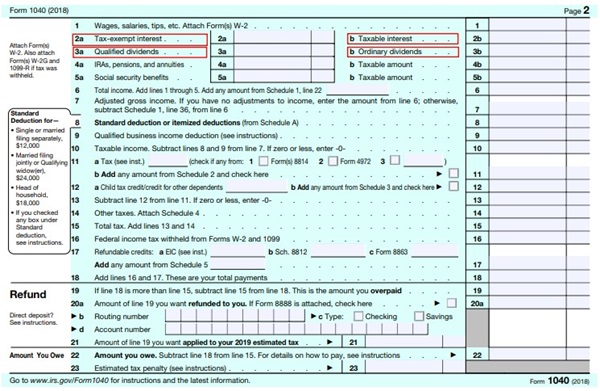

Forms 1040A and 1040EZ have gone the way of the dodo bird. The IRS has promoted its simplification of Form 1040, with all taxpayers reporting basic information on the new "postcard-sized" 1040.

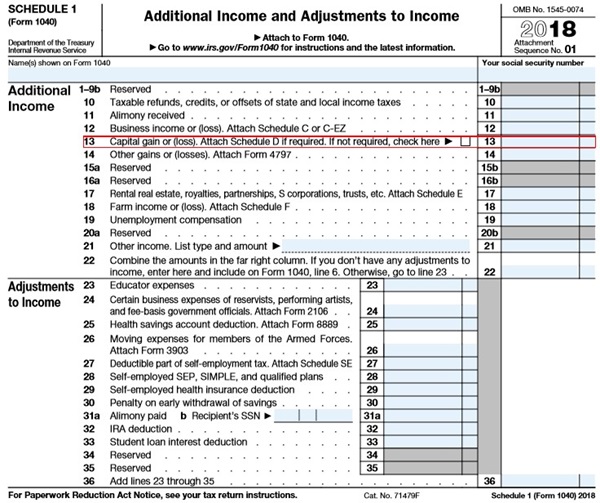

But most taxpayers with any investment income, capital gains, business income or other type of income beyond very basic wage income also will have the pleasure of completing the new Schedule 1 (see below).

How to help clients with investment taxes

To analyze the impact of taxes for your clients, you first need to know their marginal tax rate (which is the tax rate on the next dollar earned) and effective (average) tax rate. Then go through page two of the new Form 1040.

Line 2a: Tax-exempt interest. Is the client's marginal tax rate so low that municipal bonds may not make sense? Evaluate the tax-equivalent yield of municipal bonds versus taxable bonds.

Line 2b: Taxable interest. Conversely, is the client's marginal tax rate enough to erode after-tax income? Clients always want to focus on the yield of a given investment and often fail to consider the after-tax yield.

Line 3a: Qualified dividends. Qualified dividends are taxed at long-term capital gains rates. Does the client's situation require generating income? Perhaps a strategy focusing on capital appreciation or a similar tax-smart approach focusing on capital appreciation versus high dividends is warranted.

Line 3b: Ordinary dividends. Sometimes referred to as nonqualified dividends, these dividends are taxed as ordinary income and can be taxed at higher rates than qualified dividends. Many non-U.S. equity mutual funds (active and passive) have nonqualified dividends greater than 20% of the total dividend amount. Tax-smart funds will look to minimize this amount.

New Schedule 1, Line 13: Capital gain (or loss). Look to Schedule D to see the source of gains for line 13. Are the investments creating capital gains that are too high as a percentage of the investment amount? In 2018, the average U.S. equity mutual fund paid out capital gains equal to 11% of its net asset value. Does the distributed gain reflect an amount larger than this? Even 11% is painful and can likely be improved upon with a more tax-friendly approach.

Schedule D: Capital Gains and Losses and supporting statements: Look to see if turnover (the selling of mutual funds, stocks or bonds) appears too high given the value of the investment amount in Parts I and II. There may be a reason for the high turnover, such as harvesting losses or generating income, but one should understand the investment purpose of the turnover on Schedule D. Nonproductive turnover can lead to increased taxes.

And the attempt to make the new Form 1040 “post card sized” at 5 x 7.5 inches? The U.S. Postal Service stated they would deliver something this size at the standard-size letter rate, not as a postcard.

The bottom line

Helping your clients reduce the impact of taxes and maximize their after-tax returns can be one of your most valuable services. Thoughtful planning around taxes can improve successful after-tax outcomes.

For taxable investments, consider tax-managed equity funds, municipal bonds and thoughtful withdrawal strategies to help deliver successful outcomes. And remember that the goal is not to avoid taxes but to maximize after-tax wealth. Not paying tax is not a financial goal.

This article first appeared in InvestmentNews on March 5, 2019.