Grasp the opportunity: Tax-loss harvest your legacy mutual fund portfolio

It’s easy to say something should be done. It’s much harder to do it.

We are living in a different world today, yet much remains the same. We know the grass needs mowing but getting out the mower … that takes effort. Laundry needs to get done, but we wait until we are almost out of shirts. Or how about this one, for those of us that are parents: what has changed is that most parents have suddenly become educators, on top of everything else. What has not changed is the number of times that the kids need to be reminded to brush their teeth! It’s easier said than done.

Helping clients with their long-term financial plans—that is what we all do. It is an important job, one that is focused on providing financial security for people.

What is hard sometimes is knowing the right steps to take to move forward. Actually doing it is even harder.

Transitioning to tax-managed investing

Let’s talk about the topic of taxable accounts and transitioning clients to tax management. It’s obvious that it’s the right thing for clients. What is hard is actually doing it and knowing what steps to take. Harder still is the analysis—how does one calculate the cost and the benefit of transitioning to a tax-managed portfolio from a client’s current legacy portfolio?

Here is an easy way to think about it and calculate the cost of switching. Look at the Net Asset Value (NAV) of a mutual fund today, and compare it to the purchased NAV. Those numbers are remarkably easy to find—current NAV is published daily, and a client’s purchased NAV should be on their statement or otherwise readily available. The difference in the two numbers (purchased NAV vs. current NAV) is an investor’s price return.

The current NAV already reflects adjustments for past dividend and capital gain distributions, which investors would’ve needed to pay taxes on. So, it’s adjusted downward by the amount of prior distributions. Which, in the case of the topic at hand, means that the difference between the two NAVs is the total capital gain an investor would need to pay taxes on if they sold now. Add to this the fact that the market is still down for the year (as of June 16) and there is a decent likelihood a given client’s portfolio could be near or at tax neutral if they sold today. Meaning, transitioning out of that legacy mutual fund portfolio could have very little to no tax impact to the client. That would make switching easy, wouldn’t it!

If you are curious how this could be, keep reading as the data is below.

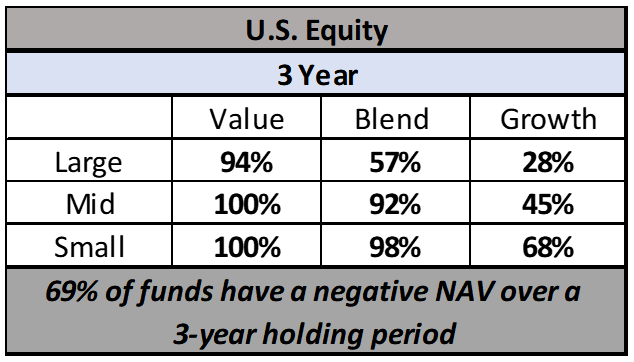

Using NAV to calculate tax switching costs

The proof is in the numbers. We compiled the data below from the Morningstar. Let’s assume an investor bought a U.S. equity mutual fund three years ago—69% of funds had a lower NAV than three years ago. Meaning the tax cost of switching for those investors is most likely zero (or less than zero if able to realize a loss). Diving deeper, let’s say an investor had a small cap blend fund. 98% of small cap blend funds had a NAV lower on May 15, 2020, than three years prior! This makes the cost of switching much easier, or even advantageous if a loss is realized.

Click image to enlarge

Source: Morningstar Direct as of May 15, 2020

Source: Morningstar Direct as of May 15, 2020

Let’s take a further look back – over the last 5 years. The numbers work out to be almost the same. 67% of U.S. equity funds have a lower NAV vs. five years prior. For funds focused on value stocks, that number is over 90%, while small cap blend funds work out to be 99% again.

Click image to enlarge

Source: Morningstar Direct as of May 15, 2020

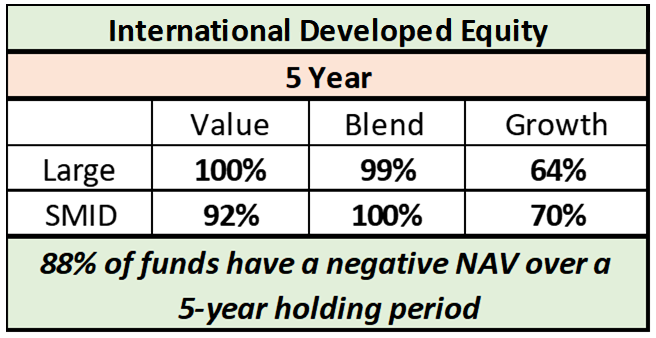

We believe the story – meaning the opportunity of making a low to no tax cost switch to a better tax-managed outcome – is even more appealing as you move outside of the U.S. Among international developed funds, 88% have a lower NAV compared to 5 years ago, while that number goes up to 99% for international blend funds.

Click image to enlarge

Morningstar Direct as of May 15, 2020

How to take action

Consider how this information and data can help you move clients to a better after-tax outcome going forward. The cost of switching right now may be low and likely lower than you thought. The future might not hold the same opportunities as what is available right now. Putting a plan together of how to take action is key.

Action Plan: Transitioning to Tax-Managed

- Identify clients that could benefit from a better after-tax outcome (or, a lower tax bill)

- Pull the info on their mutual fund holdings, including purchase NAV and current NAV

- Compare the difference between the two numbers. Close to zero means minimal switching cost. A negative number means you are actually harvesting losses for the client in the process—a tax asset!

- Transition to a tax-managed solution. Potentially a better long-term outcome.

Take advantage of this current market opportunity to have a different conversation with your clients. Use it as a way to make adjustments to their long-term financial well-being by taking better control of tax cost. And lastly, use this as a way to have a more robust conversation with prospects. They too can use this type of help and advice.

Related articles

Be opportunistic: Tips on transitioning to tax-managed investing from a legacy mutual fund portfolio