Growing a sustainable book of business based on advisory

Let me tell you a little story

Three little pigs set out to make their fortune in the world. The first two little pigs built their houses out of straw and twigs. When the big bad wolf came to visit, he huffed and puffed and blew their houses down. The third little pig took a different approach. He planned for the long term and put in the extra effort to build his house from a strong foundation of brick. When the wolf came to visit, the third little pig’s foresight paid off; he was able to weather the wolf’s storm, triumphing over his antagonist. In the classic fairy tale, The Three Little Pigs, the first two pigs took a short-cut and were ultimately devoured by the wolf, while the more practical third pig, through hard work and discipline, built a house to last.

Like the three little pigs building their houses, financial advisors have many choices of how they will build their books of business. Many of the most successful advisors embrace fee-only wealth management. They see past the typically higher near-term earnings potential of commission-based sales and establish long-term, service-oriented, trusting relationships with clients based on the fiduciary standard. Not only do fee-only advisory relationships tend to generate a more predictable, recurring revenue stream for the advisor, they also tend to align advisor and client interests. In this blog post, we put some numbers to these theories.

A common hypothetical scenario

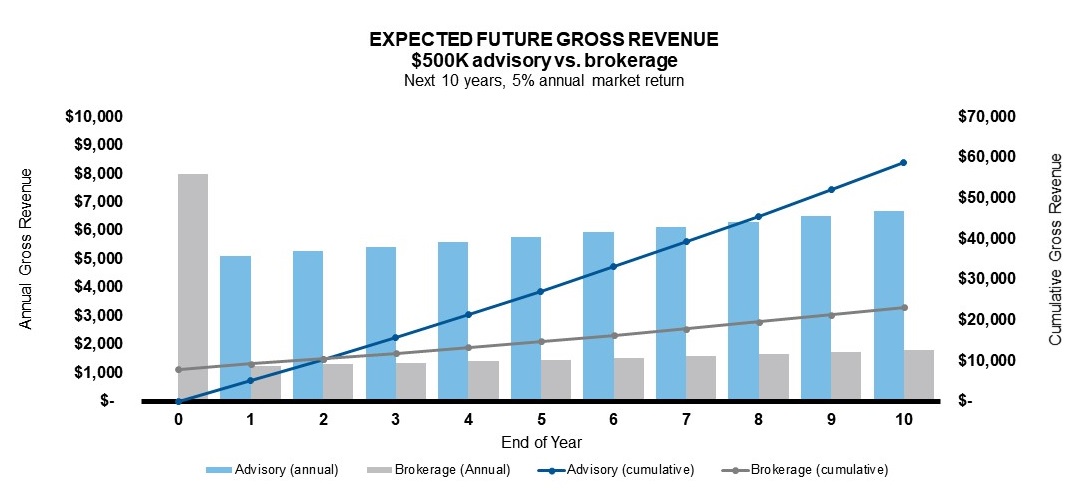

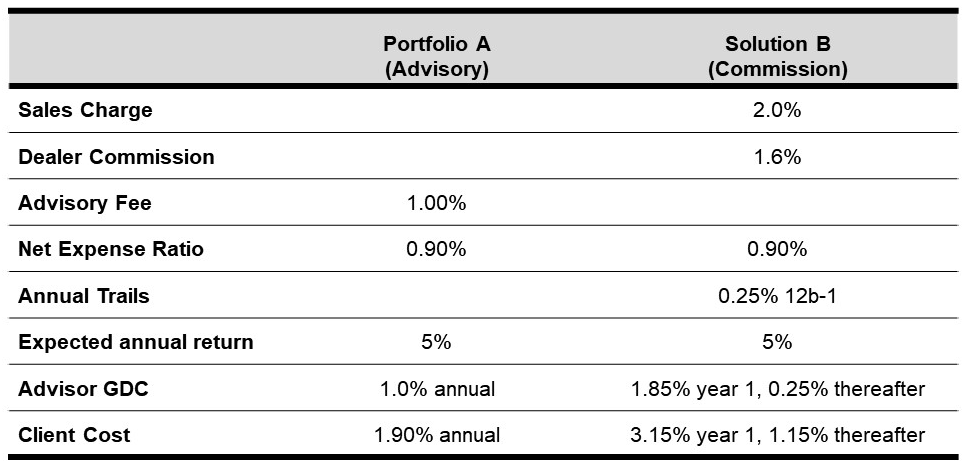

An advisor is recommending a “balanced” investment solution for a prospective client with $500K investable assets. The advisor may choose between an advisory solution—let’s call it Portfolio A—and a commission-based solution—let’s call it Solution B—with the following pricing characteristics and assumptions:

Click image to enlarge

For illustrative purposes only.

For the sake of comparison, both options are expected to deliver 5.0% annual performance and charge a net-expense ratio of 0.90%.1

Advisor gross revenue:

In an advisory relationship, advisors may charge an annual fee (collected quarterly) that we will assume to be 1.0% of assets managed. On the other hand, commission-based sales generate a significant dealer commission at the time of sale (assume 1.6%). Advisors also earn a small trailer for commission-sales that we will assume to be 0.25% annually.

Client cost:

Using advisory, the client’s cost is the annual advisory fee plus the annual net expense ratio. Under a commission-based sale, the client’s cost is the up-front sales charge of 2% plus the annual net expense ratio for the product.

From a purely economic perspective, the commission-based sale is expected to generate $8,000 in gross dealer commissions (GDC) at the time of sale and 25 basis points (bps) trail of $1,200 in year one. The advisory-based relationship earns nothing up-front but is expected to generate over $5,000 in annual GDC each and every year that the client remains in that investment solution.

2-year breakpoint:

After the relationship is two years old (assuming no changes in investment solution), the advisory solution earns significantly more for the advisor than the commission-based sale. In the fifth year, annual advisory fee exceeds the commission-trail by nearly four times ($5,771 vs. $1,477) and can be relied on as a recurring revenue stream, assuming the client remains invested in that solution. Cumulative revenue generated from the advisory relationship is nearly twice the amount earned from a commissioned-based product sale.

The average lifetime relationship of an advisor and client is quite long: around 20 years.2 The implication is clear:Building a book of business based on advisory tends to be more profitable for the advisor in the long run. But, more importantly, how does an advisory relationship affect the client’s experience?

Click image to enlarge

How does the advisory relationship impact the client experience?

- Client cost: Advisory is more expensive for the client after two years of relationship. However, the potential value received by a client from a full-fledged advisory relationship is expected by many to far exceed the fee. Advisory fees are pay-as-you-go, which may be more attractive to some clients compared to the up-front charges for commission-based sales.

- Commission-based product sales may be more appropriate for clients with medium-term investment time horizons who are not likely to need any portfolio changes. Investors who do not require additional planning and wealth management services may also benefit more from a commission-based relationship.

- Portfolio outcomes: Similar investment outcomes can be expected from advisory and commission-based in a stable market environment.

- Under an advisory relationship, the financial advisor’s compensation is intrinsically tied to the success of the client’s portfolio and has an incentive to offer the best strategy and client experience possible, compared to commission-based sales, where most of the compensation comes up front.

- Portfolio alignment: Advisory relationships allow more flexibility and complexity for the management of client portfolios.

- Commission-based sales are transactional by nature. If the client’s goals or circumstances change, there may be additional costs for every transaction made in the portfolio. Under an advisory agreement, the client is paying a fee for advice and does not incur additional charges for transactions. Historically, the advisory relationship placed a higher burden of care on advisors. The fiduciary standard requires that advisors place their clients’ interests above their own. Commission-based product sales required only suitability, which means that transactions must be suitable for clients’ needs, but not necessarily in the clients’ best interests. With the adoption of Regulation Best Interest (REG BI) in June of 2020, this distinction will be made obsolete. All client relationships will fall under the fiduciary standard.

- Wealth management and client outcomes: Many of the best advisors offer a suite of wealth management services for their clients as part of their ongoing advisory fee.

- These services extend beyond basic asset allocation, investment selection and portfolio construction. Services may include in-depth financial planning, budgeting, estate and retirement planning, and managing taxes.

- For many clients, especially those with more complex needs, an advisory relationship should afford the client a better and more complete experience because it takes a more holistic view of the client’s family wealth picture. Under an advisory relationship, advisor and client interests may be better aligned.

Building a sustainable business of advisory relationships

Advisors who sell commission-based products must always be looking for the next transaction in order to maintain their earnings, which can be exhausting in the long run. By prioritizing advisory relationships with clients, advisors may spend more time on advice and planning and less time managing, researching and trading client’s investment portfolios. The recurring revenue that advisory relationships may generate offers advisors the freedom and flexibility to deepen their relationships with existing clients and create advocacy that may eventually lead to referrals.

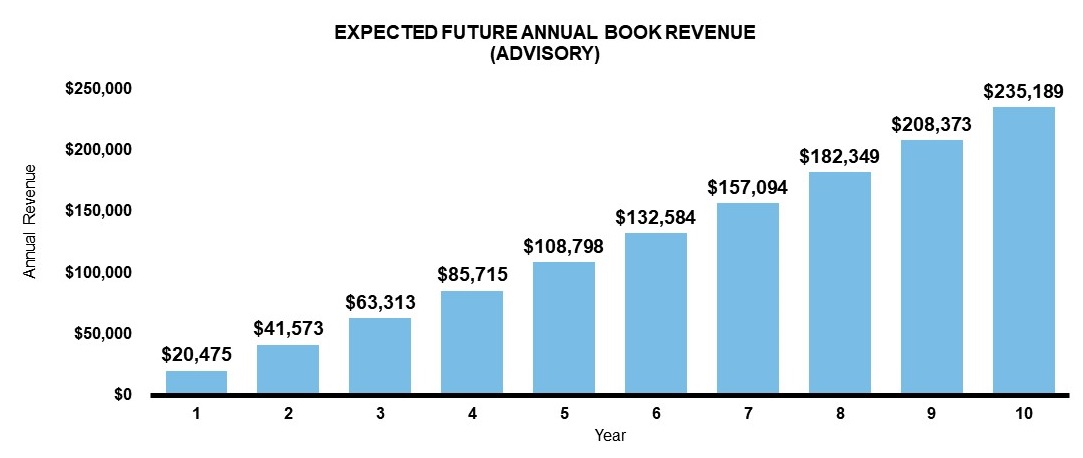

Another hypothetical scenario: Where do you want to be in 10 years?

A new financial advisor decides to build a book based on advisory relationships. He is successful in accumulating clients and adds $2 million in advisory at the beginning of every year (10 clients with $200K assets each). Like the previous scenario, the product expense ratio is 0.90% and the expected annual market return is 5%. The advisor charges a 1% advisory fee.

Click image to enlarge

For illustrative purposes only

In five years, the advisor is expected to earn $109K in annual revenue, all of it recurring. The AUM of the book will grow to $13M.

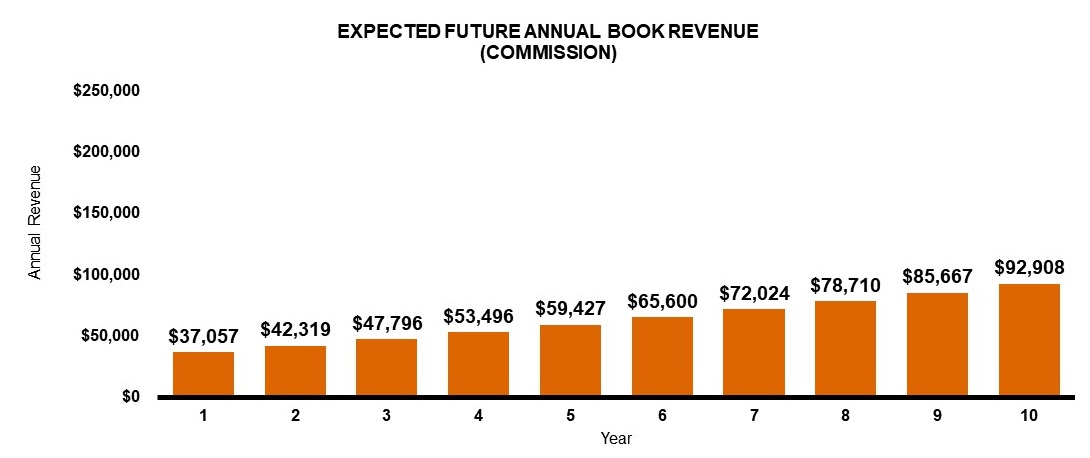

Now consider if the same clients were sold commission-based products with the exact same net expense ratios and expected returns. The only difference is in how the advisor is compensated. This time we will use a 1.6% up-front dealer commission plus 0.25% annual trail.

Click image to enlarge

For illustrative purposes only

What a difference! The commission-based advisor is only expected to earn $59K in the fifth year, a fraction of the revenue generated by advisory. To build a sustainable book of business while adding value to the client relationship, consider an advisory solution.

The bottom line: Advisory may offer a win-win situation

The reality is that clients’ needs are ever evolving, and the advisor must respond with planning, advice and investment recommendations that maximize the probability of achieving their goals. Advisory relationships may offer increased flexibility and a greater focus on planning and advice. Advisory relationships also earn more sustainable, recurring revenue for the advisor, and align the interests of the client and advisor.

Advisors should begin to think like the third little pig who built his house on a foundation of brick. With discipline and long-term planning, advisors may build a sustainable book of business to last and deliver better outcomes for their clients at the same time.

1 For the purpose of this example, the advisory solution is priced the same as the commission product, but this will not always be the case. The Sales Charge, Dealer Commission, Advisory Fee and Annual Trails may also vary greatly between product solutions and providers.

2 Pricemetrix states average client retention at 95% (or 5% annual turnover) which translates into a 20-year expected lifetime relationship. Lifetime = (1 / annual-turnover%). https://www.mckinsey.com/industries/financial-services/pricemetrix/overview.