De-risking implementation: What DB plans should know

2022 has started off like no other year in recent history. Following an all-time high for the S&P 500 in early January, markets have sold off meaningfully in the following months. U.S. equities are now in bear-market territory, fueled by the Russia-Ukraine conflict along with something we haven’t seen in years: aggressively rising interest rates and high inflation. Despite asset values falling 15-20%, rising interest rates have provided a cushion to corporate defined-benefit-plan funded status, with the status of many plans holding strong or even improving. Higher rates also provide additional opportunity—de-risking to better match liabilities and buying bonds with more attractive yield. Both Treasury rates and credit spreads are now above median levels over the past 20 years.

All of this, of course, had been unimaginable just a few months earlier, with equity markets moving higher amid the notion that inflation was merely transitory. In short, the market has given DB plan sponsors another chance to de-risk to stabilize funded status. We continue to see a strong de-risking trend among pension plans as they look to reduce funded status volatility and potential future contributions.

What can be done in advance?

Not surprisingly, we are often in discussions with clients about the optimal approach to implement a de-risking strategy. In most cases, the best results can be achieved by first de-risking using a derivative overlay to effect the broad asset allocation shift and hedge ratio.

It’s important to understand that it can often take days, if not weeks, to implement a large-scale de-risking of physical portfolios. This is why having the proper tools in place—such as an overlay program—at the outset is so vital. This helps speed up the de-risking process and minimizes potential regret and Monday-morning quarterbacking of a delayed implementation in the event of market turmoil.

Notably, clients with a plan-level overlay often implement de-risking trades within days—and even hours—of their decision. This helps ensure that the plan is not overexposed to a market selloff that could occur between decision and action. The current elevated volatility means that any misstep in positioning comes with a higher potential cost. A plan-level overlay can dramatically lessen this risk, to the extent that we’d argue it’s a must-have for many. After all, when your main objective is de-risking, why take on massive unintended risk?

The mechanics of de-risking

Having an overlay in place is a critical first step, but importantly, it’s only the beginning. Once the plan’s asset allocation is aligned to the strategic policy portfolio, the real work begins. The progression of moving the physical portfolios from equity assets to long duration fixed income, while concurrently adjusting the overlay hedges to maintain this asset allocation, is the riskiest and most operationally challenging component of making the asset allocation shift. With this in mind, we believe a great deal of planning should be applied to this process to ensure that portfolios maintain proper beta exposure and are not exposed to unwanted leverage or cash.

The sequencing of events should be planned out and executed with precision:

1. Create a transition account with your implementation provider for the event.

- This account is for segregating the assets in transition from the rest of the plan and can be done well in advance of initiating the de-risking process

- Ensure the account has all the needed sub-custodial arrangements for trading foreign legacy and target securities

- Make sure the custodian has all the necessary documentation and the direction letter to take instructions from the implementation manager

2. Identify target destination fixed income mandates that will be funded with proceeds from equity liquidations

- All destination managers should be contracted and ready to receive assets. This should also be done well in advance where possible and this contracting process can take several months.

3. Identify reduced/terminated equity managers that will provide the assets to be transitioned to fixed income mandates

- Know the details of the terminations and reductions (commingled funds, open dates, pre-notifications, etc)

4. Notify managers of upcoming activity for the asset reallocation

- Terminated managers should be notified as late in the process as possible

- Instruct reduced managers to work with your implementation provider to get lists for in-kind transfer or dates for cash redemptions out of commingled funds

- Instruct target managers to coordinate with your implementation provider to deliver preliminary and final target portfolios for trading

5. Monitor the transition process.

- Your implementation partner should be managing all aspects of the event and reporting progress back to the plan daily, if not more frequently

- The implementation partner should lead regular calls with custody and accounting to ensure the process is going smoothly

6. Always review the project after the event is complete.

- Evaluate both the process and results.

- The performance outcome of the event should be measured with T Standard implementation shortfall, and this result should be compared to the pre-transition estimate created prior to the event.

- Qualitative assessment should also be undertaken. Was the process operationally smooth and completed in the expected timeframes? This is key, as delays create risk, and risk is the enemy of good process and good outcomes.

- The quantitative and qualitative reviews are critical for creating a standard of success, as issues can be identified and addressed with corrective process for the next de-risking event.

Ultimately, the key is recognition of what’s going to create the biggest impact on performance—and the biggest factor in performance will always be asset allocation. Transaction costs do play a factor, but transaction costs will represent a small amount of total cost compared to the opportunity costs that could be incurred if portfolio exposure is mismanaged. This implementation risk should not be viewed through weekly or even daily volatility, but rather through the lens of hourly tracking error to capture the potential risk of poor implementation. In the matrix below you can see the hourly tracking error between the asset classes is 60-80 bps. In many cases, a single hour of risk can be more costly than the collective transaction costs of the event.

| Hourly tracking error | USD Cash | U.S. Large Cap Equity (SPY) | International Equity (EFA) | Emerging Markets (EEM) | Long Treasury Bonds | Long Credit (IGLB) |

| USD Cash | 0 bps | |||||

| U.S. Large Cap Equity (SPY) | 56 bps | 0 bps | ||||

| International Equity (EFA) | 59 bps | 31 bps | 0 bps | |||

| Emerging Markets (EEM) | 67 bps | 49 bps | 37 bps | 0 bps | ||

| Long Treasury Bonds (TLT) | 48 bps | 75 bps | 79 bps | 81 bps | 0 bps | |

| Long Credit (IGLB) | 42 bps | 58 bps | 63 bps | 68 bps | 27 bps | 0 bps |

Hourly tracking errors calculated based upon 60-day historical tracking errors between S&P 500 ETF (SPY), MSCI EAFE ETF (EFA), MSCI EM ETF (EEM), US Long Treasury ETF (TLT), and US Long Credit ETF (IGLB) through 05/14/2022. Standard & Poor’s Corporation is the owner of the trademarks, service marks, and copyrights related to its indexes. For illustrative purposes only. Data is historical and not a guarantee of future results. Indexes are unmanaged and cannot be invested in directly.

Pitfalls of using money managers to de-risk

When it comes to de-risking, using multiple managers to liquidate equity and then passing the cash on to bond managers may not sound all that problematic on the surface—after all, managers are pretty good at trading, right? However, this approach introduces significant market exposure risk, along with several other impactful shortcomings. Here are some of the key reasons why we believe using managers to de-risk is a hazardous approach.

- Performance holidays and a lack of accountability

It is good governance to measure the impact of the de-risking event. Having money managers trade rarely produces a meaningful performance number, and even when attained, it is nearly impossible to build a composite of all managers involved and measure the true cost of the event. When a cash raise or funding of a manager occurs, and it is greater than 20% of the portfolio value, there is the potential for significant impact to the track record of that account. For example, if a manager raises 25% of the value in cash, and the market rallies 2% over the two days before settlement, the manager incurs a negative 50 basis point headwind to performance. This gets embedded in the longer history of the account. In most cases, the manager will ask for a performance holiday. To be clear, if the manager is on a performance holiday, then the plan sponsor, as the fiduciary, is still fully accountable for any performance outcomes during this time.

- Unnecessary round trips

Fixed income managers will often look to manage funding risk by putting on duration with Treasuries. This provides the best initial hedge to the target portfolio and allows them to take a more patient approach to buying less liquid securities. However, if an overlay is already in place to hedge the initial trade, those derivatives must now be unwound, and the manager will round-trip Treasuries to get to the ultimate portfolio. While it’s true that Treasuries are very cheap to trade—at about 4 to 6 basis points round trip—every basis point counts. So why incur this cost when a superior strategy is readily available?

- The concurrent trading of physicals and derivatives in real-time does not happen by chance.Only a purpose-built implementation infrastructure can actively manage this market exposure risk while contemporarily minimizing transaction costs. Having multiple managers all involved can make this difficult task even messier, as shown in the herding cats example (#5) below.

- Multiple long credit managers experiencing a large funding at the same time can create heated competition for attractive bonds.

Take the example of three separate managers attempting to purchase the same bond. They will likely go to the same dealers, and these dealers could interpret three different managers buying the same bond as information that these bonds are in high demand. This, in turn, could create a detrimental price impact that pushes prices higher. A single implementation manager running the purchase program will minimize this competition factor and reduce market impact.

- Herding cats

A transition manager runs the coordination of all aspects of the de-risking trade, removing the substantial operational burden from the client. Simply put, when you don’t hire a transition manager, you are the transition manager. Taking on this responsibility can be like herding cats: arranging the trade timing of the managers providing funds, transferring assets, and—if an overlay is involved—coordinating the exposures with the funded managers. This can be incredibly complex, making it increasingly difficult to maintain the desired exposures. Every minute matters when exposures are off target.

- Purpose built trading

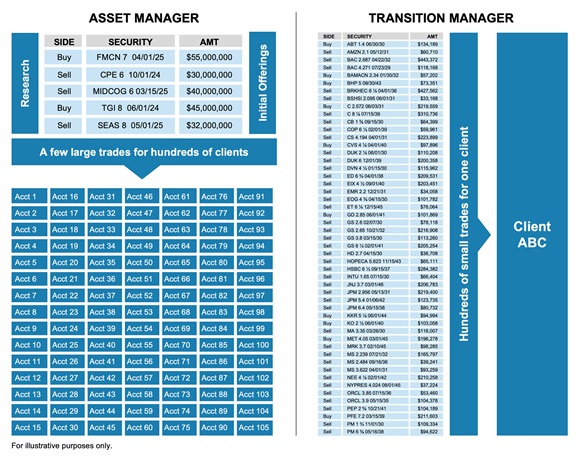

Managers and transition managers are both very good at trading, but they are built differently. If we focus on fixed income trading and specifically credit managers, these managers generally trade large blocks of bonds and allocate across hundreds of their accounts, with trades often done through a handful of dealers. Transition managers, by contrast, are built to trade a high volume of trades for a single account and access credit markets through hundreds of liquidity providers. These structural differences also significantly effect trading horizons. Managers executing transition trades will often need several weeks to complete trading and require a performance holiday during the month the transition is completed. Conversely, a transition manager can execute the same trading activity in just a few days, and be fully accountable for the performance outcome measured in T Standard Implementation Shortfall methodology.

Comparing manager vs. transition manager trading

Both are experts, just in different disciplines

In our experience, the best risk-management and most cost-effective approach to implement a de-risking event is having an expert implementation partner manage the process with full accountability for the outcome.

The bottom line

The challenging market environment in the first half of 2022 has led to a surprising outcome to many: stable and even improved funded status for most defined benefit plans. We believe that DB plans that are in a position to de-risk should strongly consider doing so—but only in a deliberate, precisely defined manner that does not create additional unintended risk. This where the combination of an overlay and skilled transition management team working seamlessly together can produce a tightly risk-managed and cost-effective solution. Let us know how we can help.