Funded status volatility: Why it matters for pension plans

Let’s get right to the point: Funded status volatility creates problems. Reducing that volatility can help mitigate those problems.

Significant drops in funded status can lead to larger, unexpected contribution requirements for plan sponsors, if a plan’s funding drops below a certain level. And funded status volatility can also impact Pension Benefit Guaranty Corporation (PBGC) premiums. If a plan’s funded status drops at the wrong time, PBGC premiums can increase significantly due to that funded status decline.

Learning from the past

We had observed in prior risk-off events, like the Global Financial Crisis, that many defined benefit (DB) plan sponsors experienced unpleasant surprises in the form of material funded status declines. We’ve heard from our own plan sponsor clients today—who are understandably wary, due to their own past experiences—that they want to avoid any sudden, dramatic drops in funded status. This is why, aside from a general client desire for no surprises, we believe the best OCIO providers focus on risk management—alongside traditional return generation strategies—to guard against potential funded status losses.

A low-vol approach to funded status: The three-legged stool

We believe that plan sponsors should take a holistic perspective to managing total plan risk. And we advocate a three-legged risk management approach that focuses on the following:

- Diversification of the asset portfolio.

- Management of liability sensitivities to interest-rate changes.

- Consideration of the interaction between these return-seeking and liability components.

Does it work? The proof is in the pudding.

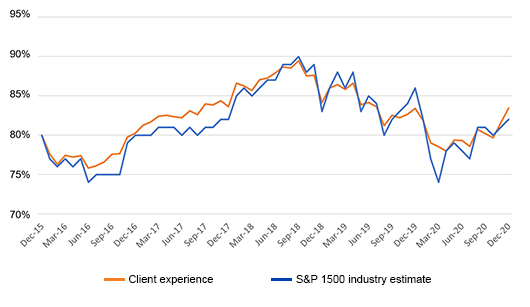

As a case study to the validity of this approach, we can point to the results of our own clients in 2020. Data shows that our investment approach mitigated funded status risk. Corporate DB plans managed by Russell Investments experienced significantly less volatility of funded status movements over the last five years, when compared to industry estimates. Incidentally, these client plans also experienced a greater improvement in funded status over this time frame.

Russell Investments' OCIO success:

Client funded status experience vs. S&P 1500 industry

5 years ended December 31, 2020

Source: Russell Investments

From 2015 to 2020, the volatility of funded status movements for Russell Investments’ DB OCIO clients was 4.5%. Over the same time period, the estimated volatility of funded status movements for DB plans sponsored by S&P 1500 companies was 7.4%*. That represents an approximate 40% reduction in the volatility of funded status movements for Russell Investments’ DB OCIO clients.

When it comes to funded status movements, the data shows that the monthly path for our DB clients has been significantly smoother than what was typical in the industry. This more predictable experience was especially noteworthy amid the market upheaval of 2020. As a result of our approach, the data shows that the volatility of funded status movements for Russell Investments’ clients was only 5.3% in 2020, in contrast to the S&P 1500 industry estimate of 9.7%.

Russell Investments' OCIO success:

Client funded status experience vs. S&P 1500 industry

As of December 31, 2020

| Funded status change |

Volatility of funded status change (annualized) |

|||

| Client experience |

S&P 1500 industry |

Client experience |

S&P 1500 industry |

|

| 1 year | 0.1% | -4.0% | 5.3% | 9.7% |

| 3 years | -0.1% | 0.0% | 5.1% | 8.8% |

| 5 years | 3.5% | 2.0% | 4.5% | 7.4% |

Source: Russell Investments

Was there a tradeoff in the actual funded status of these plans? Not according to the data. On average, the funded status of these client plans improved 3.5% from 2015 to 2020—an improvement above the S&P 1500 industry estimate of 2.0% during this same time frame. While 2020 saw liabilities often increasing due to the dramatic drop in discount rates, the average DB plan managed by Russell Investments maintained its funded status—while the estimated funded status industry-wide fell by 4.0%.

Providing options to clients: Repurposing reduced funded status volatility

In addition, recognizing that each client is unique, the significant reduction in volatility of funded status movements could be repurposed to provide more options for plans that desire higher returns. Institutional investors could alternatively spend that risk in other areas to seek higher expected returns, where appropriate.

The bottom line

We believe the holy grail of risk management for institutional investors is to provide the smoothest funded status experience possible while simultaneously progressing funded ratios towards desired outcomes. We also believe recent data shows that—with the right holistic approach to risk management—this is not only possible, it’s been done. Even during the roller coaster ride of 2020.

*S&P 1500 industry data based on monthly funded status estimates published by Mercer.