Municipal bonds: Volatility is creating a potential opportunity, but choose carefully

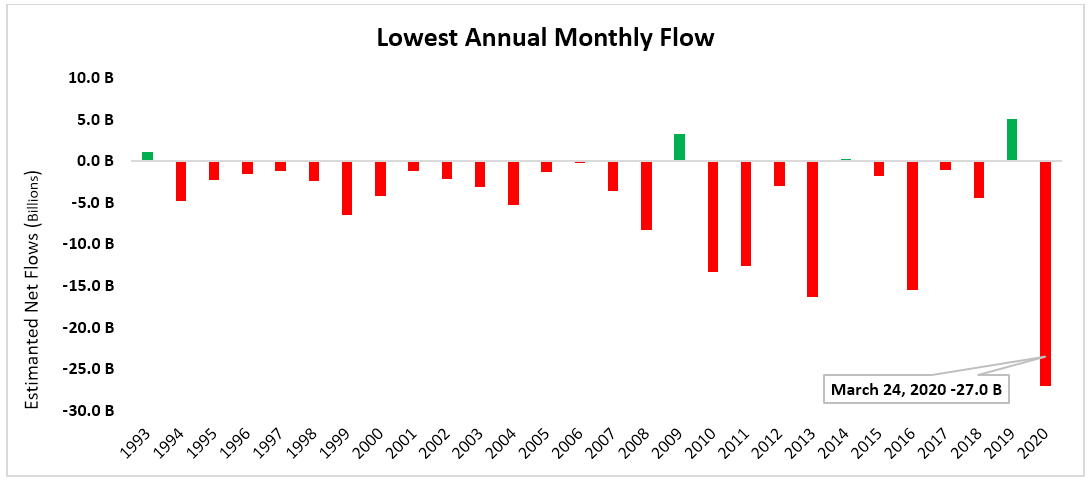

Until very recently municipal bonds were a very different experience, finishing 2019 with a 14-month run of positive net inflows2, equating $95 billion into open-end mutual funds and exchange traded funds. 2020 is also setting flow records, although from an outflow perspective, with Friday, March 20, marking a one-week outflow record of $12 billion and possibly a month-to-date outflow record, with $27 billion so far.

Source: Morningstar Direct

Why are we experiencing this?

The massive sell off is driven by the near term economic uncertainty presented by COVID-19, a pandemic that has driven wide-spread indiscriminate selling across all asset classes—including the municipal bond market, which is typically considered a safe haven asset class. Investors rushed to sell municipal bonds to raise cash, making these relatively less liquid (versus U.S. Treasuries) high quality bonds extremely illiquid, driving mark-to-market price losses in funds. So March represented a liquidity crisis, not a credit or default crisis.

What’s worth noting is that during a 2019 of record-breaking inflows and limited supply, some of the larger municipal funds appeared compelled to purchase speculative non-rated (NR) issues that they otherwise may not have. Now these funds are experiencing pressure to keep up with redemptions, selling their high quality munis so as to not force-sell the less liquid NR bonds, exacerbating the price pressure on high quality bonds. When buyers do start to emerge, they could potentially come from relatively smaller tax-exempt bond funds that are able to more nimbly navigate the selling pressure.

Why municipal bond funds, why now?

The benefit of buying now is investing in bonds at attractive price points. Four main points to consider while contemplating an allocation of sidelined cash to municipal bonds come in the form of forward-looking expectations that may be hidden behind negative headlines:

- Yield curve:

Currently the municipal yield curve is inverted (ie shorter-maturity yields are higher than longer-maturity yields), seeing the Securities Industry and Financial Markets Association (SIFMA) tax-exempt seven-day rate at +5.2% as of March 20, 2020.4 The last time this occurred the inversion lasted for only one week, and quickly snapped back (with prices increasing) to more normal levels.This time the window may be open a bit longer due to economic uncertainty, but it’s truly difficult to say at this point. However, it’s important to remember the history of strong credit quality that municipals have demonstrated:

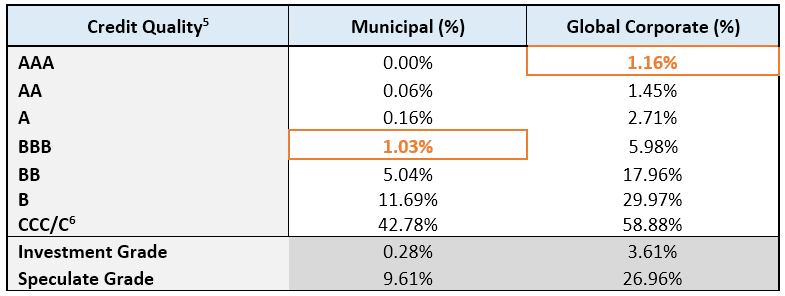

- BBB-rated municipal bonds (i.e., the lowest rating within investment grade) have essentially the same ultra-low default rate as AAA-rated (highest quality) corporate bonds.

- Investment Grade: Municipal default rates are less than one-tenth of corporate default rates.

- High Yield: Municipal default rates are one-third of corporate bond default rates.

Click image to enlarge

Source: S&P

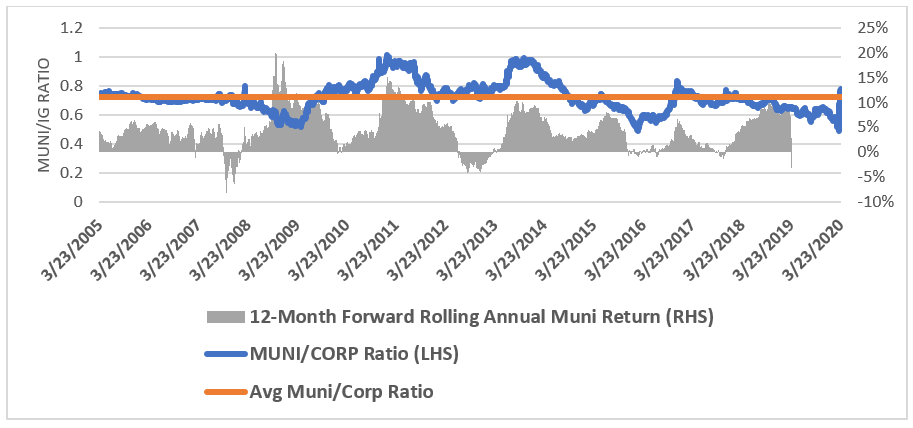

- Municipal-to-corporate bond yield ratios are at extremes:

The graph below shows that in the last seven years when this ratio has exceeded its long-term average, then high quality municipal bonds tend to enjoy total returns of 5-10%. In the years immediately after the global financial crisis (GFC), municipals enjoyed annual returns around 15%.

- Government providing unprecedented stimulus:

The U.S. government is injecting approximately $2 trillion toward essential services like hospitals and transportation, with certain municipal bonds likely benefiting.

- Federal Reserve Bank is providing unprecedented liquidity:

On March 20, the U.S. government announced it would make an additional effort to support the U.S. municipal market in the form of $700 billion in loans via its Money Market Lending Facility. This was greatly expanded on March 23, with the Fed announcing unlimited quantitative easing or QE (i.e., bond buying), along with $300 billion in new lending programs to help all corners of financial markets, including municipals.

The bottom line

To be sure, we are entering an unknown period of economic stress, and appropriate caution should be exercised. But there are signs that the precipitous market sell-off may have been overdone for municipals driven by illiquidity, which the Fed is rushing to remedy. While municipal bonds are at attractive entry levels, it’s important to remember that they have historically been a safer alternative with much lower default rates versus corporate bonds—plus the multi-trillion dollar government stimulus package will very likely directly support dedicated segments of the muni market. During this time of opportunity, it is important to navigate media headlines objectively, resist scare-mongering and not let fear lock up our ability to make informed investment decisions and take advantage of rare opportunities.

1,2 Source: Morningstar Direct

3 U.S. Municipal Bonds: Morningstar broad category ‘US Municipal’ which includes mutual funds and ETFs (and multiple share classes). 2020 YTD Flows as of 3/20 – which only includes funds that report daily flow data.

4 Source: Moodys

5Source: S&P. For municipal defaults, S&P’s study period was Jan. 1, 1986, to Jan. 1, 2019. For corporate defaults, S&P’s study period was Jan. 1, 1981 to Jan. 1, 2019. The calculation represents a 15-year cumulative default rate.

6 S&P’s study calculations include all ratings in the C category, from CCC to C.