Municipal bond funds: The involuntary move toward risk

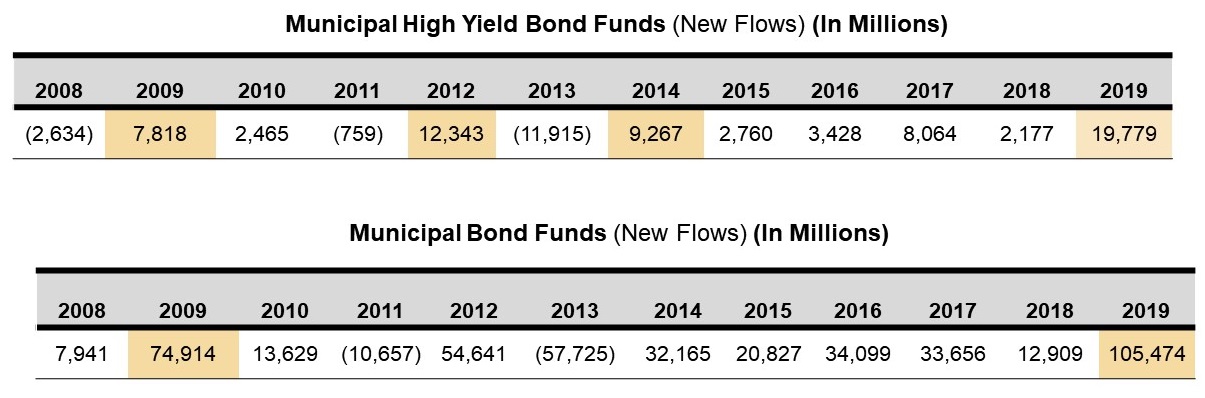

Municipal bond fund inflows in 2019 were tremendous. In fact, they set an annual record of $105 billion through Dec. 31 into open-end mutual funds and exchange traded funds, as illustrated in the chart below. This is 41% higher than 2009, which held the previous record of $74 billion. A much smaller segment of the municipal bond fund market is high yield (or sub-investment grade). This segment also had a record-setting year, pulling in $19 billion of net flows, 60% higher than the last record set in 2012.

Click image to enlarge

What’s fueling the muni-bond frenzy?

This influx of flows can largely be explained by strong technical demand, which in turn was driven by:

- Continued economic growth

Driven by the U.S. consumer and low unemployment.

- Concerns about declining credit fundamentals and increasing default rates in corporate bonds

Municipals are often used as substitutes for taxable corporate bonds, and concerns are rising about increasing leverage on corporate balance sheets.

- Tax Cut and Jobs Act of 2017

Beginning in 2018, tax reform eliminated benefits of refinancing debt for muni-bond issuers, which contributed to a reduced supply of new tax-exempt issuance in the ensuing two years. Concern over decreased supply—along with reduced mortgage interest expense deductibility—spurred demand, pushing muni yields lower and credit spreads tighter, while boosting returns.

- Elevated equity market levels

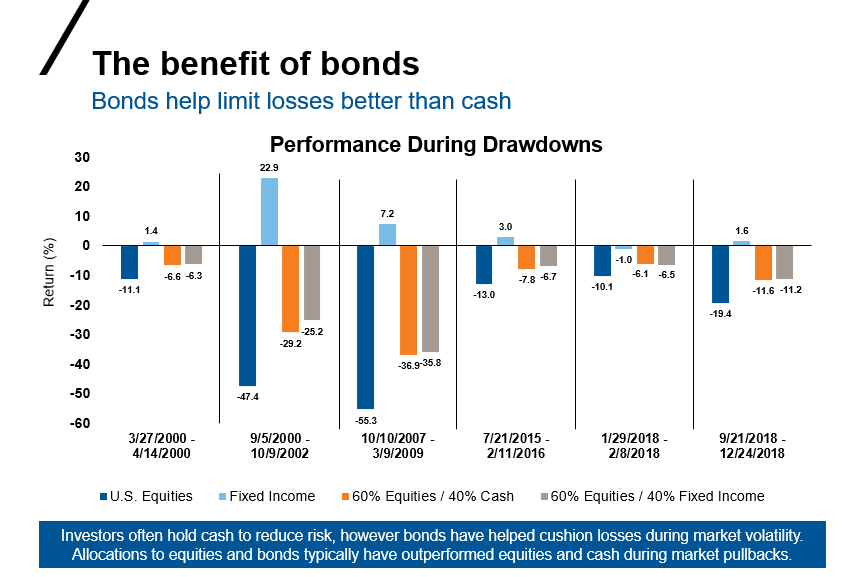

Municipals (including high yield municipal debt) are considered a safe-haven asset class. As equity indexes continue to set record levels, investors may seek out asset classes that protect on the downside while still providing some amount of yield and return. Allocations to equities and bonds typically have outperformed equities and cash during market pullbacks, as evidenced in the chart below.

Click image to enlarge

Source: Morningstar; U.S. Equities: S&P 500; Fixed Income: Bloomberg US Aggregate Bond; Cash: FTSE Treasury Bill 3 Mo Index. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

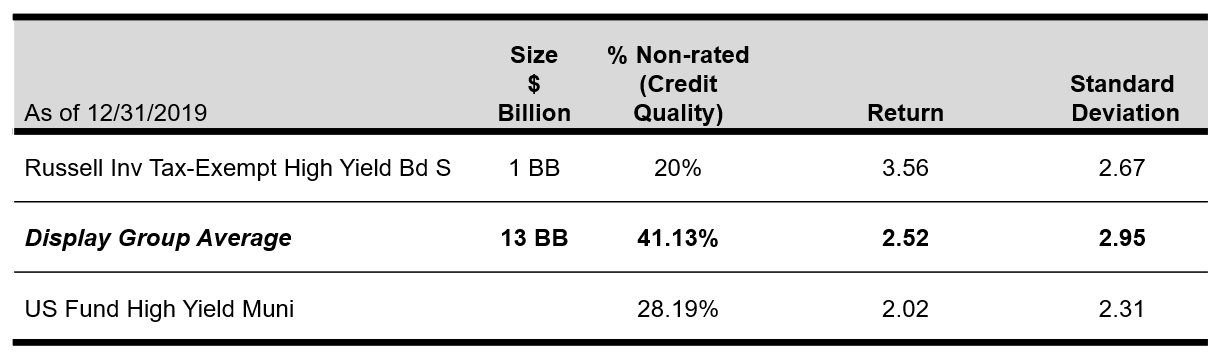

2008 bond landscape similarities

As low rates, stable credit quality and an accommodative (low rates) Fed stance prevail, strong demand from 2019 has continued into 2020. However, so has muted issuance. This results in managers of large funds venturing into riskier bond issues where they otherwise would not be inclined to invest, in order to keep portfolios fully invested.

Similar to 2008, this has increased the amount of non-rated (NR) issues in some of the largest high yield municipal bond funds. Although non-rated securities represent a legitimate category to explore to find value opportunities, positions call for elevated due diligence and resources to fully vet the risks involved.

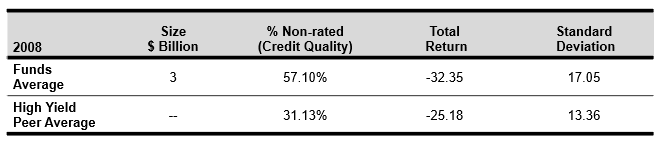

For perspective, we measured the three largest funds which are currently active and held over $1+ billion in assets in 2008. These funds averaged approximately 57% exposure to NR issues, while the peer average held 30%. Further, the average of these funds lost 32%, which was 5% lower than the peer average, while also carrying more risk over the same period.

Source: Morningstar Direct

How does the bond landscape look today?

Reviewing our current landscape, when considering the same search criteria as above, average non-rated exposure grew by 23% since December 2015—flirting with levels similar to 2008. This doesn’t necessarily indicate that an end is imminent, although it does indicate that if volatility emerges—and the markets come unhinged—funds that have increased their exposure to riskier issues may not have the flexibility to sidestep potential pull backs. The reason being, NR issues that have a brighter outlook would be lumped into the same category as ones that may not have a favorable outlook. This would prompt investors to sell or steer clear of the asset class in general—the proverbial tossing out the baby with the bathwater scenario.

What’s the solution? A few alternatives to consider

For many investors, today’s low interest rate environment increases the need to consider a wider opportunity set of funds to meet yield requirements. For taxable investors—even those who aren’t in the top tax bracket—municipal bond vehicles may help them achieve their desired outcomes.

At Russell Investments, we believe advisors and investors alike should consider nimbler alternatives that have the ability to be discerning with bond selection and maintain lower non-rated exposure. These alternatives typically come in the form of funds with relatively lower asset sizes. Smaller asset sizes mean the portfolio manager can pick and choose which bonds they want for their strategy, and don’t have to feel compelled to buy riskier, less-than-desirable credits to fill the demand from a very large fund.

For investors with higher risk tolerance and in higher tax brackets, we recommend investigating high yield (sub-investment grade) tax-exempt fixed income funds. It’s important to note that non-rated securities typically carry sub-investment grade risk and are thus found in high yield municipal funds. However, the foregoing point still stands, and investors should look for relatively smaller funds with lower percentages of non-rated securities.

Click chart to enlarge

Source: Morningstar Direct and Russell Investments

The bottom line

Although defaults are known to be quite low in the municipal bond space relative to corporate bonds, when you have limited supply and record inflows, larger municipal bond funds have historically struggled to be discerning when it comes to credit selection to keep up with the demand. Although they may warrant a place in an investor’s tax efficient portfolio, be mindful of outsized high yield municipal bond funds that have increased their positions in lower rated and—more importantly, non-rated issues—which could magnify drawdowns if and when the markets become unhinged.

While non-rated issues certainly do have great long-run potential, we believe investors may want to consider smaller municipal funds that have the capacity and latitude to be very selective when adding NR securities to their fund, keeping the overall exposure at a more manageable level.