Why non-profit investors should stick to their strategic asset allocation right now

If you’re like many non-profit investors right now, you may be fielding a lot of tough questions from your board about the state of your investments. It’s understandable. The long bull market made us all a little comfortable.

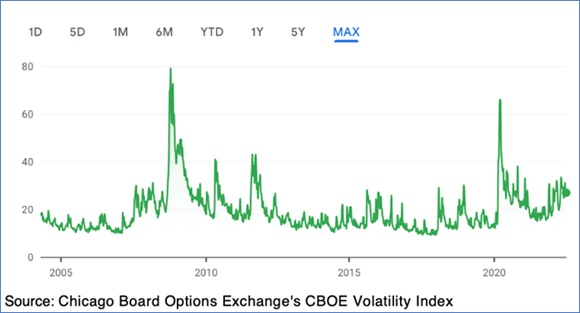

Today’s market feels more than just uncomfortable. It’s downright unsettling. But before we get too panicked, let’s set some context. First of all, take a look at volatility. It probably feels remarkably high right now, but a historic glance backwards puts our current volatility into perspective. As of June 27, 2022, the CBOE Volatility Index (VIX) is at 26.95, which is higher than average. But compare that to the peak volatility of 79.13 on October 24, 2008, or, more recently, the spike of 66.04 on March 20, 2020. In other words, our current wild swings are pretty tame by historic standards.

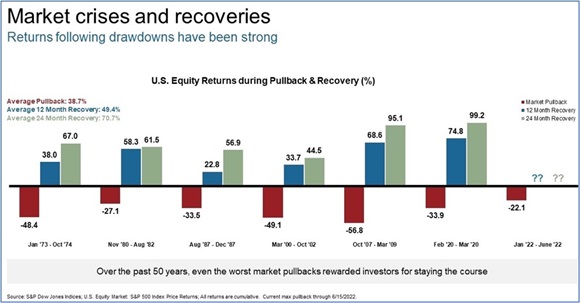

It's also important to look at the cyclicality of corrections and recoveries. While past performance is no guarantee of future results, it’s important to see that drawdowns and recoveries tend to go hand-in-hand.

Finally, let’s look at the most likely scenarios for the near future. In our most recent Global Market Outlook, our colleague Andrew Pease, our global head of investment strategy, says the following: “We think a slowdown or mild recession are the two most likely outcomes. U.S. household and business balance sheets are in good shape, and these should protect against a more severe downturn.”

Keeping all that context in mind, it’s still been a challenging year for non-profit investors. So what should you be doing about it?

First, do no harm.

This is not the time to start making wild changes. Amid this backdrop of increasing pessimism, non-profit investors may be tempted to respond by doing something in their portfolios—whether it’s dialing back on equities or increasing an allocation to fixed income. But we believe that making changes like these today would not be in their best interests. Instead, we contend that investors are better-served by standing pat and sticking to their strategic asset allocation and portfolio weightings for the time being.

Simply put, at this stage of the game, there’s not enough information about what could happen to economies and markets down the line to be placing any sure-fire bets. Yes, there could be a recession in 2023, but the Fed could also engineer a so-called soft landing, where it slows growth enough to tame inflation without triggering an economic downturn. Or, the U.S. economy could still slip into a recession—but not until 2024. It goes without saying that each of these scenarios would likely have wildly different implications for both equities and fixed income—and betting heavily on any particular one could prove to be perilous when so much is still unknown.

Second, gut-check your governance.

Hopefully, you’re the kind of non-profit investor that took the time to put a rock-solid governance plan in place, with a robust investment policy statement that will guide you through our current rocky period. If you didn’t have the right governance in place before, making drastic investment changes right now is not going to help. If you had the wrong strategic asset allocation, or you didn’t know what your liquidity was or your rebalancing ranges are too wide or too small—this is not the time to change them. As the saying goes, you go to war with the army that you have, not with the army that you want.

If your governance—including your investment policy statement—is lacking, you’ve probably already found that out the hard way this year. Doing the work to create good governance may seem like a mind-numbing task during bull markets, but poor governance WILL impact you negatively during hard times. It's times like 2022 that test the quality of your governance. So, as hard as this is, a governance gut-check is a good thing. If you find your plan and resources lacking, it might be time to consider adding to your resources via outsourcing.

Third, use your rebalancing bands wisely.

As we stated above, we think this is the time to leave your strategic asset allocation alone. There are certainly some tactical moves you could make now, but we recommend you do so within the range of your rebalancing bands. Do you want to be at the bottom of your band or the top of your band, based on your short-term views of the market? Fine. But stay within the bands to remain aligned with your long-term strategy, even as you adjust within them to take advantage of short-term, tactical opportunities.

For example, let’s say you’re a university and, due to down markets, you need to increase the percentage of your spending payout. You may need to increase your bond allocation to keep your liquidity high enough to meet those payout requirements. But it’s important to stay within your agreed upon rebalancing bands so that your long-term plan remains intact. If you find that your rebalancing ranges are too prohibitive to allow you to meet your needs, we recommend you call in professional help to sort things out. Making major changes in a volatile, unpredictable market has additional layers of complexity.

Bonus section: Board questions you should be prepared to answer

You may have already heard from your board, with a question that, in one way or another, asks how suited your plan is to handle today’s market volatility. Hopefully, you can respond and say, “We’re covered. This is why we worked so hard on our governance and our investment policy statement. It has positioned us well just for times like this.”

Here are six other questions your board is most likely to ask you—and that you should be prepared to answer:

- Which managers are down? Why are they down?

- What exposures do we have that are helping us? Is anything positive?

- How much public equity do we have and how much is it down?

- Of the funds that are down, what’s down the most and why?

- Do we have enough liquidity to make the payments we need to?

- Is there any use of leverage or derivatives in our name that have the risk of blowing up in our faces?

The bottom line

As a non-profit investor, a lot is riding on the success of your investment strategy. And so much of investing boils down to risk assessment. Earlier in the economic cycle, we thought that the balance of risks were skewed favorably for equities and other risk assets to outperform bonds. Today, we see the risks as being more balanced. Yes, there’s a risk to owning equities, but it’s offset by the potential upside of market gains over the next year. And yes, there’s a risk to owning bonds, but that’s offset by the diversifying role they’re likely to play when the next recession strikes. Ultimately, this is why we believe that remaining at your strategic asset allocation or portfolio weighting makes the most sense right now.

We understand that amid all of today’s uncertainty, the temptation for investors to do something in their portfolios is hard to resist. It’s only human, after all. But the bottom line is we don’t think it’s prudent to be making changes to an overall investment strategy right now. In our opinion, the best thing for investors to do today is to stick to their strategic asset allocation.