Why we believe you should be investing in private markets during down equity markets

Executive summary:

- In private markets, the best investment opportunities can arise in a time of declining equity markets, rising interest rates and economic uncertainty

- Analysis of past performance has shown that the best vintages are those that start during recessions or soon after

- Secondary private equity interests are trading at steeper discounts to NAV and we believe yields available in private credit present investors with a compelling entry point

Introduction

A key consideration for investors when building and maintaining their desired strategic asset allocation target to private markets is their ongoing commitment strategy. Private markets strategies are typically implemented via closed-end fund structures where capital is called down during a fund’s investment period (typically the first 3-6 years). Portfolio company investments are made and capital is subsequently distributed back to investors as companies are sold (typically in years 4-10) of the fund’s life. Given this dynamic where investments are made in one economic environment and sold in another, a fund’s vintage year can have a meaningful impact on returns.

The current environment of economic uncertainty, increasing interest rates and declining equity markets presents a particularly attractive environment to be committing capital to private markets. In this article we will consider some of the key considerations as to why we believe 2023 is looking to be an attractive vintage year across private markets including private equity, secondaries and private credit.

Key reasons private equity valuations look promising

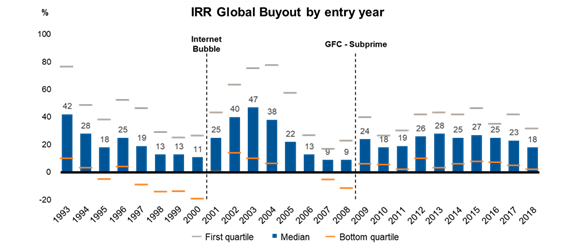

Exhibit 1 below highlights median global buyout internal rate of returns (IRRs) for the 26 vintage years from 1993 to 2018.1 As seen, historical performance has shown that the best vintages are those following challenging economic conditions and negative equity markets, such as the aftermath of the internet bubble in the early 2000s, or the Global Financial Crisis in 2008.

Exhibit 1: Global buyout IRR by entry year

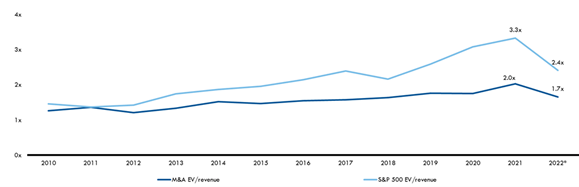

Another key consideration is that entry multiples for private companies are currently lower than their public market counterparts. Exhibit 2 highlights public vs. private valuation multiples since 2010 on an enterprise value (EV) / revenue basis.2 Notwithstanding that since 2010 private companies have on average traded at a 20% discount relative to S&P 500 constituents, at the end of 2022, private companies traded 40% cheaper than public companies on an EV / revenue basis. Given this attractive valuation environment, deploying capital with high quality general partners should drive strong performance for the 2023 vintage year.

Exhibit 2: Public vs. private valuation multiples

Secondaries market ripe for opportunities in 2023

Challenging market environments provide opportunities for investors, creating conditions that allow more room to make acquisitions at a discount. This trend is consistent with previous recessions or distressed environments which can create great opportunities for secondary strategies.

By focusing on secondary investments and related strategies, we believe there are numerous opportunities to provide liquidity to the market and attractive returns for investors. One element that is affecting the secondary market is the denominator effect. Equity and bond valuations have fallen significantly, and this has affected the strategic asset allocation of institutional investors, forcing them to create liquidity from various sections of their portfolios. In these instances, private markets managers can step in as liquidity solutions providers while delivering to their investor’s investment opportunities that can exploit an environment characterized by rising interest rates, fewer exit opportunities and liquidity strains.

Looking at opportunities on the secondary side, we usually see that traditional private markets funds start exchanging owners three and five years after launch, because this is the time when the portfolio has sufficiently developed and there is enough portfolio visibility for sellers and buyers to gain comfort transacting. So, if we look at the recent tremendous global interest in private equity in the last few years, we can anticipate that an incredible amount of assets will reach the secondary market. In addition to some of the limited partners (LP) interests that have started to trade at deeper discounts to net asset value, we are also seeing continued growth in general partners (GPs) continuation solutions. Essentially, managers looking for sources of liquidity for their existing portfolios may be attractive to buyers on the secondary market.

Private credit yield continues to grow

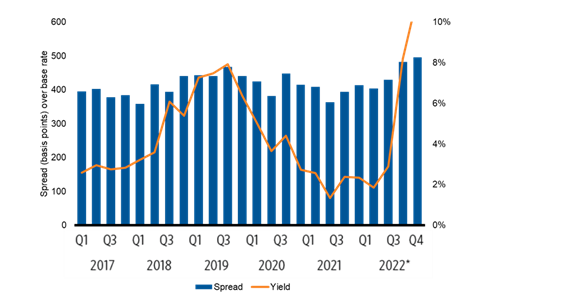

When considering credit, we would highlight that spreads and yields have increased significantly since the beginning of 2021. Exhibit 3 shows the spread over base rate and yield on new issue leveraged buy-out (“LBO”) loans.3 In the case of spreads over the base rate, these have increased from 387 basis points (bps) in 2021 to 514 bps in 2022. In addition, yields have increased from 4.7% to 9.86% over the same period. Given that loans in private credit are typically floating rate, investors are poised to benefit from participating in higher levels of absolute returns (unlike fixed rate instruments that can lose value when interest rates rise) along with protection from inflation.

Exhibit 3: Spread over base rate and yield on new issue LBO loans

In addition, there is $554 billion in upcoming maturities from 2024-2026 that will need to be rolled over at significantly higher rates.4 Given these current market dynamics, we believe private credit provides investors with highly attractive entry points and the potential for downside management through the application of stronger covenants as part of credit agreements.

Vintage 2023 – A compelling entry point

Ultimately, in private markets, the best investment opportunities can arise in a time of declining equity markets, rising interest rates and economic uncertainty. As such, we believe 2023 could be an opportune time to commit capital to private markets including private equity, secondaries and private credit. Analysis of past performance has shown that the best vintages are those that start during recessions or soon after. In addition, secondary private equity interests are trading at steeper discounts to NAV and yields available in private credit present investors with a compelling entry point. It is precisely during these difficult market environments that top tier private markets managers can underwrite investments with the potential to deliver attractive returns to investors.

1 Hamilton Lane, Cobalt, 1993-2018

2 Pitchbook, January 2023

3 Pitchbook, LCD, December 2022

4 Apollo, S&P LCD, Bloomberg as of September 2022.