The state of the SPAC market

Executive summary:

- The volume of SPAC IPOs and mergers has reverted to pre-hype levels. Funding from public and private investors has plunged, while redemptions by existing investors have increased sharply.

- The outlook for SPACs is far more muted than in the past few years. We expect a return to a far smaller level of issuance, deal making and execution as the space bears more scrutiny from sponsors, investors and regulators alike.

- We anticipate that there will be still some opportunities—albeit a fraction of recent volume—for seasoned, sophisticated investors to take advantage of in 2023, due to the smaller market size, a decrease in competition for deals, fewer sponsors and stronger companies coming to market.

Not with a bang but with a whimper. -T.S. Eliot, The Hollow Men

In the past three years, special purpose acquisition companies (SPACs) experienced stratospheric growth, became a manic bubble as sponsors raised new IPOs with a relentless fervor along with a market happy to oblige. However investors experienced poor performance and sponsors have lost capital from a lack of successful mergers and inevitable SPAC redemptions and liquidations. The outlook for SPACs is far more muted than we have seen. We expect a return to a far smaller level of issuance, deal making and execution as the space bears more scrutiny from sponsors, investors and regulators alike.

How did we get here?

Market growth

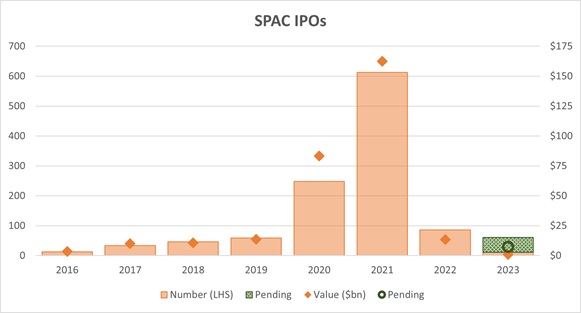

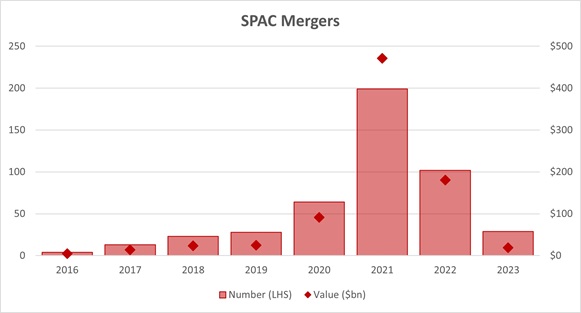

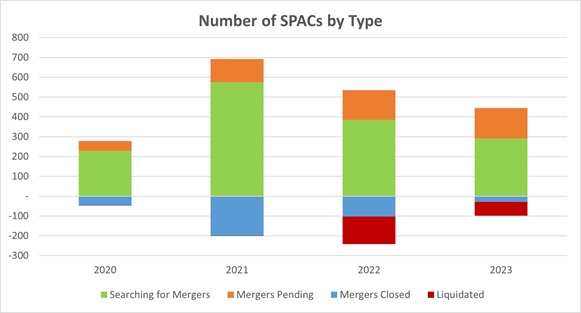

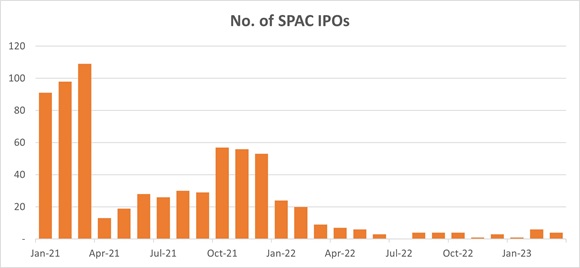

For many years, SPACs were a little known, niche investment vehicle in capital markets. This began to change in 2017, when the number of SPAC IPOs and mergers started to grow as sponsors saw them as an attractive alternative to traditional IPOs to bring (primarily tech-focused) companies public. Momentum continued in the following years, driven by a number of high -profile mergers and greater investor interest, and SPACs were able to raise record proceeds.

Source: SPAC Research

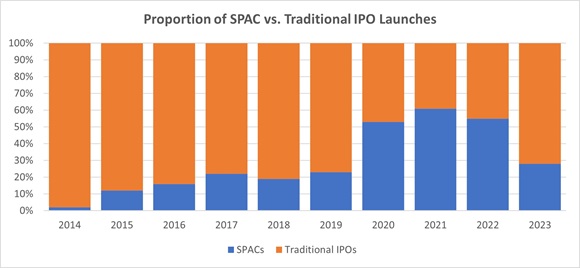

SPACs soon became the private-to-public vehicle of choice. At their peak, SPACs accounted for the majority of new U.S. public listings, exceeding traditional IPOs.

As noted, a large appeal of SPACs for sponsors and target companies is the absence of transparency around future projections. By comparison, traditional IPOs are under far tighter disclosure requirements. And therefore, with the rapid growth in SPACs, their lower disclosure requirements led to an inevitable increase in regulatory scrutiny. As the market hit peak growth in 2021, the Securities and Exchange Commission (SEC) proposed stricter rules covering forward-looking statements and accounting and disclosure. The prospect of tighter regulations contributed to a sharp decrease in the number of new SPAC IPOs being brought to market in 2022.

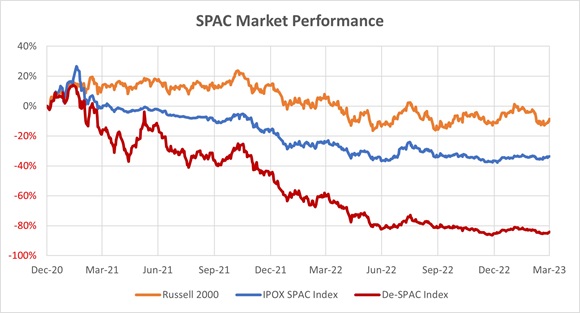

Performance

Despite all the hype, investors considered this a low-risk opportunity to invest in unlisted companies, especially in the technology sector that had, in theory, the potential for massive growth. In reality, most post-merger SPACs have performed poorly. The De-SPAC Index, which measures the performance of companies taken public through a SPAC merger, fell almost -75% in 2022, after losing -45% in 2021.

Some of the losses can be chalked up to broader market weakness. A large number of companies that were brought public via SPACs tend to be more speculative, high-growth and cashflow negative. As the broader financial markets have been buffeted by central bank tightening, higher inflation and recession concerns, these growth companies have been disproportionately impacted.

However, several of the features that make SPACs attractive led to over-crowding in the space and subsequent disappointing performance. The looseness of financial disclosures and growth projections led to a number of high-profile electric vehicle companies brought public via SPACs to overpromise and underdeliver. Many companies have missed their forecasts and restated their financials, and some have even gone bankrupt.

In addition, many of the fundamental performance outcomes were a function of SPAC structure in which a potential misalignment of interests between SPAC sponsors and their shareholders exists. In exchange for committing upfront financing (on average $8-10 million per SPAC IPO) to cover underwriting and operating costs, sponsors are compensated via the promote, in which they are awarded a sizeable allocation of shares and warrants in the SPAC, but only if they successfully complete a merger. Conversely, SPACs have a finite window to successfully complete a merger (normally 18-24 months). If they fail to do so, the SPAC is liquidated, investor money is returned with interest, and the sponsors lose their initial investment. This deal or lose structure creates a significant conflict of interest, even if the shareholder right to redeem is an important protection.

In combination with the huge number of SPACs looking for targets and the skewed incentives for sponsors, a large number of suboptimal mergers were completed during the early stages of the hype, promising the world. However, most companies that completed deals have tanked. Notably the trend in post-SPAC companies that have restated financials and incurred large goodwill impairments has increased significantly. In 2022, 39 de-SPACed companies wrote off goodwill of almost $12 billion, compared to $2.7 billion across 11 companies in 2021.

Some sponsors care about their reputation and prefer to swallow the loss over pushing a bad deal, but for others there is arguably an incentive to rush due diligence, underplay the risks and overpay.

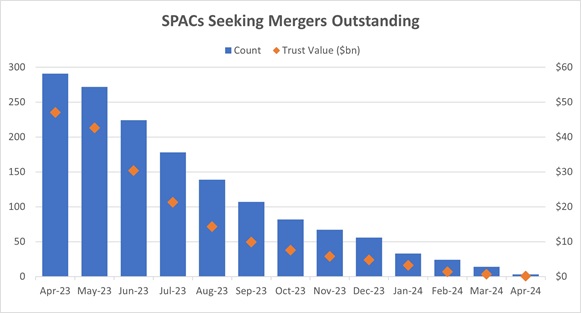

Around 300 SPACs with $700 billion in trust have deadlines to invest in the first half of 2023, and the temptation is to throw a Hail Mary pass and hope to score a deal intime.

Investors

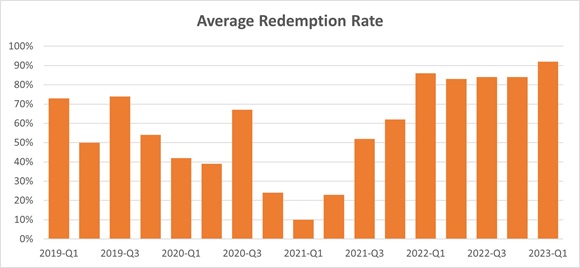

As a result, investors have left the space in droves. SPACs provide shareholders the opportunity to either sell their units in the secondary market while the SPAC is still seeking a merger target, or when presented with a merger, they have the option to reject the proposal and redeem their shares to get their investment back with interest.

As the post-SPAC performance became more telling, some shareholders chose to sell their units early. Notably this gave rise to a new arbitrage opportunity in which other investors could capitalize by purchasing SPAC units at a discount to their trust collateral value in a pull-to-par as SPACs are liquidated.

Even for SPACs that were able to identify potential targets, investors were already voting with their feet and electing to reject proposed mergers, opting instead to take their cash. The average redemption rate has increased significantly since the bull market of 2021, with now over 90% of investors voting no on proposed deals, according to SPAC Research.

Source: S&P Capital IQ; SPAC Insider

This redemption rate also had a material impact on the ability of sponsors to complete mergers with the remaining capital. As the pool of shareholder capital was removed from SPACs, they were forced to become reliant on secondary forms of finance, normally in the form of a convertible note or PIPEs (private investment in public equity). These sources of finance come from larger, generally more sophisticated sources of capital that apply greater scrutiny and more onerous conditions on sponsors. What may have been an appealing deal when financed with cheaper shareholder equity, may be far less compelling when needing a heavy debt burden to fund the transaction.

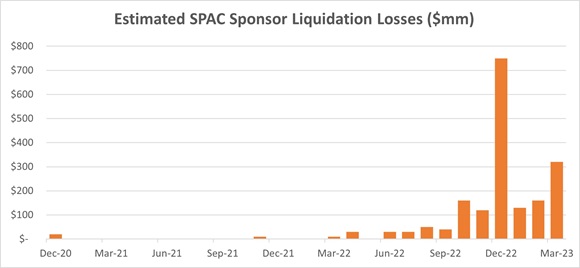

Liquidations

As a result of these various headwinds facing sponsors, there has been a dramatic increase in liquidations. As noted, SPACs typically have to be liquidated if they can’t complete a deal within 18-24 months. However, many sponsors have opted to liquidate their SPAC early and return capital to investors. According to SPAC Research

| Period | 2022-Q1 | 2022-Q2 | 2022-Q3 | 2022-Q4 | 2023-Q1 |

| Number of liquidations | 1 | 6 | 14 | 117 | 69 |

Some of December’s accelerated liquidations came as a result of the aforementioned uncertainty around year-end changes to tax legislation. As year-end approached, the market waited for clarification regarding the excise tax guidance released in December by the Treasury Department and the IRS. There was concern that liquidating a SPAC and returning capital to investors could be deemed a share buyback, creating a significant tax burden for sponsors. As a result, many sponsors rushed to liquidate in December to avoid the additional cost. Toward the end of the month, the government provided guidance and SPACs are, at present, not subject to this law. However, the broader pace of redemption has continued into 2023 as a swathe of sponsors throw in the towel as they continue to struggle to find suitable targets within the narrow remaining window.

This has led to a significant impact for sponsors who provided upfront capital in exchange for the anticipated promote from a successful deal. In 2022, this amounted to well over $1 billion in losses to sponsors, and more than $500 million YTD 2023. This will surely dampen the unbridled enthusiasm by all who thought sponsoring a SPAC was a cheap ticket to accruing significant wealth.

Source: SPAC Research; Russell Investments

Where to from here?

The SPAC asset class is not extinct. It has existed for many decades as an alternative form of financing, especially for more speculative VC-type investments. We do not believe this will change. However the size of the market will continue to dramatically diminish with various market changes. While SPACs are likely to remain an opportunistic investment, regulatory changes and investor skepticism will reduce both supply and demand for these securities.

Regulation

SEC Chairman Gary Gensler has communicated he wants SPACs to be scrutinized more like traditional IPOs. There are proposed additional rules covering disclosures by sponsors, liabilities of financial advisors and underwriters, financial projections and restatements, and other disclosures. The market is expecting further regulatory guidance from the SEC later in 2023 which should provide more certainty to issuers and investors by providing a clearer framework and guidelines. While these changes are yet to be fully defined and implemented, any changes will truncate the advantages of going public via a SPAC versus a traditional IPO.

Market size

How the sector evolves in the future remains uncertain, but we expect the market will be a fraction of its recent size and return closer, albeit larger, than historic norms. The volume of SPAC IPOs and mergers has since reverted to pre-hype levels. Funding from public and private investors has plunged, while redemptions by existing investors have increased sharply. Currently just under 300 SPACs are searching for targets, with around another 150 already waiting approval from shareholders to approve deals.

Regulatory scrutiny continues to weigh heavily on new supply coming to the SPAC market. The prospect of increased SEC regulation has effectively frozen the market. Given the recent outcomes to sponsors from increased liquidations, as well as the lack of investor appetite, we expect new SPAC issuance to remain muted—particularly as the market waits for clarity from the SEC.

In addition, the existing pool of SPACs seeking acquisition targets will shrink significantly this year, as a large number of SPACs mature in the first and second quarter.

Some SPAC sponsors are offering incentives to shareholders in the form of additional cash paid into the trust or offering founder shares to extend the term of the SPAC by 3-9 months. However, despite these enticements, we expect the size of the market to diminish quickly, given investor fatigue and the lack of new SPAC IPOs coming to market (only 11 for $0.9 billion through Q1).

Outlook

As the market rolls down during 2023, we expect there will still be some opportunities —albeit a fraction of recent volume—for seasoned, sophisticated investors to take advantage of due to:

- The smaller market size

- A decrease in competition for deals

- Fewer (and likely higher quality) sponsors

- Stronger companies coming to market via SPACs due to increased regulatory and investor scrutiny

- Potential difficulties raising capital from traditional areas such as venture capital and private markets.

The bottom line

Are SPACs dead? No. Despite the recent over-hype, SPACs have existed for decades and do fulfill an important function in the capital markets. Simply, they can be thought of as an alternate form of venture capital financing, that provides some advantages over traditional IPOs to bring private companies public. However, a trifecta of regulatory uncertainty, sponsors hit in the hip pocket from liquidations, and generally poor performance making investors much more wary has created headwinds and will change the future landscape of this sector. Many underwriters will revert to traditional IPOs with SPACs returning to their previous place, albeit more visible and understood, as an option for riskier, but potentially more lucrative, deals. The space will continue to evolve and regulatory clarity will provide active investors with idiosyncratic opportunities.