The case of two masked returns

The premise

I started in the business in a mutual fund call center right out of college in 1999 (DVD players were all the rage, Y2K panic was a thing and “Who Wants to be a Millionaire” was on). At that point, average annual returns were high for the S&P 500 and most mutual funds—until the bubble burst.I worked the second and third shift in that call center (by the way, you should never call a mutual fund family after hours. You get what you pay for!).

People would call in when they finished dinner and wanted to do their mutual fund research.The first question was almost always, What was your best performing fund? Some of the savvy investors would be bold enough to ask, What was your best one, three and five-year performing fund? That was long-term investing for them. I can’t remember a single investor asking, How much risk is the fund taking to achieve that performance? As a new kid to the industry, I didn’t see anything wrong. People were making more than 100% returns and I thought I was getting into the best industry in the world (I still believe that, by the way). You all know how this story ends.

The same thing was happening only a few short months ago.Some investors were thinking diversification was broken and they should own what did well, which was more U.S. large cap.Thinking only about return, not risk-adjusted return.

The suspects

Let’s look at two investments: The U.S. large cap market and a balanced portfolio.

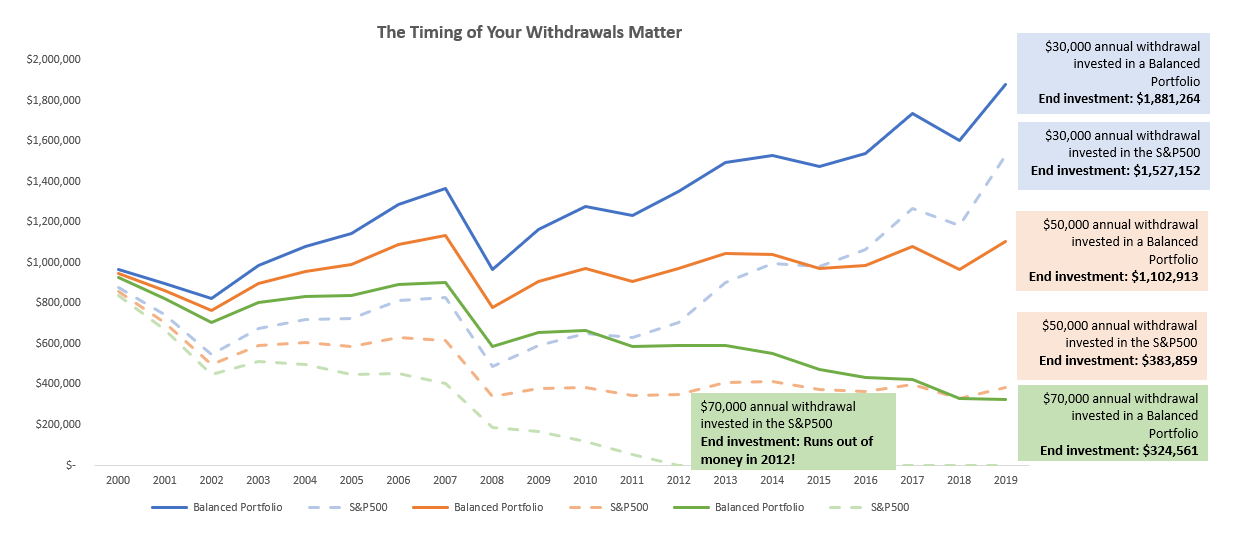

The U.S. large cap market has averaged 6.3% the last 20 years, and a balanced portfolio, 5.7%.1Based on that alone, U.S. large cap won the race.However, clients that invested at the beginning of the 20-year period and started withdrawing money for retirement had a very different experience.Most of us don’t save money just for the sake of saving it.

If you’ve saved hard over the course of your entire life and build up a nest egg of $1,000,000 and want to take $50,000 out each year to live off, what happens with these two investments?Investors calling into my call center would have believed the investment with the best 20-year performance would have given them a better outcome. The reality is shocking.The investor in U.S. large cap would have ended up with about $380,000. The boring balanced investor would end up with over $1.1 million after 20 years.

The evidence is clear in the chart below. The timing of your withdrawals matter. If we take the same two suspects and extrapolate the last 20 years with an annual withdrawal of $30,000, $50,000, and $70,000, the results are dramatic. A client investing in the S&P 500 over the last 20 years and taking out $70,000 a year would’ve run out of money by 2012!

Source: Morningstar as of Jan. 31, 2020. For illustrative purposes only.

Solving the case

Many investors only worry about risk after they lose money, not before.They base their investment decisions on what may be staggering numbers, but don’t consider how much risk they’re taking. That’s why the role of an advisor is crucial. If you happen to retire at a bad time, whether it’s because it’s simply time or because you were forced into early retirement, you will most likely need to tap your nest egg. When you withdraw from an investment during a period of decreasing returns, it has a reverse compounding effect.

The bottom line

Albert Einstein once said, “compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t it, pays it.”The earlier we save, the better. Unfortunately, the same math is true when you withdraw money during market downturns.Losing less on the way down will result in a better outcome.The next time you have any investor ask you why their portfolio didn’t beat the S&P 500, feel free to say, You’re welcome!

1 Annualized return as of 12/31/2019. U.S. Equity Large Cap – Russell 1000® Index. Balanced: 30% Russell 3000® Index; 35% Bloomberg U.S. Aggregate Bond Index; 20% MSCI EAFE Index; 5% MSCI Emerging Markets Index; 5% FTSE EPRA/NAREIT Developed Index; 5% Bloomberg Commodity Index. Please note that is based on past index performance and is not indicative of future results. Indexes are unmanaged and cannot be invested in directly. Index performance does not include fees and expenses an investor would normally incur when investing in a mutual fund. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets.