Is a financial adviser worth the cost?

We have all heard people say… Nothing in this world is for free and if someone tells you otherwise, walk the other way.

Can something as important as wealth planning be offered for free?

When cost becomes the primary factor in decision making and when we don't understand the true value of what we are paying, could we be missing out on something that could be one of the best decisions we could make? When it comes to working with a financial adviser, it's critically important to understand the price you pay, to know the value you receive and to understand why it's important.

Request a copy of our 2020 Value of an Adviser Report which gives you access to our End Investor report to use in your client conversations. Click here.

Understand the price you pay for what you get

In the last decade, the financial services industry has gone through a lot of change. Technology and modern business models have given more investors direct access to markets. Today, there are an overwhelming number of investment options for investors with even the most modest amount of assets. These solutions come in the form of robo-advice, low cost advice or self-service investment or trading platforms. These solutions are getting many investors started at a younger age. In some cases, these solutions are teaching them the importance of saving, being disciplined and engaging with their personal wealth. However, these low cost advice solutions are not a replacement for a full-service financial adviser. They may provide basic building blocks of investment management which are asset allocation, security selection and portfolio construction. Low cost advice that delivers investment-only management and no financial plan, ongoing service, or guidance have set prices for only very basic services – annual statements, online access and a phone number to call in case of questions.

Utilising the expertise of full service Financial Advisers

In the case of a full-service financial adviser, many focus on goals and objectives that take time, planning and ongoing coordination to accomplish. But it is more than just the time it takes to prepare a single client's financial plan. It is the years of experience and expertise imbedded in that plan that underpins the value of a true holistic financial adviser.

Imagine if you were needing to have some major surgery. The value of a specialist surgeon is not just the hours spent with you in consultation and surgery. You are also benefiting from their years of study, their years of practical placements, observations and mentorship. Individually you also are a beneficiary from the cumulative hours and experiences of the many surgeries they already have successfully completed.

In parallel, a financial adviser must meet every requirement of the Professional Standards for financial advisers. including requirements to complete 40 hours of 'qualifying CPD activities' in each CPD year with minimum requirements in specific knowledge areas. They need to have or be working towards a relevant degree qualification and pass the FASEA exam and comply with the Financial Planners and Advisers code of Ethics.

Just as important as formal education is, the years of expertise and experience that advisers build over time working in advice businesses and with clients. This practical experience is invaluable to maximise both the technical skill set along side the client skills.

This formal and practical evolution of an advisers skill sets all take time.

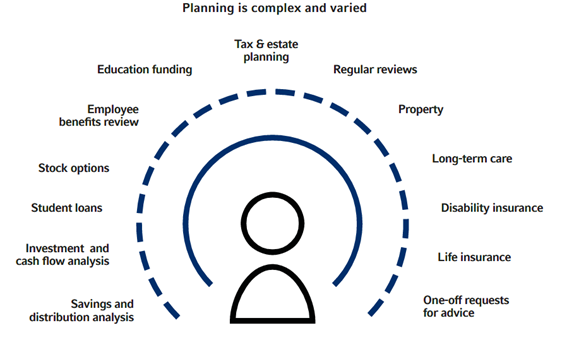

Planning is a complex and specialised experience personalised for individual investors. The following topics cover the various areas of planning that financial advisers undertake:

Click image to enlarge

How many hours of meetings, preparation and follow-up would it take to cover these topics appropriately? More importantly, what is the cost of not establishing an appropriate plan? In this regard, we believe a financial adviser is priceless.

Know what you know

It's important to know what you are getting for the price you pay. In the investment world, many investors are buying low-cost investment solutions to save money on fees.

It seems simple but there are a lot of questions that must be answered when it comes to investing ...

- Do investors understand what they own?

- How much risk is in the investment they own?

- What is the return expectation?

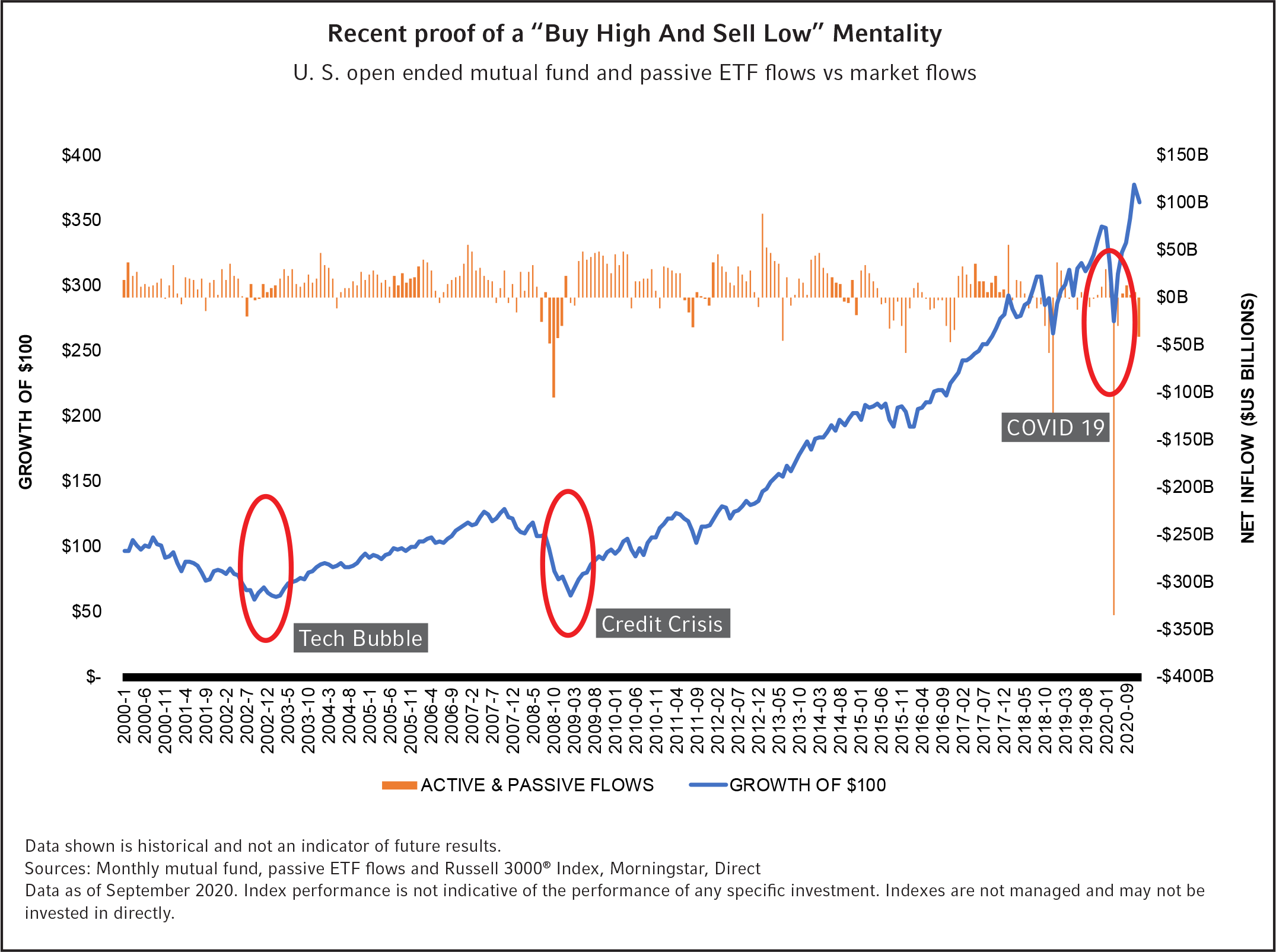

It may be fair to say that many investors don't completely understand the amount of risk they are taking during given points in the market cycle. From January 2000 to September 2020 $100 constantly invested in the Russell 3000® Index more than tripled in value. And those that chose to stay in cash during that period missed a cumulative return of nearly 250%, based on the Russell 3000® Index. You can visually see a pattern of investors buying high and selling low. These mistakes can be very costly over time.

Click image to enlarge

These numbers reinforce the importance of knowing what you own and the importance of a Financial Adviser as a behavioural coach and risk manager. Helping clients avoid pulling out of markets at the wrong time and sticking to their long-term plan is one way we believe advisers provide substantial value.

Understand why it's important

In Malcolm Gladwell's book "Outliers," he dedicates a chapter to what researchers have come to identify as the 10,000 hour rule. The rule states that for an individual to achieve a level of mastery, they must dedicate 10,000 hours of practice to the subject. To put 10,000 hours into perspective, most people only work 2,000 hours year. So, any professional working in a field for more than five years would be considered a qualified expert. Five years isn't a lot of time—however, many investors are taking on the responsibility themselves with little to no experience.

And when it comes to delivering value, we see that planning, managing investor behaviour and helping clients reach their financial goals are key ways advisers are able to contribute value. We believe wise advisers educate investors on understanding the products and services they receive for the price they pay. We also believe it's important for investors to understand the value they are receiving and the process you're providing in helping them achieve their outcomes.

The bottom line

Goods and services are priced a certain way for a reason. The most important thing to discover is WHY they're priced that way. Sometimes, a bad purchase based on price is a learning experience. However, some bad decisions based on the price of a good or a service can leave irreparable damage that cannot be undone. It's important to do your due diligence. Spend time asking questions, analysing and understanding the value you are receiving for the price you are paying so you can avoid any devastating consequences.