Manager of Manager or Fund of Funds?

At Russell Investments, we believe that a Manager of Manager (MofM) approach is superior to the more popular, traditionally unitised Fund of Funds (FofF). We explore the significant differences between the two approaches, from research to portfolio construction, active management and implementation to costs.

Is a Manager of Manager approach more expensive?

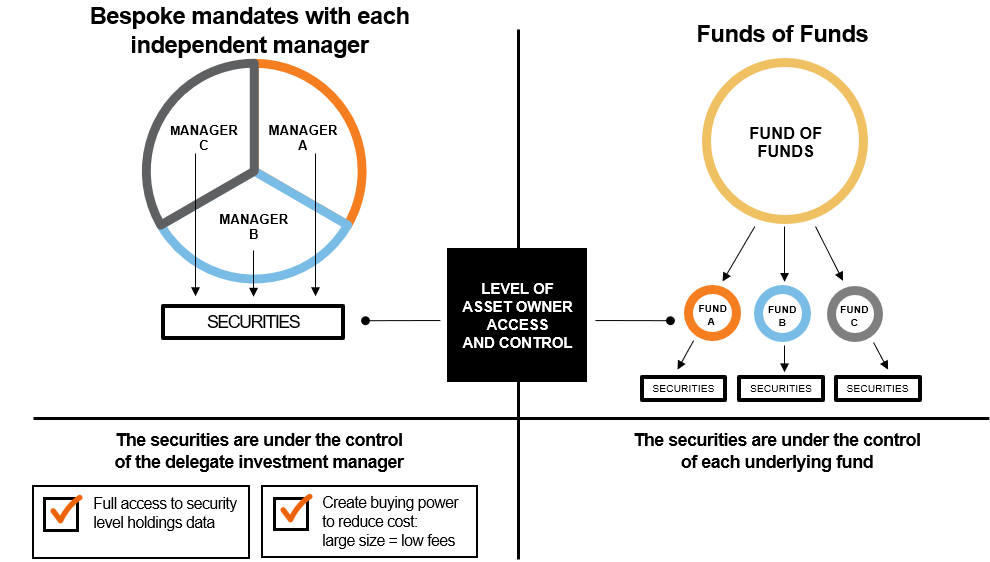

We often come across the misconception that MofM is expensive due to the perception of multiple layers of fees. This may be true of a FofF but is not the case for MofM. A FofF, as its name suggests, is a unitised fund with its own set of charges that invests (or buys) units in other underlying funds, with additional underlying charges ranging from custody to dealing to annual management charges. In the case of MofM, there is only one set of charges (i.e., one custodian, one auditor and one management charge from which the underlying managers are paid). To put it simply, the underlying managers are paid directly by the asset manager - not by an additional management charge of their own. Given the size and scale, it can provide significant buying power, which allows access to managers at highly competitive rates. All this helps to keep the headline costs to a minimum. The following chart shows the difference between a Manager of Manager vs. Fund of Funds approach.

(Click image to enlarge)

Source: Russell Investments. For illustrative purposes only.

Manager of Manager is a single portfolio

When comparing the two approaches, there are additional differences in operational structure. The most obvious of these is that a MofM fund is one fund structure with one administrator and price as opposed to multiple funds and multiple layers of costs. Managers are chosen for their expertise in a given asset class or sector and given an explicit mandate. This is more efficient from an operational perspective and reduces overall costs.

Increased transparency

A MofM fund has greater transparency than a FofF. The reason for this is that all the appointed managers are directly managing a portion of a fund, enabling full transparency of every single holding and trade, in real-time. Transparency also comes from the fact that MofM assets are segregated rather than the involvement of the underlying manager. When buying a unitised fund, you rely on the fund manager to report the holdings and any trades. This is often done retrospectively, periodically and only partially. Having full transparency ensures that the manager is adhering to their mandate, enabling the overall risk to be monitored in an accurate and timely manner, adjusting if necessary.

A broader opportunity set

Underpinning both a MofM or FofF is the research. In the case of FofF, the focus is on fund research, ultimately leading to a position being taken in a given (UCITS) fund that is typically widely available. Once the position is taken, the only adjustments that can take place are to either sell or add further units, depending on the inflows or redemptions of the overriding fund. The MofM approach differs from the above as it is not limited to a relatively narrow universe of existing unitised funds with the correct structure. For example, will the best Japanese equity managers have a UCITS fund? Will they even have a fund? Ultimately, a fund is a vehicle that allows smaller investors, such as retail clients, to access a particular manager or strategy. Not every fund manager or strategy is available as a fund. Being able to appoint a manager, rather than buying a fund, provides a much broader opportunity set - the ability to search across the globe, in large firms and small, to find the best active managers.

After careful research and monitoring, a manager is selected and awarded a mandate and the investment guidelines for the mandate are drawn up. These guidelines are developed to play to a manager’s strengths (i.e., those areas where the manager has demonstrated consistently adding alpha and has been identified by in-depth research and analysis). As a result, the mandates are often bespoke and will deviate from the selected managers’ strategy (often constrained by risk controls or regulation). This bespoke approach allows greater flexibility and can often be a cornerstone investor unconstrained by assets under management (AUM) or investment track records. Ultimately, the objective is to produce superior risk-adjusted returns.

Dynamic and active management

A MofM approach enables each fund to have a dedicated portfolio manager. They bring together different active managers, with different skills and investment styles, to construct a portfolio that is aligned with our preferred positioning and exposures. Unlike FofF, this approach is not limited to merely changing the weights given to each underlying fund. The ability to create bespoke mandates and the high level of transparency conferred by the MofM approach allows for a dynamic and active strategy. Portfolio managers have the tools to manage sources of risk and return, at any point in time, to ensure that the portfolio continually reflects the best thinking. To achieve this, proprietary positioning strategies are used to precisely manage the portfolio and tilt exposure as required.

Excess return and risk management

Positioning strategies are customised portfolios that are directly managed by the asset manager to ensure the portfolios reflect the best thinking at all times. While portfolio managers have the tools to manage sources of risk and return at any point in time, not every strategy is available externally and active managers can't mitigate every risk. Therefore, portfolio managers use internally managed positioning strategies to seek an excess return and to manage portfolio risks by targeting specific exposures. These strategies are used in conjunction with allocations to third-party active managers to fully reflect strategic and dynamic insights, with integrated liquidity and risk management.

Asset allocation and portfolio construction

At Russell Investments, a portfolio’s asset allocation and positioning is determined by our investment division and strategy team. We adopt a cycle, valuation and sentiment (CVS) approach to our dynamic asset allocation. Observing changes in the macroeconomic environment that can influence assets classes (cycle), understanding the return potential from these assets (valuation) and assessing price momentum versus contrarian indicators that signal overbought or oversold conditions (sentiment).

We express these outcomes by allocating assets to a selection of global best-of-breed managers, but it doesn’t stop there. These allocations are continually monitored, and adjustments made as necessary. We believe that no one manager has the necessary skill or resources to be a specialist in all asset classes.

Best-in-class implementation and trading capabilities

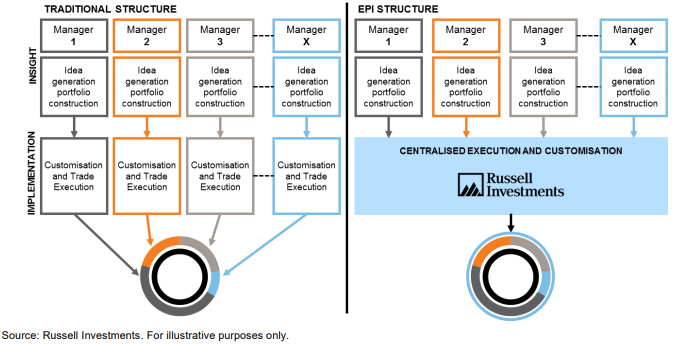

In a FofF, investment managers are typically appointed to provide both idea generation and implementation of a portfolio. In other words, each manager operates completely independently from the other, which introduces additional complexity, costs and operational challenges.

An asset manager with long-established trading capabilities and implementation strategies can capitalise on the benefits of the MofM portfolio structures. At Russell Investments, one such example is enhanced portfolio implementation (EPI). This enables us to combine all investment insights into one centrally managed portfolio.

(Click image to enlarge)

Source: Russell Investments. For illustrative purposes only.

The bottom line

Both FofF and MofM have existed side by side for many years. For some time, a number of investment trusts have employed a segregated MofM approach. If you are currently running or considering setting up a FofF we believe that you should consider the advantages of MofM.