Be opportunistic: Tips on transitioning to tax-managed investing from a legacy mutual fund portfolio

With markets experiencing significant volatility lately (might be slightly understating that), and many of us experiencing work as well as daily-life scheduling changes of an unprecedented magnitude, it’s important to find the bright spots or even ways one might be able to take advantage of this time.

We recently wrote a blog on how to take advantage of this wild market ride we are on, specifically aimed at taxable accounts (non-qualified accounts in industry parlance). It’s important to think through investment decisions in a grounded, forward-looking manner. Long-term investing has a demonstrated track record of success, while short-term volatility tends to be just that … short term. So, to ask the question out loud, How specifically can an investor today potentially benefit from this volatility and market downturn?

Here are some pro tips specifically focused on how Canadian investors can optimize current market volatility and transition taxable investments in order to invest into a more tax advantaged (or tax efficient) portfolio like one that is in a Corporate Class structure designed for non-registered investment accounts. It is important in taxable accounts as the tax cost (tax bite, tax bill, tax drag … no matter the phrasing, it’s money that leaves your account and stops working for you) is significant and has a much more pronounced impact when a market downturn hits.

Transitioning from a legacy mutual fund portfolio

I will start by saying … we think you might be able to transition right now with no tax impact!

Did that grab your attention? If you held equities or an equity mutual fund for the last three to five years in a taxable account there is a chance that you can transition now (sell out of the holdings) with lower or potentially no capital gains being triggered by the transaction. Canada Revenue agency allows Canadian Investors to carry losses forward or backward to apply them in different years tax-returns.

CRA allows you carry net capital losses back up to three years. IF you have capital gains from previous years,this is a good way to off-set them. If you do not have capital gains in either the current tax year or the previous three years you can carry your losses forward. Each year, the accumulated value of your capital losses becomes your net capital losses, which you may carry forward indefinitely.

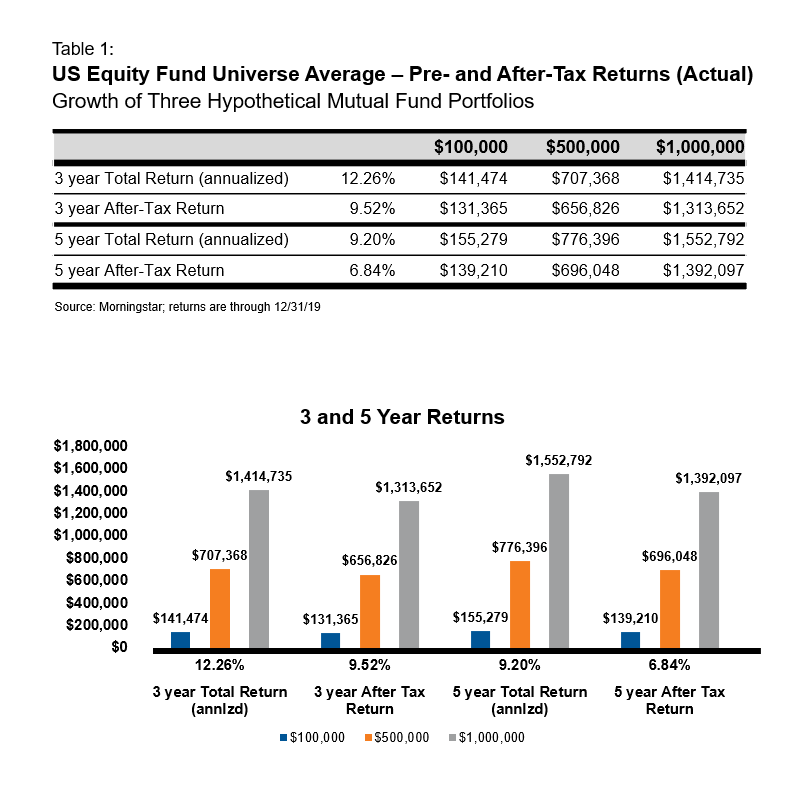

Click image to enlarge

Note: This is a hypothetical illustration and not meant to represent an actual investment strategy.

Example of three hypothetical mutual fund portfolios

What you are looking at in Table 1 is the growth of three different hypothetical values (i.e. three different investor portfolios) using actual mutual fund total returns, pre- and after tax.

The current rolling 3 yr return on the S&P/TSX is -3.85% do we highlight gains 3 yr ending 12/31/2019 and contrast it to the current 3 year loss?

ie tax bill paid vs loss harvested and loss carried forward?

The current rolling 5 year return is -1.75%

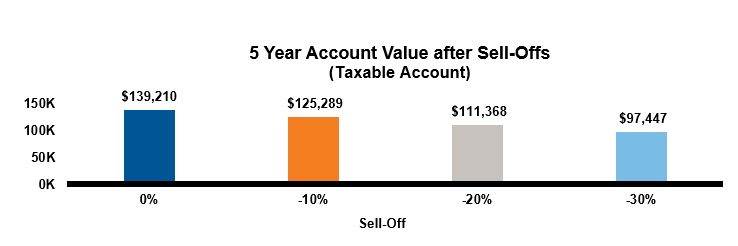

Click image to enlarge

Note: This is a hypothetical illustration and not meant to represent an actual investment strategy.

Source: Morningstar; returns are through 12/31/19. The Morningstar US Category Group “US Equity” includes the following Morningstar Categories: US Fund Large Blend, US Fund Large Value, US Fund Large Growth, US Fund Mid-Cap Blend, US Fund Mid-Cap Value, US Fund Mid-Cap Growth, US Fund Small Blend, US Fund Small Value, US Fund Small Growth.

Here’s how you can use market volatility to potentially lower a client’s tax bill

With the decline in recent years of the availability of Defined Benefit pension (DBP) plans and with contribution limits on registered savings plans like Defined Contribution Plans, (DCP) RRSP's and TFSA's, most Canadians also rely on non-registered or taxable savings to help fund their retirement. The above tax drag numbers represent negative wealth creation and can impact long term financial outcomes if they are not well managed. What can you do right now, especially if you don’t want to get stuck with a really high additional tax bill? Check out Table 2 and its corresponding graphs to see what can be done with market volatility:

Click image to enlarge

Note: This is a hypothetical illustration and not meant to represent an actual investment strategy.

This shows how different market moves can change the embedded gain situation of a portfolio, such as the examples I discussed above. Let’s take a look at the 3-year portfolio example. With what has already been paid out and the compounding impact of taxes due, with a -10% market move the total embedded gain is now reduced to $18,000 on the $100k portfolio. The payback period on making up that tax bill is actually not that high. Even assuming the highest marginal tax rate of 23.8% on the remaining $18k gains, that works out to be a tax bill of about $4,300. For most people that is doable to transition out of this account and into a tax-managed portfolio.

What about with a more extreme market move, let’s say one of -30%? Outside of the shock factor of such a market move, let’s think about how to be opportunistic here—in a way that potentially reduces the investor’s tax bill. That same $100k portfolio invested over the last three years now has an embedded loss in it, which means it's time to think about two things. First, transition now as the situation doesn’t get better than this for lowering a tax bill.Second, the investor can actually harvest a tax loss for themselves to use in the future. This is how you make lemonade out of lemons. And for that $1 million portfolio, well, this just makes the benefit potentially exponential for that investor.

Minimum first step: Redirect automatic reinvestment

At a minimum, it’s important to take a step. A first step, if the client is not ready to do a full-on switch. That first step is to turn off automatic reinvestment. Most investors have it turned on, which means that all their dividends, interest and capital gain distributions are reinvested. All three of these items get taxed in the year they are received; that money and those proceeds are now free and clear of taxes. Use these to start saving regularly into a well diversified Corporate Class portfolio. Quarterly taxable distributions or income are minimized as much as possible within a Corporate Class structure. If there is income, it is only distributed as Canadian dividends or capital gains, which are currently the most tax-efficient forms of income in Canada.

Act now: Opportunities don’t last forever

We believe that practicing suitable asset location and leveraging taxable investment structures like Corporate Class portfolios supports the tax optimization of clients and households, and can be an important differentiator for you as an Advisor. Taxes are complicated but tax smart investing doesn't have to be.