It won’t be easy, you’ll think it strange – Interpreting the mixed messages from the U.S. labor market

Executive summary:

- Despite the anecdotes of layoffs, the U.S. labor market continues to be resilient, but also overheated.

- The U.S. Federal Reserve is serious in its inflation fighting efforts, and the labor market strength could mean further rate hikes.

- We still view a U.S. recession as likely, but a well-capitalized banking sector should help limit the severity of the recession.

- Bottom line: We think that investors should still stick close to their strategic asset allocations, but there might also be opportunities to add to their U.S. Treasury exposure.

“It won’t be easy, you’ll think it strange. When I try to explain how I feel.” – Evita

That’s what the U.S. labor market might say in response if you ask it how it’s doing. Of course, this requires us to assume that the U.S. labor market can speak and is a fan of the musical Evita. Although anthropomorphizing the U.S. labor market is a bit of a fantasy, we can nevertheless glean useful insights from the real signals emanating out of labor market data. With a pickup in anecdotes of large U.S. companies conducting layoffs, now might be a good time to reassess how strong the U.S. labor market really is, and where it might be headed.

A layoff illusion: why the layoff situation is likely less severe than you might think

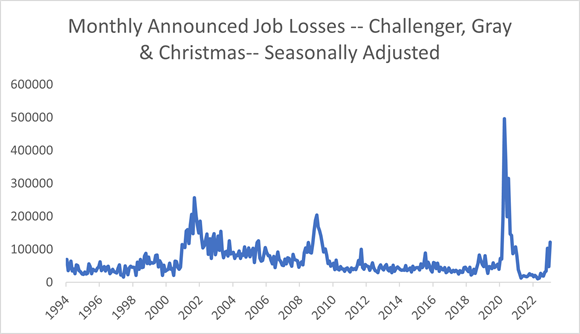

Meta. Amazon. Microsoft. And more. It’s true that there has been a noticeable amount of large U.S. companies that have announced layoffs recently. According to statistics tracked by labor analysis firm Challenger, Gray & Christmas, companies in the U.S. announced layoffs affecting more than 102,000 people in January 2023. Challenger, Gray & Christmas notes that the number of layoffs is the “highest January total since 2009.”

Click image to enlarge

Source: Refinitiv Datastream

While the Challenger data can be a useful starting point of analysis, it’s important to note that it tracks announced layoffs. Smaller firms might not announce their layoffs in the same way that large megacap companies do. Thus, in order to get a more complete picture of the layoff situation, we may also want to look at the number of layoffs that have actually occurred.

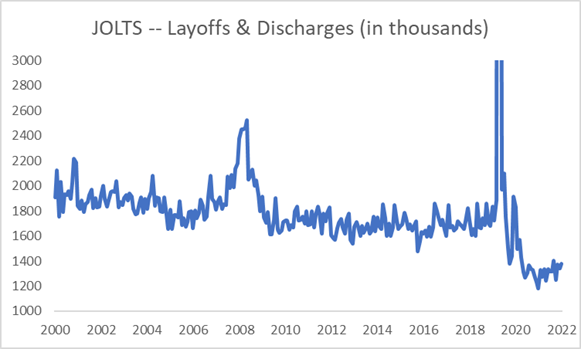

The Bureau of Labor Statistics’ Job Openings, Losses, and Turnover (JOLTS) survey keeps track of the total number of layoffs that have actually occurred in the U.S. Even though the number of layoffs is no longer at the historical lows, it is still noticeably less than the longer-run average. In December 2022, there were approximately 1.4 million layoffs in the U.S. on a seasonally adjusted basis, versus a monthly average of approximately 1.8 million from December 2000 to December 2022.

Click image to enlarge

Source: Refinitiv Datastream

Astute readers might recall that the Challenger data is more timely than the JOLTS data. And with the Challenger data showing significant month-over-month increases in announced layoffs from December 2022 to January 2023, it’s tempting to think that we will also see a noticeable uptick in realized layoffs in January 2023 once the data becomes available. That could be possible, but since the correlation between the layoff announcements and actual layoffs is quite low (R-squared less than 0.3), an increase in actual layoffs in January 2023 is not inevitable.

In addition, workers who lose their jobs through layoffs still have the chance of finding new employment relatively quickly. A January 2023 Bloomberg/Harris poll shows that nearly more than 40% of employed Americans believe they could find a new job within 3 months of being laid off. And the January 2023 Conference Board survey showed that nearly 50% of respondents thought that jobs are “plentiful”, still significantly better than the long-run pre-pandemic (2000 to 2019) average of 22%. Thus, we believe that the layoff situation is not as dire as the headlines might seem.

Job creation is still impressive

While looking at layoffs can be important, it is also helpful to look at net changes to employment. In the U.S., the traditional benchmark of monthly job creation comes from the “establishment survey” of the non-farm payrolls report produced by the Bureau of Labor Statistics (BLS). This survey uses data from businesses to compute how many jobs were added.

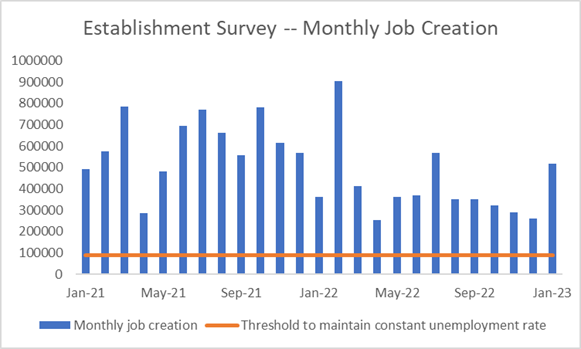

Even though the Fed has been taking the U.S. economy through the fastest rate tightening cycle since the Volcker era, headline job creation in the U.S. still appears robust. In January 2023, the U.S. added more than 500,000 jobs, significantly exceeding consensus expectations for only 185,000 jobs being added.

To put the number in context, the Atlanta Fed Jobs Calculator says that to maintain the unemployment rate at the current low level of 3.4%, the U.S. would only need to add around 90,000 jobs each month. And as you can see from the chart below, monthly job creation has exceeded that threshold every month in the past two years.

Click image to enlarge

Source: Refinitiv Datastream, Jan 2023

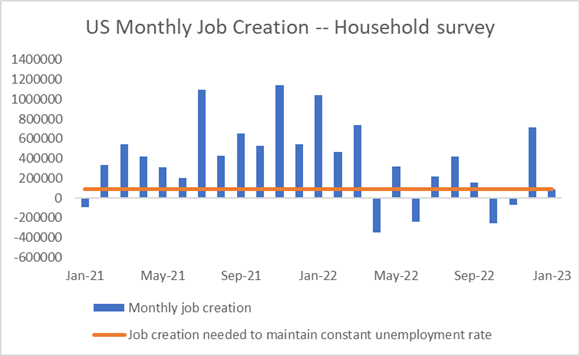

For another perspective on the pace of job creation, we can look at the household survey that the BLS puts out. While it’s a less-preferred measure of job creation due to its inherent volatility, it can still be a useful supplement for us to analyze. Taking a look at this survey, we see that in the last two years, monthly job creation has generally been above the threshold needed to maintain a constant unemployment rate.

Click image to enlarge

Source: Refinitiv Datastream, Jan 2023

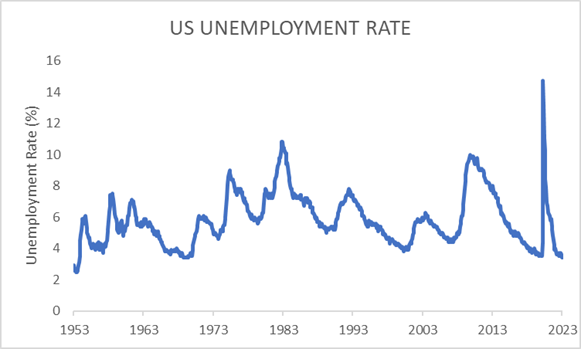

The unemployment rate is still down here below NAIRU

Another important measure of the strength of the labor market is the unemployment rate. When we published our “It’s the economy” article back in November 2022, we pointed out that the unemployment rate was near a historically low level, hovering between 3.5% and 3.7%. Today, the unemployment rate is even lower, at 3.4%. In fact, to find an unemployment rate that is lower than the current unemployment rate, you would have to go back to the 1950s! And down here at its current level, the unemployment rate is still below the Fed’s estimate of non-accelerating Inflationary rate of unemployment (NAIRU), suggesting that the economy is still beyond full employment.

Click image to enlarge

Source: Refinitiv Datastream

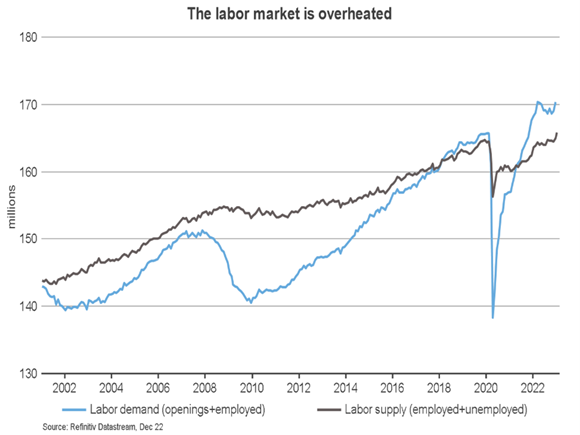

You can try to stay out of the sun, but the labor market is still overheated

Thus far the labor market has been quite resilient. But on a more worrisome note, the labor market may also be overheated. Despite the Fed having undertaken the fastest tightening cycle since the Volcker days, labor demand continues to outpace labor supply.

Click image to enlarge

Source: Refinitiv Datastream

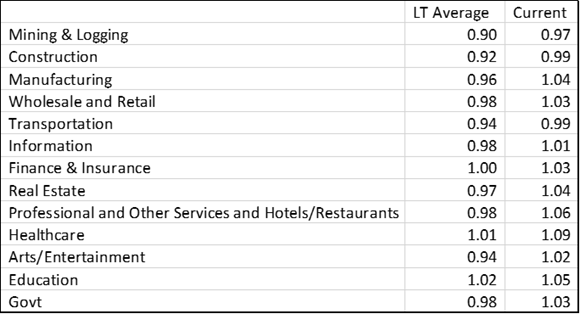

This overheating is pervasive across industries. Following a similar methodology, we conducted a Labor market slack score by comparing the labor demand in each industry against the labor supply. A number above 1 suggests that labor demand is exceeding labor supply. Since the labor market slack scores for each industry are higher than their longer pre-pandemic average and are generally above 1, it suggests that the labor market remains broadly overheated, despite the actions that the Fed has undertaken.

Table: Labor market slack indicator

Source: Russell Investments’ calculations using data from Refinitiv Datastream. Labor demand is defined as the sum of job openings + employed persons in the sector. Labor supply is defined as the sum of employed + unemployed persons in the sector.

The imbalance is particularly pronounced in sectors related to leisure and hospitality (e.g., restaurants, hotels, etc.). According to the Bureau of Labor Statistics, even after a whopping 128,000 jobs were added to leisure and hospitality related occupations, employment in this area is still roughly 3% below the pre-pandemic peak. Given the significant labor shortages, companies in this sector are likely reluctant to lay off workers, even as we stare down the barrel of what some economists call “the most anticipated recession.”

It has to change: Why the Fed can’t allow an overheated labor market

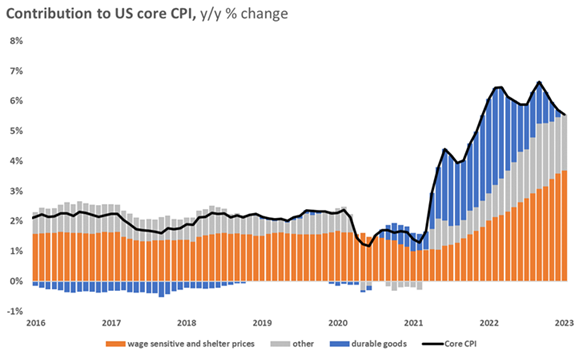

An overheated labor market adds to the inflationary woes affecting the U.S. economy. There are many ways to decompose core inflation, but let’s meet the three ghosts of inflation in our framework: durable goods, other, and wage sensitive and shelter prices.

Click image to enlarge

Source: Russell Investments and Refinitiv Datastream

As you can see from the above chart, inflationary pressures in durable goods have been virtually wiped out as supply chains heal. We expect durable goods prices to persist in deflation—similar to the experience shown from 2016-2018 in the chart. The “other” category, which includes nondurable goods like clothing and volatile service prices like airfares, appears to be flattening out, although this category is harder to forecast. But the third ghost of inflation still lingers—the inflation caused by wage sensitive sectors and shelter prices.

And the “other” category, which includes things like airfares, appears to be flattening out, although this category is harder to forecast. But the third ghost of inflation still lingers – the inflation caused by wage sensitive sectors and shelter prices.

We have written before about the likely softening in the housing sector, and while shelter costs in the CPI calculation come with a lag, we expect that the strong increases in shelter costs will abate over time. The “wage-sensitive” piece, which we define as core services inflation excluding shelter, medical, and transportation, is the component that still creates ongoing headaches for the Fed.

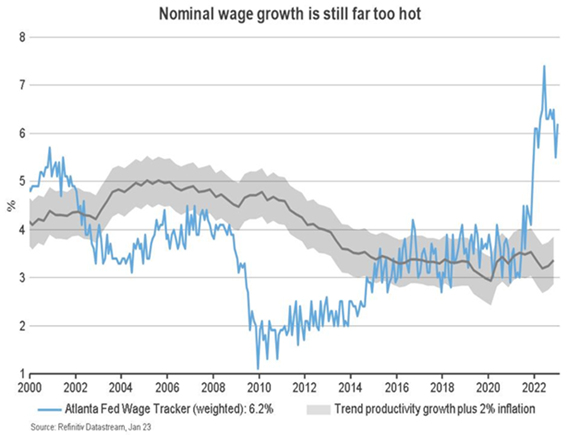

In these “wage-sensitive” areas, wages make up an overwhelming amount of the total input costs. As such, wage pressures likely play a key role in determining how sticky this component of inflation is. Unfortunately, even though nominal year-over-year wage growth has moderated from its peaks, it is still well above levels that would be consistent with the Fed’s inflation target. (grey area in the chart below)

Click image to enlarge

Source: Refinitiv Datastream. Blue line is the unsmoothed year-over-year wage growth produced by the Atlanta Fed Wage tracker.

The answer is here, all along; but not necessarily a pleasant one

Chair Powell has been quite clear as to his intentions. He argued once again at the February FOMC (Federal Open Market Committee) press conference that the Fed’s inflation battle isn’t over, and that failing to win the inflation fight would be a bigger mistake than overtightening and causing a recession.

The rates market has become more in line with the Fed’s thinking. As of Feb. 21, 2023, the market was pricing in a peak federal funds rate of around 5.3% by mid-year. That would imply a potential for interest rate hikes in March, May, and possibly even June.

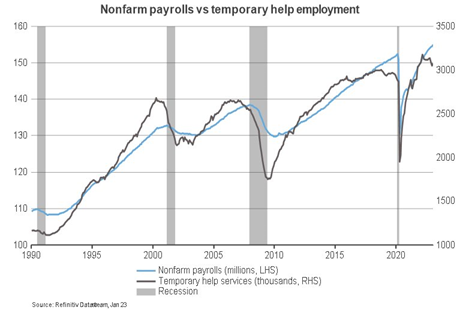

We believe that the market is right to assume that Powell is serious in his inflation-fight, but we also think that the U.S. Federal Reserve risks potentially overtightening and tipping the U.S. economy into a recession. Even as the labor market continues to be generally resilient, some of the more leading indicators have been pointing to signs of economic softness. Analysts have been steadily downgrading their earnings expectations. Manufacturing PMIs remain in contractionary territory (below 50). And temporary-help employment—which tends to lead to regular employment because it’s easier to not renew labor contracts than to conduct layoffs—has already shown signs of peaking.

Click image to enlarge

Source: Refinitiv Datastream

The Fed’s foot is still on the brake. And while terrain and weather may cause the car to skid along for a while, ultimately the car will have to slow down. We believe that a recession in the U.S. in the coming 12 months is more likely than not, but a well-capitalized banking sector would likely help to attenuate the severity of the recession.

Given our economic outlook, we continue to think that investors should avoid trying to tactically overweight equities, despite the significant drop in equities in 2022. We believe that investors should stay disciplined and stick close to their strategic beliefs. That being said, U.S. Treasuries may be a useful diversifier if a recession ultimately does come to pass.