Q2 2021 Fixed Income Survey: The end of the pandemic within sight

In this latest survey, 72 leading bond and currency managers considered valuations, expectations and outlooks for the coming months.

In the previous 1Q21 survey, market sentiment had evolved rapidly with managers embracing the confluence of vaccines, fiscal spending and easy money supply supporting asset prices. Managers expressed more optimism about the speed of the economic recovery and reduced preference towards investment-grade (IG) assets, tilting towards high yield (HY) assets and emerging markets debt (EMD) in local and hard currencies, in the endless pursuit for yield. In regard to higher inflation, managers seemed to be comfortable with predicting levels hovering around the U.S. Federal Reserve (Fed) target rate. The consensus of managers seemed in line with Federal Open Market Committee (FOMC) minutes at the time, explaining that the threat of subdued inflation is greater than that of higher inflation.

Since then, U.S. core inflation surged to 3.0% year-over-year (YOY) in April and then to 3.8% YoY in May – levels last seen in the early 1990s. FOMC meeting minutes revealed in May showed that some members discussed adjusting monthly asset purchases if the economy “continued to make rapid progress to the committee’s goals”. However, the Fed also reassured markets that higher inflation readings were transitory and that the data was entirely consistent with their models. Will investors see the hawks or the doves within this Fed messaging?

With the economic recovery undeniably ramping up, we ask managers for their thoughts on valuations in the markets. With inflation data broadly beating market estimates, are managers also expecting inflation to remain a little longer and will this force central banks to bring forward interest rate hikes, or to start tapering asset purchases?

Inflation joins the Party

Views from interest rate managers

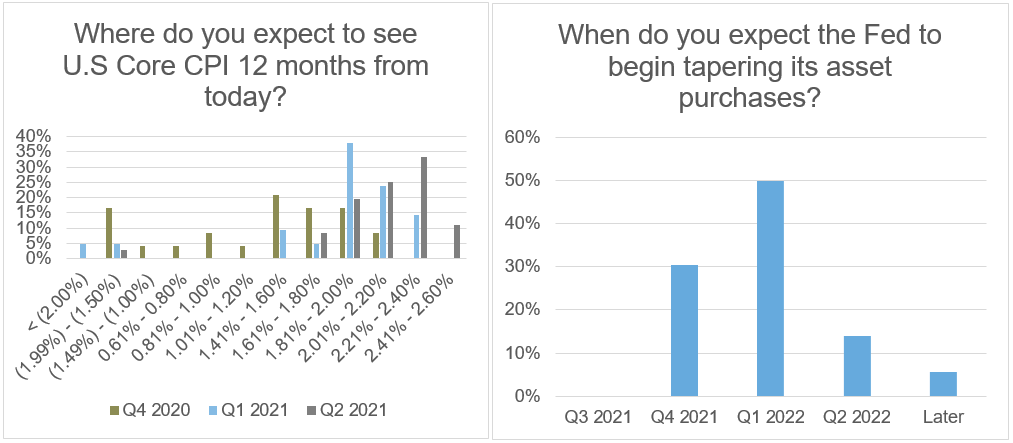

- Inflation expectations surge. Circa 70% of managers expect inflation for the next 12 months to exceed 2.0% versus the 38% of managers that expressed such a view in our 1Q21 survey. This is the highest expectation in inflation since 1Q20 where 75% expected inflation to exceed 2.0%.

- Can the Fed deliver? Roughly 50% of managers expect the Fed to deliver its inflation promise. However, 30% are still sceptical in the Fed’s ability to achieve its target. In our 1Q21, 60% of managers were confident the Fed would deliver its inflation promise.

- 31% of managers expect the Fed to start tapering its asset purchase program as soon as in 4Q21. However, the consensus seems to be in 1Q22 for the Fed to start tapering asset purchases.

- Managers believe interest rates will remain lower for a longer. Circa 80% of managers expect the next Fed hike not to occur before 2023. This contrasts with the 36% of managers that expressed such a view in our 1Q21 survey. 80% of managers expect between two to four interest rate hikes per year after hiking lift-off.

- Less consensus around the movement of the U.S. yield curve, however. 43% of managers expect a bear steepening1 of the yield curve in the next 12 months versus 71% that agreed with that statement in our 1Q21 survey.

- 86% of respondents expect the 10-year U.S. Treasury yield to trade between 2.0% and 3.0% in the next 12 months. Almost 45% of them expect rates to range between 2.5% and 2.75% in the year ahead.

- Roughly 2.3% is the level of the 10-year U.S. Treasury, that managers believe the Fed would consider as disruptive (i.e. where the Fed could implement some sort of yield curve control). In 1Q21, 1.9% was the level market participants considered the Fed would perceive as disruptive.

- When asked if the Fed would implement yield curve control before a rise in interest rates derails risk assets, only 17% agreed with such statement while 70% don’t expect this curve control to happen at all.

Click to enlarge the image

Source: Russell Investments Fixed Income Survey. CPI refers to the Consumer Price Index.

Views from IG credit managers. Are managers concerned about valuations?

- Almost 30% of respondents are expecting a moderate widening in spreads in the next 12 months, the first time since 1Q20. Only 5% expressed such a view in our 1Q21 survey. 60% of them still see spreads to be range-bound for the next 12 months.

- Change in sentiment? Managers expect to see a spread widening of 5 basis points (bps) over the next 12 months. In our previous survey managers expected a spread compression of -6 bps.

- Managers remain confident on declining leverage of IG companies with 70% of managers expressing such a view. Almost 30% of managers expect leverage to remain at least stable over the next year. There is some deterioration in sentiment with managers less confident on IG to beat cash over the next 12 months. Additionally, when asked if current spreads compensate for current risks, circa 40% of managers mentioned caution is warranted, up 7.0% from our previous survey.

- Most of the managers still favour the U.S. as the region with the most attractive return, while EM lost some momentum. UK IG corporates are gaining some interest from managers, however. Meanwhile, given the increasing investor focus on environmental, social and governance (ESG) factors, managers consider the energy and utilities sectors as areas where there could be material mispricing from potential risks.

Global leveraged credit. More balanced views.

- 83% of managers expect range-bound of spreads over the next 12 months versus 50% in our previous survey. Only 9.0% of managers still expect a moderate tightening of spreads, 30% lower than the 1Q21 survey.

- Positivism around fundamentals: 70% of managers are expecting to see a material improvement in corporate fundamentals, +65% more than in our previous survey.

- A steady decline in interest from managers in U.S. HY bonds since 2Q20, whilst U.S. leveraged loans is where managers expect to see the most compelling opportunities in the market, followed now by CLO Mezzanine.

- Return expectations remained unchanged: roughly 60% of managers expect total return of the U.S. HY market to be in the 4%-5% range.

- Inflation and rising interest rates are what managers consider the most concerning potential risks for the global HY market in the next 12 months. No manager expressed concerns about inflation in our 1Q21 survey though. Respondents also seem to be less concerned about slow vaccine rollout during this survey.

- Around 70% of the managers still consider Fallen Angels (FAs) represent a potentially good opportunity and 23% of them consider FAs as potential rising stars.

- Concerns on defaults evaporate: Almost 80% of managers expect defaults to be between 0-3% in the next 12 months. In our 1Q21 survey, 50% of managers still considered defaults could be in the 3-5% range.

Risk across the globe

Emerging Markets (less bullish views!)

- Within local currency emerging market debt (LC EMD) , managers remain very constructive in regard to the performance of EM currencies, with almost 86% expecting a positive performance of developing currencies in the next 12 months. Roughly 17% of managers expect EM foreign exchange (FX) to post strong positive returns in the next 12 months versus 40% that expressed such view in our previous survey. 11% of managers expected FX to be a detractor in the next 12 months.

- Managers expect the Brazilian real and the Russian rouble to be the best performing currencies in the next 12 months. 35% of managers expect the Turkish lira to be the worst performing currency in the year ahead. In our 1Q21 survey, 30% of managers considered the lira the most attractive currency amid the GBI EM Universe, however, this has completely reversed in just a matter of months.

- 63% of managers consider positive returns will come from FX while 10% consider rates will see the most positive return potential over the next 12 months. Roughly 30% expect a combination of FX and rates to contribute to positive returns. Additionally, circa 90% of managers still think depreciating the currencies is the release valve for countries at risk of restructuring their debt. In the last survey, 66% made the same statement.

- Managers are also less bullish within the hard currency2 emerging markets debt (HC EMD) space. Only 33% of the managers expect spreads in the hard currency EMD index to tighten in the next 12 months versus 74% in 1Q21. Weighted average expected return stands at 3.9% over the next 12months, 0.8% down when compared to our 4Q20 survey.

- Closer gap in terms of growth differential between EMs and developed markets: 47% of managers expect the growth differential to remain between 1-2% versus 36% of managers that expressed such view in our previous survey. 31% now expect the growth differential to be between 2-3% over the next 12 months.

- Managers expressed again their preference for Ukraine and Egypt as the countries with the highest expected return over the next 12 months. China and the Philippines remain as the top two underweight countries.

- For managers, the Fed policy is the most significant risk factor for the hard currency EMD performance in the next 12 months followed by changes in the level of U.S. Treasuries.

- Interestingly, 44% of the managers expressed having more than 15% exposure in hard currency EM Corporates, the highest since the start of the survey.

Europe and UK

- Wider expectations for the euro: Circa 80% of managers expect the euro to trade in the 1.21-1.30 range. In our 1Q21 survey, 61% of managers expected the euro to be in the 1.21-1.25 range.

- More consensus with a tilt towards appreciation of the British pound: Roughly 72% of managers expect the GBP in the 1.41-1.50 range in the next 12 months.

Securitized sectors

- 67% will maintain risks.

- When asked about taking a meaningful beta position, 22% of managers expressed already having a long basis in their portfolios, down from the 64% from our 1Q21 survey. 50% expect to add a short position.

- 48% of managers expect non-agency spreads3 to moderately tighten in the next 12 months, down 9% from our 1Q21 survey. 29% of respondents expect spreads to range-bound.

- Regarding long/short positions on credit default swaps on commercial mortgages, 47% of managers responded they would take a short position, while 32% responded that they would buy protection.

- Managers expressed more balanced views regarding concerns for the CLO market with 57% mentioning broad risk-off market sentiment as main the risk, followed by underlying loan collateral credit deterioration.

The bottom line

What a difference a few months can make. Although lockdowns were protracted affairs for so many of us, the economic recovery has been astoundingly rapid in many parts of the world. This pushed up inflation considerably, especially in the last two months. Our managers understand that the high figures are transitory but nevertheless predict higher inflation numbers going forward in the next 12 months.

This survey was completed before the recent Fed statement, but managers were accurate in estimating potential interest rate rises. The reason for this is that in mid-June, the Fed shifted its tone by forecasting rate increases in 2023.

That being said, the shift in the Fed’s tone caused the yield curve to flatten and market pricing for inflation to cheapen somewhat, contrary to the survey participants consensus. Managers clearly expect interest rates to rise from here, but perhaps technical factors such as pension demand for long-end duration may be at play.

Regardless of the shift in tone for the Fed and survey participants’ concerns around potential inflation, it is clear that managers’ outlook for most credit is relatively stable, but with a preference for the higher yielding segments.

Going into our next survey cycle, we will be further into the global reopening and we are keen to see how managers’ views would have evolved in regard to growth and inflation.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.

1 A bear steepening is when the yield curve steepens because long-term rates are rising faster than short-term rates. A bull steepening is when short-term rates fall faster than long-term rates.

2 Refers to money issued by a nation seen as politically and economically stable, Hard currencies are widely accepted globally as a form of payment. The U.S. dollar and the euro are the most common hard currencies.

3 Non-agency refers to debt issued by a private corporation rather than a government or quasi-government agency.