Product updates and commentary in response to key market developments.

Performance review - 4th Quarter Update

The Fund added to its positive year-to-date performance.

- The allocation to global equities remained rewarded and suited the risk-on market environment.

- Unlike the previous quarter, the allocation to Bluebay’s convertible bond strategy was positive.

- Allocations to global high yield and unconstrained fixed income were positive.

- An allocation to Emerging Markets added value.

However,

- Unhedged currency exposure detracted amid sterling strength. Exposure to the Japanese yen was unrewarded as sterling appreciated 8.6% on a total return basis.

- Exposure to duration was a slight negative as bond yields increased over the quarter.

- The allocations to local currency emerging market debt and infrastructure detracted.

Performance (%)

Average annualised returns as of 31/12/19

| RUSSELL INVESTMENTS MULTI-ASSET GROWTH STRATEGY GBP PERFORMANCE (%) | 1 month | 3 months | Year to date | 12 months | 3 years | 5 years | Since inception |

|---|---|---|---|---|---|---|---|

| Return Gross of Mgmt Fee A |

1.1 | 2.3 | 12.8 | 12.8 | 4.9 | 5.3 | 6.4 |

| Return Net of Mgmt Fee | 1.0 | 2.1 | 11.9 | 11.9 | 4.1 | 4.4 | 5.5 |

| RPI +4% Benchmark | 0.5 | 0.8 | 6.3 | 6.3 | 7.2 | 6.6 | 7.1 |

Source: Confluence. Data as at 31st December 2019

Discrete rolling 12-month performance (%)

Average annualised returns as of 31/12/19

| Returns shown in GBP | Q4 2014 - Q4 2015 | Q4 2015 - Q4 2016 | Q4 2016 - Q4 2017 | Q4 2017 - Q4 2018 | Q4 2018 - Q4 2019 |

|---|---|---|---|---|---|

| Return Gross of Mgmt Fee (0.80) | 2.4 | 9.3 | 7.8 | -5.0 | 12.8 |

| Return Net of Mgmt Fee | 1.6 | 8.5 | 7.0 | -5.8 | 11.9 |

| RPI +4% | 5.1 | 6.3 | 8.0 | 7.3 | 6.3 |

Source: Confluence. Data as at 31st December 2019

"The Fund performed well over the fourth quarter, largely driven by the allocation to global equities."

Portfolio review

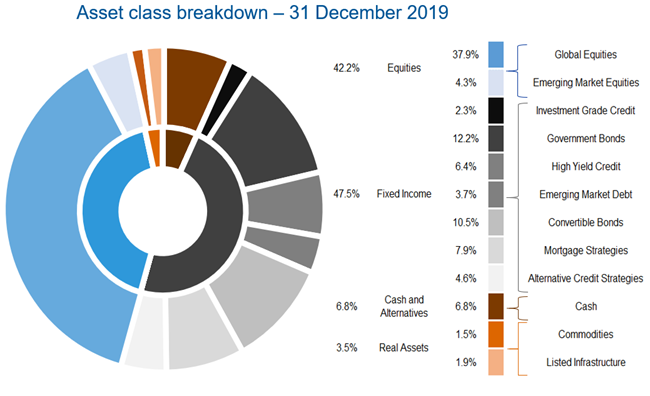

Asset allocation chart

Source: Russell Investments. Data as at 31st December 2019. Inception date: 8 December 2009.

Over the fourth quarter, we made the following portfolio changes:

- Early in the quarter, we added to our equity allocation as our belief around a cyclical economic upswing grew. However, to keep risks balanced, we also increased our exposure to US Treasuries.

- We made the same trade in November – adding to UK equities where we saw good value and a catalyst for a re-rating if the Conservatives gained a majority in the election.

The Fund remains well balanced between growth orientated asset classes like equities and more defensive allocations, particularly alternative forms of fixed income. We use enhanced diversification and overlay strategies designed to mitigate downside during material drawdowns.

Disclaimer:

FOR PROFESSIONAL CLIENTS ONLY

Unless otherwise specified, Russell Investments is the source of all data. All information contained in this material is current at the time of issue and, to the best of our knowledge, accurate. Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.

The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

Any past performance figures are not necessarily a guide to future performance.

Potential investors in Emerging Markets should be aware that investment in these markets can involve a higher degree of risk. Issued by Russell Investments Limited.

Some investments/bonds may not be liquid and therefore may not be sold instantly. If these investments must be sold on short notice, you might suffer a loss.

Company No. 02086230. Registered in England and Wales with registered office at: Rex House, 10 Regent Street, London SW1Y 4PE. Telephone 020 7024 6000. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London E20 1JN.