Tax planning for high-net-worth individuals: Avoiding collateral damage

Executive summary:

- Many advisors today are helping clients with a broad range of their financial planning needs.

- With millions of baby boomers preparing to retire by the end of the decade, enrolling in Medicare will become a crucial aspect of the financial planning process.

- Advisors should be aware of which income levels could trigger a surcharge and increase their Medicare premiums.

- Tax-aware advisors can help their high-net-worth clients avoid this type of collateral damage.

Do you remember the 2002 movie "Collateral Damage" starring Arnold Schwarzenegger? Don't worry if you don't: it received negative reviews and was a commercial failure. I don't remember much about it except for the title. And that title is what matters right now because it relates to financial planning in 2023.

Stick with me here for a minute!

In my 19 years at Russell Investments, I have had a front-row seat to seeing how the role of an advisor has evolved and continues to do so. We are so far past the days of advisors simply providing investment management services alone because clients can essentially get that service anywhere now. It's largely been commoditized. What hasn't been commoditized is the importance of planning. In fact, today I see more advisors doing more planning. And these advisors aren't just helping clients with relatively simple planning questions like, "please help me retire, help me save for college, help me generate income." Instead, today MANY more advisors are addressing a much broader range of financial planning topics. For instance, they're helping with tax planning, Roth conversions, estate planning, and Medicare enrollment (just to name a few). Essentially, advisors are helping their clients manage potential collateral damage in their portfolio, especially as it relates to taxes and tax management. This is a great thing!

This expanded role might have something to do with the fact that about 10,000 baby boomers (born between 1946 and 1964) reach retirement age every day. According to Pew Research Center, baby boomers are retiring at a faster pace since COVID-19 began. Nearly 29 million boomers retired in 2020 – three million more than in 2019. By 2030, 75 million more boomers are expected to retire.1

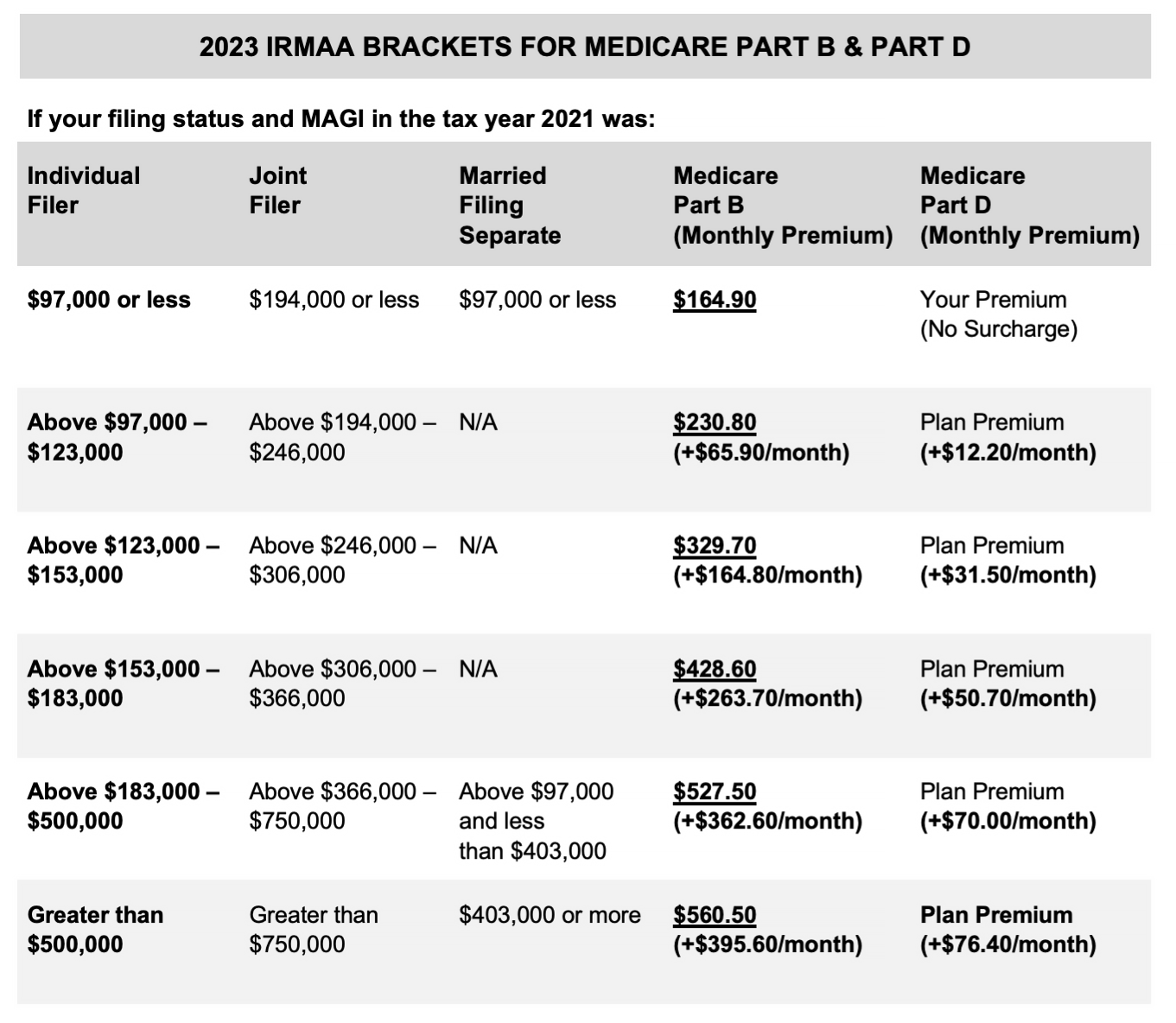

Well, what will every baby boomer need at some point in their retirement? Health insurance and health insurance through Medicare. Anyone who has applied for Medicare knows it is NOT an easy process. One of the more confusing aspects relates to Medicare Part B, and Part D, and the Income-Related Monthly Adjusted Amount (IRMAA).

Here are a few refreshers about IRMAA 2 (handy chart to follow):

- IRMAA is a pesky fee/surcharge that high-earning Medicare members must pay each month

- Your 2023 IRMAA is based on your Modified Adjusted Gross Income (MAGI) from 2021

- The Medicare Part B 2023 standard monthly premium is $164.90

- Updated 2023 IRMAA brackets can increase Medicare Part B monthly premiums by as much as $395.60 ($4,747.20 for the year!) and Medicare Part D monthly premiums by as much as $76.40 ($916.80 for the year!)

- IRMAA is determined by the Social Security Administration and if you are over a threshold (even by $1), you pay the premium increase for the next 12 months

(Click image to enlarge)

Source: https://youstaywealthy.com/medicare-irmaa-brackets/

Source: https://youstaywealthy.com/medicare-irmaa-brackets/

How does all this talk of health insurance relate to taxes? Here's how: Reducing your MAGI (Modified Adjusted Gross Income) has the potential to help you reduce or avoid IRMAA in future years.

To understand how that works, let's look at the potential "trickle down" effects, or collateral damage, of a sample high-net-worth (HNW) investor's taxable portfolio that is NOT managed with eye to tax impacts.

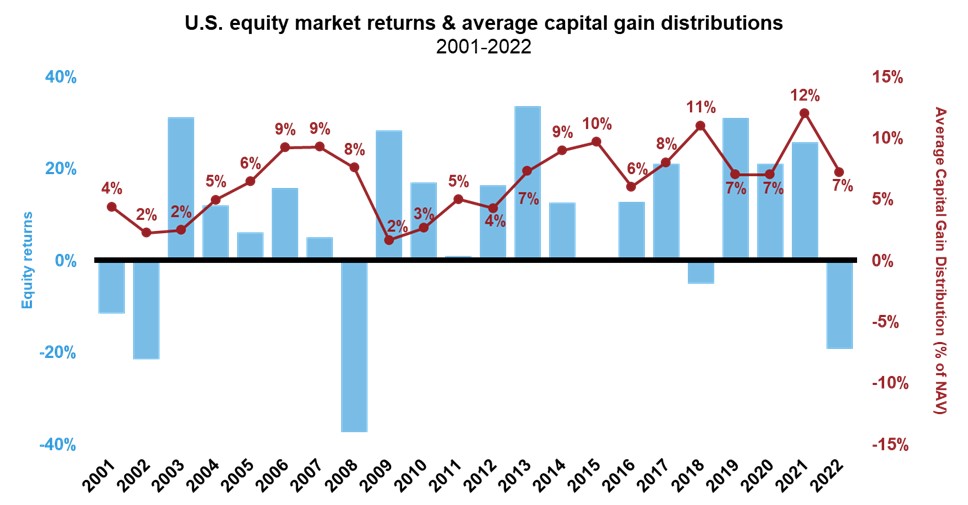

As clients are filing their 2023 tax-return, remember it is the 2021 MAGI that really matters. Well, if you recall back to 2021, the average mutual fund capital gain distribution was 12%—the highest it had been in 20+ years! (See chart below). So, a hypothetical HNW investor's $1 million taxable portfolio with a 12% capital gain distribution would have increased the client's MAGI by $120,000 in that year alone.

Further:

- The client would owe a 2021 tax bill on that $120,000 in capital gain distributions (ouch)

- That $120,000 in capital gain distributions would bump the client into a higher IRMAA calculation— potentially causing the client thousands of dollars in higher Medicare Part B/Part D premiums for the next 12 months in 2023.

Who knew a non-tax-managed investment portfolio could cause so much collateral damage!

(Click image to enlarge)

Source: Morningstar Direct. U.S. stock market represented by Russell 3000® Index. Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Average capital gains distribution: Morningstar broad category 'U.S. Equity' which includes mutual funds and ETFs (and multiple share classes). For years 2001 through 2020, % = calendar year capital gains distribution ÷ year-end NAV. For 2021 & 2022, % = capital gains distribution ÷ respective pre-distribution NAV. For years 2001 through 2013, used oldest share class. 2014 forward includes all share classes.

How can advisors help their clients avoid these sorts of negative surprises?

The "no surprise" portfolio

When you're thinking about managing for taxes, it's not simply about lowering your client's tax bill in the current filing year. Instead, it's anticipating the collateral damage of IRMAA, Roth Conversions, the 3.8% NIIT tax, and more. Many advisors are coming to the realization that financial planning for high-net-worth investors today is not for the faint of heart. Which is probably why I'm fielding a growing number of questions from advisors about our nearly 40 years' experience in tax-managed investing. Those decades have helped us learn what it takes to avoid negative surprises and collateral damage in clients' taxable portfolios.

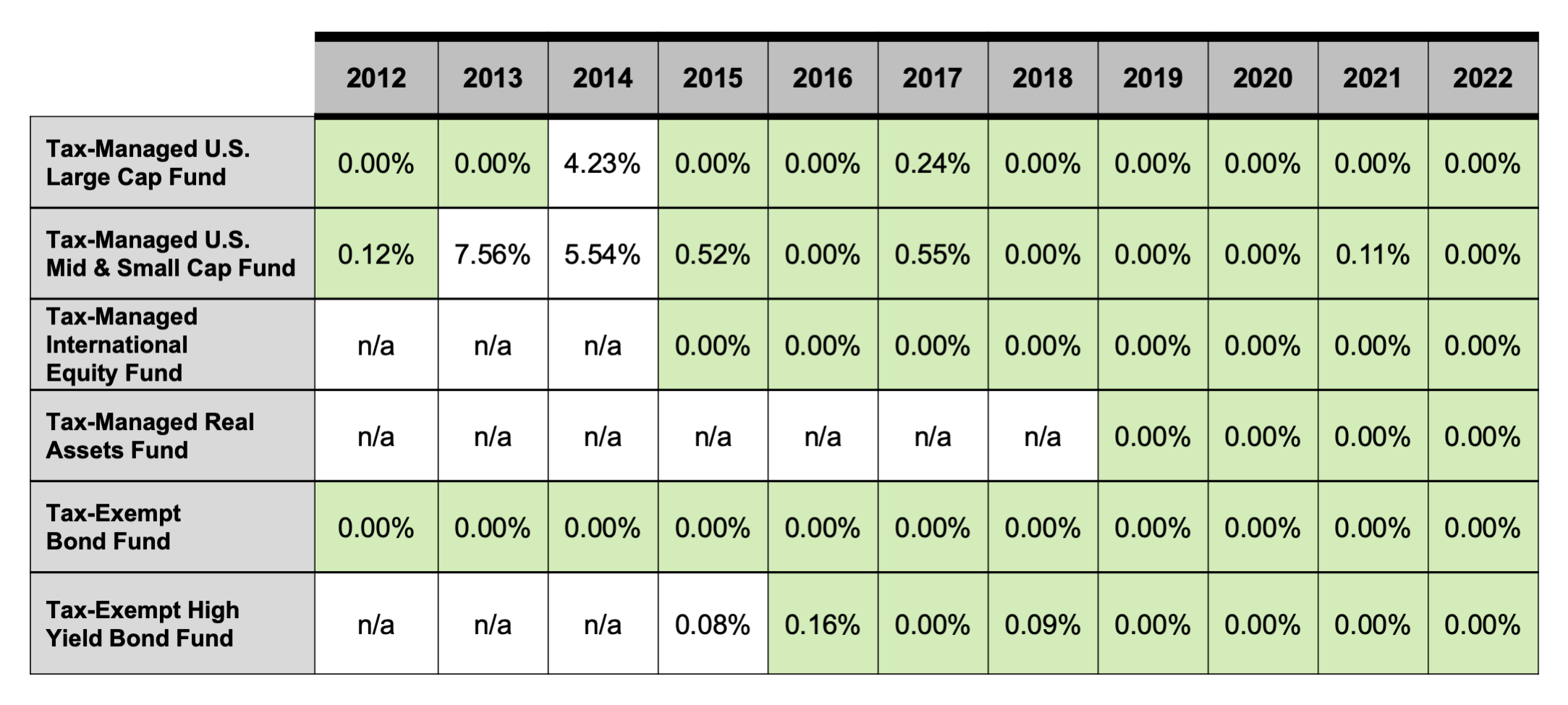

Unsure what a "no surprises" tax-managed portfolio can look like? Check out the annual capital gain distributions of the Russell Investment Tax-Managed Equity and Tax-Exempt Bond Fund over time. Don't blink – you might miss those distributions: they've hovered between 0% and less than 1% for each of our funds in that space since 2015.

Annual Capital Gain Distributions (% of Net Asset Value)

(Click image to enlarge)

Any distribution less than 1% of NAV = Green

Source: Russell Investments. Please see Important Risk Disclosures for information related to this chart.

With Tax Day (April 18th this year!) right around the corner, we are seeing many advisors and investors looking at doing something different with their taxable portfolios. Make sure you know where the landmines are in your clients' portfolios. And let us help you identify strategies to manage the potential collateral damage. We have a TON of resources at your disposal.

For example, our 1099 Guide is designed to help you connect the dots for your clients between their Form 1099-DIV and their investment portfolio. We can show you how to help your clients better understand how their investments are taxed. Our Tax Season Essentials flyer can help you address some of the misconceptions around investment taxes using simple charts and illustrations. As always, we're here to help.

2 Source for all data on IRMAA: https://youstaywealthy.com/medicare-irmaa-brackets/