Four "secrets" you can use to help lower your clients' tax bills

We all know the secrets to a long, healthy life: eating well, staying active, work-life balance and building a strong network of family and friends. But how many of us do these things, even though we know they are good for us?

There are also secrets that tax-aware advisors and investors rely on to manage the tax bill on their investments. There are numerous strategies that you can use to reduce the cost of taxes on your client portfolios. In a time of high inflation, rising interest rates and volatile markets, helping your clients keep their tax bill as low as possible may be one of the only things you can control. But are you?

While it may take a lot of willpower to not eat the pound cake, we believe that helping your clients avoid unexpected surprises on their annual tax bill can be quite simple and easy. Here we want to share the four secrets that could help you enhance your value to your clients by reducing the bite that taxes take.

1. Beware the taxable investor’s double whammy

Every year, mutual funds add up their realized gains and losses for the fund’s fiscal year. If the gains are greater than the losses, that amount is distributed as a capital gain to investors. This is a fact of life. Mutual funds (and ETFs) are required to pay out 98.2% of net realized capital gains to shareholders. This happens every year, regardless of how the overall market has performed. So that means that capital gain distributions happen in both up and down markets.

To us, that feels like adding insult to injury. Because taxable investors pay taxes on those distributions, sometimes substantial taxes. Imagine how your clients might react if their year-end statement shows their portfolio lost value and then they receive a Form 1099-Div with a big tax bill due in April. Wouldn’t it be better to avoid that challenging conversation?

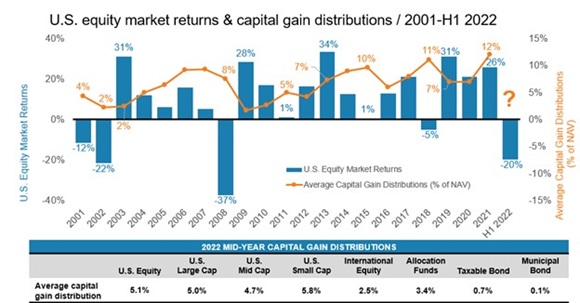

We’re not talking in hypothetical terms here. As you can see in the chart below, there have been capital gains distributions from U.S. mutual funds in every year since 2001. And in that 20-year period there have been good years, bad years and meh years. The irony is that some of the largest distributions were made in some of the worst years in that period. Just look at 2018, for example.

Source: Morningstar Direct. U.S. Stocks: Russell 3000® Index. U.S. equity funds: Morningstar broad category ‘US Equity’, all other categories are based on Morningstar Category Group each including mutual funds and ETFs. For years 2001 through 2013, used oldest share class, 2014 forward includes all share classes. Average Capital Gain Distribution % = calendar year cap gain distribution ÷ year-end NAV (For years 2001 through 2020), = total cap gain distribution ÷ respective pre-distribution NAV (For 2021 & 2022). Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

Notice the big question mark over the bar for 2022? That’s because we don’t yet know how large the average capital gain distribution is going to be this year. But as history shows us, it’s unlikely to be zero.

We also don’t know how the market is going to end the year, but at the halfway mark the Russell 3000 Index was down -20%. With the U.S. Federal Reserve aggressively raising interest rates to contain inflationary pressures, ongoing geopolitical conflicts, midterm elections and other issues worrying investors, the outlook for the remainder of the year is a little grim.

You may not be able to keep your clients’ portfolios from losing ground this year given all the issues roiling the markets. But you can do something about the tax bill they will receive.

You can potentially avoid those difficult conversations with your clients in April by moving them now into tax-managed solutions that are designed to reduce or minimize capital gains distributions. And that might ease the pain of what is looking to be a very challenging year in the markets.

2. Switching to a tax-managed solution may have a lower tax cost than expected

We call this the silver lining in difficult markets. It’s fair to say the first half of 2022 was one of the most volatile periods in stock market history. And because markets were significantly lower at the midway point this year, the cost of switching to a tax-managed solution will potentially also be lower.

When your clients switch from one mutual fund or ETF to another, they pay taxes on the capital gain, or the difference between the current net asset value (NAV) of that fund and the NAV of the fund when they first purchased it. The current NAV already reflects the dividends and capital gains distributions that your clients have received and paid taxes on. So if the turmoil in the markets has caused the NAV to fall, the difference between the current NAV and the original NAV may be lower than just six months ago. That means there will be a smaller capital gain and therefore a lower tax cost to switch now.

The chart below shows that as of June 30, 72% of U.S. large cap growth mutual funds and ETFs had a NAV that has risen less than 10% over the past three years. Similarly, the vast majority of U.S. mid-cap and U.S. small-cap funds and ETFs had a relatively low increase in NAV in the past three years. As noted above, that could reduce the capital gain, depending on when your client purchased the fund.

Source: Morningstar Direct & Barclays. Balanced 60/40: 41% S&P 500 Price Return Index, 19% MSCI ACWI ex-USA Price Return Index, 40% Bloomberg U.S. Aggregate Bond Price Return Index, rebalanced monthly. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

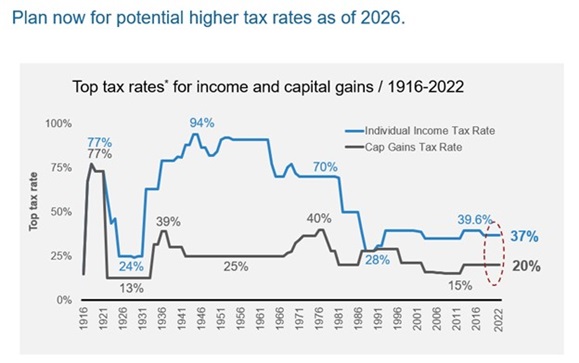

3. Tax rates may go up in the future, so plan now

What goes up but hardly ever goes down? Why taxes, of course. Granted, the Tax Cuts and Jobs Act of 2017 DID reduce individual and corporate taxes—for a while, anyway. Those tax cuts are set to expire in 2025.

It is possible that Congress will decide to extend the provisions of the act for a while longer. This could happen if the U.S. were to fall into a prolonged recession, for example. But we think that’s highly unlikely. What’s more likely is that Congress is going to need to begin paying the bill for the huge support programs launched at the height of the COVID-19 crisis.

Click image to enlarge

Source: http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=543

*Rates do not include 3.8% tax for net investment income.

You can start planning now to be prepared for any future tax increases. Or just to manage current taxes! Who needs to pay more in taxes? We can’t really think of anyone, can you?

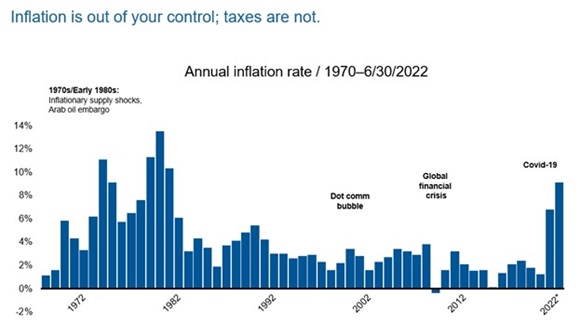

4. There’s not much you can do about inflation, but you CAN lower your tax cost

There are two phenomena that can eat away at your portfolio’s returns.

One is inflation. Many of your clients are likely saving for retirement and may have a number in mind: Let’s say $1 million as a nest egg to provide financial stability in their retirement years. We all know that $1 million today doesn’t buy as much as it did 20 years ago. And the last two decades featured price stability. Now imagine how the inflation rates we are seeing today could impact the value of $1 million in five, 10 or 20 years—when your clients are preparing to retire. Their confidence that you are helping them on the path to financial stability could be seriously eroded.

There isn’t much you can do about the negative impact of inflation on the higher cost of food, shelter, clothing and transportation. But, we believe there’s plenty you can do about the second phenomenon, which is the cost of taxes. There are all kinds of strategies you can implement to help reduce the impact of taxes on your clients’ investments. And that may help ease the pain of the inflationary bite.

Source: Bureau of Labor Statistics

*For the 12 months ending June 2022

Like most secrets, these secrets aren’t that secret. They’re things that make sense and most people instinctively know. But sometimes it takes seeing them in this article to realize how much you as an advisor can do to demonstrate your value to your clients in these difficult times.