Tax-aware investing: It’s the after-tax rate of return that matters

I recently had a conversation with an investor that made me realize the importance of perspective and understanding the true cost of ownership.

Have you ever heard someone say: the best investment I ever made was my house? That’s because most people own their home for 30-40 years. They remember what they paid for it, and they know how much it’s worth now because it’s likely one of their largest assets.

However, it’s also one of their most expensive assets when it comes to cost of ownership. Most homeowners rarely calculate their total return after all costs. In the New York metropolitan area, the average cost to buy a home can be 5% upfront and the annual carrying costs can range between 0.50%-2.5% per year.1 I calculated my own annual cost of ownership by adding my property taxes minus the $10,000 deduction, plus my homeowner insurance and divided that by the current market value of my house. My base annual carrying cost is 2.3% of the home’s value and this doesn’t even include home maintenance and my gas/electric bill.

Owning your home ends up being one of the costliest investments you can make, and there isn’t much, if anything, you can do about the essential ongoing costs of that investment. You can shop for better homeowner insurance, but you still have to pay your utilities and property taxes no matter what.

Taxes on investments: Fees of no value

Many people think of taxes as a cost when it comes to investments, one that is both permanent and lacking in requisite value. Taxes do not pay for a vigilant financial advisor. They are a drag on a portfolio’s returns. Taxes are like a government fee being applied to investment portfolios. And for non-qualified portfolios, taxes can be one of the largest costs investors pay.

Now here is where you as their financial advisor can play a key role. Your decision to use strategies to minimize taxes may significantly reduce these costs and add value to the client relationship. According to our latest Value of an Advisor study, we believe that advisors who help their clients maximize their after-tax returns can potentially add meaningful value.

The taxable investor: The challenge

U.S. investors currently have around $11 trillion of non-qualified assets invested in mutual funds according to the 2022 Investment Company Fact Book. Unless the mutual fund has a tax-managed mandate by prospectus, the mutual fund must distribute capital gains annually to its shareholders. In 2021, capital gain distributions averaged 12% of net asset value (NAV), the highest in more than 20 years. Investors who received those capital gains paid taxes on them. But many investors may not even be aware of this ongoing cost of investment because they give their Form 1099s to their tax preparer and rarely connect the dots between their tax cost and their investment portfolio return.

The tax-aware investor: A better way

There is a better way. Advisors—and the investors you work with—who pay attention to the impact of taxes throughout the investment process can not only connect the dots but also do something about it. These tax-aware investors may use tax-managed mutual funds and other strategies to minimize the carrying cost of their investments.

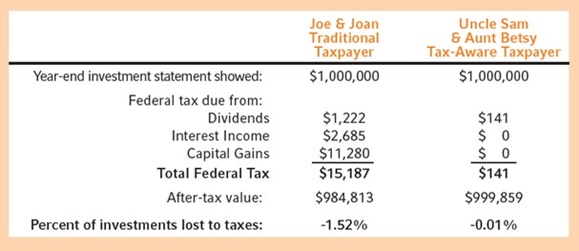

Let’s take a look at the following case study: A tale of two investors.

Our first example is a married couple earning $400,000 annually with a portfolio of $1,000,000 on Dec. 31, 2021, invested 50% in U.S. equity and 50% in taxable bonds. We use the average dividend yield for 2021 and the average corporate bond yield along with capital gain distributions and we populate the boxes in the investors' Form 1099-DIV using their appropriate tax rate. When you populate the boxes and do the math, the Federal taxes due on this $1,000,000 account are $15,187. When you divide that by the year-ending account balance you get 1.52%. That tax cost is more than they pay for investment management and it’s probably more than they pay for advice. More importantly, most people don’t realize that this cost can likely be minimized by using tax-managed investment solutions.

The second example is a married couple with the same income, asset allocation and year-ending portfolio value. However, this tax-aware couple is using a tax-managed equity mutual fund and a municipal bond fund. Using the average dividend yield, tax exempt income yield and capital gains distribution, we can populate the Form 1099-DIV boxes to find out the federal taxes due on the tax-aware example. As you can see, the amount of taxable dividend interest is significantly less and there is no reported capital gain distribution. When you apply appropriate tax rates, the federal tax due for the tax-aware investor is $141 or 1 basis point. By making the decision to invest in a tax-managed portfolio in 2021, investors could have saved 1.5% of tax cost while achieving comparable returns. It’s not about sacrificing growth to save on taxes, it’s about being able to implement the investment strategy in a more tax-efficient way.

Chart: A tale of two investors

Source: Russell Investments. A hypothetical illustration.

The bottom line

It’s one thing to pay taxes when assets are rising. However, paying taxes after your portfolio has fallen in value is adding insult to injury. As homeowners, our home values can decline, and we still have to pay our property and school taxes. But when it comes to investments, taxes don’t have to be an essential cost. They can potentially be minimized using tax-managed solutions. We must remind ourselves that it’s what we keep in our pocket at the end of the day that matters most!