Top 10 things tax-smart advisors do after Tax Day

Tax Day has come and gone. Many investors and even some advisors don’t really think about managing investment taxes until the weeks leading up to Tax Day, which usually falls in mid-April.

But at Russell Investments, we believe in managing investment taxes 365 days a year. We believe that the days and weeks following Tax Day are when you should start thinking about next year’s tax returns and the strategies that can help your clients minimize their tax bite.

In fact, now is a great time to ask your clients how they feel about taxes. That’s right. Ask. If your clients loathe taxes, you’re now in a better position to talk about tax-managed investing approaches and incorporate that into their plan. Many clients do not naturally understand all you can do for them.

It’s likely that many of your clients and prospects are quite unhappy or even shocked by the tax bill they received this year. That may be because the average capital gain distribution in 2021 was 12% of net asset value (NAV)—the highest level in 20 years. And 81% of U.S. equity funds paid a capital gain distribution. So imagine how receptive your clients may be to discussing how to avoid a similar hefty tax bill next year.

We believe that advisors who focus on tax-smart investing can distinguish themselves and demonstrate differentiating value.

We’ve asked several of our regional directors and tax experts to share their top tips to taking a tax-smart approach to investing year-round.

1. The benefits of running a tax analysis or proposal

Cory Christiana, Regional Director, Metro New England

I enjoy partnering with advisors to run proposals and tax analyses because they help investors to take positive actions in alignment with their long-term goals. Without a robust analysis or proposal, it can be hard for an investor to conceptualize the positive impact of your recommendations. By partnering with us to do the analysis and run the proposal, you are making the investing process easier for the client.

With a proposal in hand, you can show your clients how their allocations would differ, what that means from a risk/return perspective, and the impact the changes would make on their overall wealth.

Running a proposal after Tax Day allows you to understand all the assets your clients may have—even those that are outside your purview. This can give you a complete picture of their portfolio and provide you with a platform to compete for those assets.

2. Guide to the Form 1099-DIV

Ryan Dooyema, Senior Regional Director, Wisconsin and Northern Michigan

Knowing how to calculate if your client is paying too much in investment taxes puts you in a better position to help them do something about it. It’s not all about existing clients either: our guide to the Form 1099-DIV could help you win more business from potential prospects and other sources.

Simply walking through the 1099 form and discussing the implications and the impact on their income can be truly beneficial to your clients. On their own, clients are unlikely to connect the dots between dividend distribution impact on their total wealth return. You, the advisor, can reveal what they may be sacrificing to taxes. And better yet, you can do something about it.

This is why Russell Investments’ 1099 Guide is such a valuable tax-management tool. It can help you determine what to look for (there are four boxes that matter a lot more than the others!) along with actions you can take to help your clients reduce their tax burden.

3. Our After-Tax Wealth Handbook for 2022

Tim Halverson, Senior Regional Director, Illinois

One of my favorite pieces to go through with advisors is our After-Tax Wealth Handbook, which we recently updated for 2022. This is a piece we put together with Deloitte. I know it can be intimidating when you first look at it because it is 100+ pages.

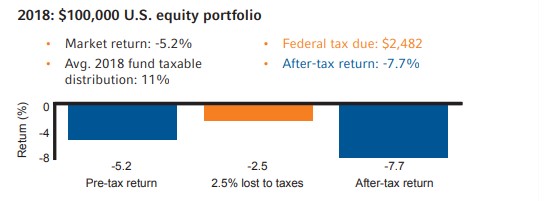

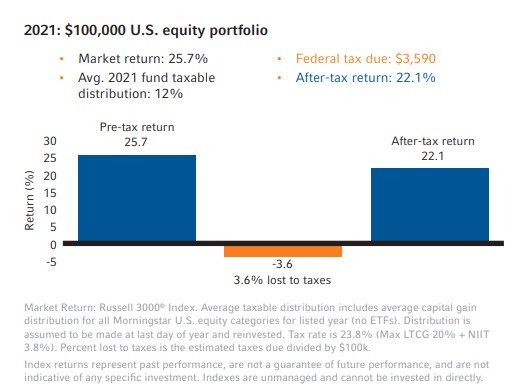

If you are like me and have the attention span of a goldfish, let me point you to two charts in the handbook that sum up why tax-managed investing is so important. These charts show that it doesn’t matter whether the market is going up or down—managing an investment portfolio for taxes can help your clients save money. In both cases we are considering a hypothetical $100,000 investment in a U.S. equity portfolio.

The first chart depicts a year with a negative market environment – 2018. Assuming the average 11% distribution is taxed at 23.8% (20% LTCG + 3.8% NIIT), the already negative return falls further to -7.7%.

The second chart depicts a year with a positive market environment – 2021. Assuming the average 12% capital gains distribution is also taxed at 23.8%, the after-tax return falls to 22.1% for the year.

In both years, the tax burden was similar, but the impact on the investor feels vastly different. After all, no one wants to lose more than they have to!

The power of tax-managed investing lies in dialing down tax drag in every market environment. Reducing the tax liability—through a variety of strategies outlined in our After-Tax Wealth Handbook—can potentially improve your clients’ returns. Ask your regional team for access to this resource.

4. Taxable trusts

Tom Flynn, Senior Regional Director, Metro D.C., Maryland and Virginia

It doesn’t take much for a trust account to quickly find itself in the highest tax-bracket. As of 2021, when taxable income exceeds a mere $13,051, trusts are most likely taxed at the top tax rate of 37%. That means a $1 million trust account yielding 2% could be paying a maximum level of federal taxes, in addition to state and local taxes. Many investors are finding that the use of a tax-smart approach to the management of these underlying assets can make a significant difference to long-term returns.

In turn, taxable trusts can be an excellent area for advisors to look for new business. Many trust holders struggle with the decision of what to do with income and capital gains kicked off by the investments within a trust. Often, strategies are complicated or result in a tangled tax reporting process. Many simply distribute them to beneficiaries, regardless of need to make things easier. Sure, this lowers the income and tax bill for the trust, but may cause tax problems for the beneficiary through a higher tax bill.

Imagine being able to tell an attorney, trustee, or anyone with fiduciary responsibility over a trust, that by being a tax-smart advisor you can help:

- Diversify a portfolio to meet the goals for the trust

- Minimize or eliminate the tax bill, thus leaving assets working the trust to compound and grow faster

- Completely outsource the process

- Simplify the tax reporting process via a single, consolidated Form 1099-DIV

Since trusts tend to hold substantial funds, this is a great opportunity to work an underserved group and could result in great networking relationships.

5. How do you identify clients most suitable for tax-managed investing?

Michael Montemayor, Regional Director, North Texas and Oklahoma

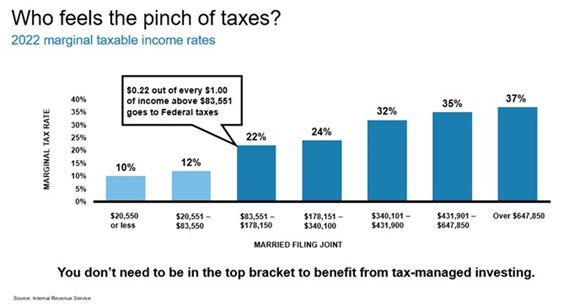

Advisors typically ask what account size will benefit the most from tax-managed strategies. I say it is not the size of the account that is important. It's the client's tax bracket. You don’t need to be in the top bracket to benefit from tax-managed investing. Any dollar saved from taxes is another dollar that stays working toward their goals.

It’s also important to consider the potential from non-qualified—or taxable—accounts. Gaining expertise in this area can help you grow your assets under management and differentiate your value proposition. The first step is to uncover those taxable assets that could benefit from being channeled into a tax-managed solution. Here are seven sources of taxable assets we believe could benefit from a tax-managed approach.

6. Tax impact comparison tool

Rob Kuharic, Director, Tax-Managed Solutions

Reading about tax slippage is one thing, but seeing specific tax drag and after-tax return by product really helps in the assessment.

Our tax impact comparison tool, which uses Morningstar data, is a great way to assess the impact taxes have on investment returns to help make informed decisions for taxable accounts. This tool shows the amount of return lost to taxes (tax-cost ratio), after-tax return and pre-tax return, and also shows their percentile rank within a peer universe.

7. Value of tax management tool

Cory Christiana, Regional Director, Metro New England

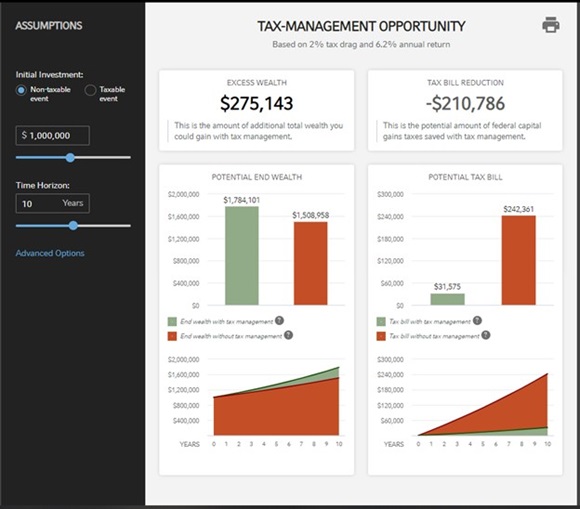

Lowering investment-related tax costs can make a significant impact in your clients’ ability to meet their long-term goals. Our value of tax management tool (financial professional login required) shows them how.

The tool allows you to quickly input specifics about your client’s case to see their tax-management opportunity, including years to break-even, dollars of excess wealth and tax bill reduction.

Source: Russell Investments

8. State tax planning

Rob Kuharic, Director, Tax-Managed Solutions

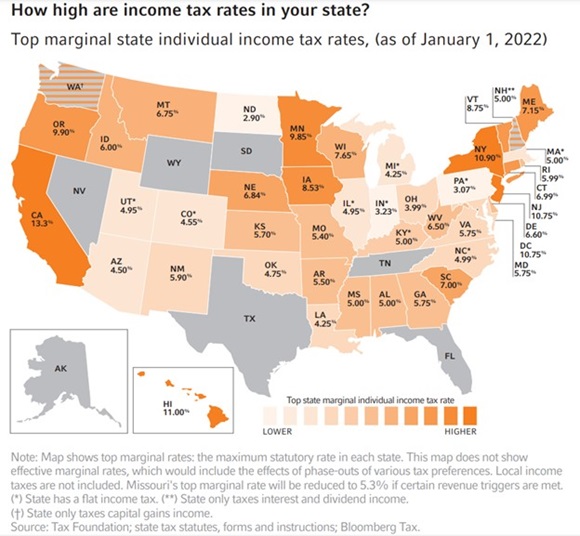

Many investors focus their tax planning on what they need to pay Uncle Sam. But did you know for many investors that are residents of higher-taxed states, 25% to 33% of their tax bill may be because of state and local taxes? It is important to think about, as well as plan for and invest accordingly, the impact that both federal and state level taxes can have on after-tax returns.

- Most states tax capital gains as income.

- State tax rates hit their higher levels at much lower income levels than federal tax rates.

- Up to 1/3 of an investor’s tax bill could be due to state and local income taxes.

9. DIY or outsource: Tax-managed model strategies or tax-loss harvesting

Rob Kuharic, Director, Tax-Managed Solutions

If only all of your work could be completed with the single click of a button. Life would be so easy!

Financial advisors know all too well that easy buttons are few and far between.

Two key tax-management strategies—tax-loss harvesting and tax-lot management—require a lot of legwork. For example, tax-loss harvesting to defer long-term capital gains means keeping an eye out for opportunities to harvest losses, which can take place at any time of the year. Are you finding the time to evaluate opportunities on a regular (monthly or more frequently) basis in your clients’ accounts? Are you able to capitalize on market declines to create value for your clients? Where are you reinvesting the proceeds of the harvesting activity? How are you managing the wash sale rule?

The same goes for tax-lot management. Whenever a client transaction occurs, chances are that new tax lots are created as well. Every tax lot has a different tax liability (or asset) attached to it. Who is monitoring that liability (or asset)? How and when are they being managed? How are the tax liability and tax costs of the trade being assessed?

Proper tax management can help a tax sensitive investor retain a meaningful amount of portfolio value. It may be a good time now to consider how tax management is being implemented in your practice. Do you have a sustainable plan in place? How might you be able to create even more value for clients, while at the same time manage your own workload?

This then becomes the question—DIY or outsource? Your Russell Investments regional team may be able to guide you to the right decision for your practice.

10. Know your client's other professional advisors

Stephen Krezinski, Senior Regional Director, Minnesota

As a financial advisor, you are the center of your clients’ financial affairs and their first point of contact for anything that falls under the broad category of money.

You should be able to speak to each of these areas at a high level and know each of your clients’ other professional advisors so you can collaborate on important decisions, educate on timely topics and partner on a reciprocal basis.It’s a wise idea for your clients, your business and your network.

If you are not working with your clients’ accountants, attorneys, bankers, trust officers, insurance agents, realtors, etc.; you should, and just-after tax season is an appropriate time to introduce yourself to your clients’ certified public accountant (CPA). Probably the one person who cares more about taxes than your clients are your clients’ CPAs.

Tax-managed investing helps you get on the same side of the table as the CPA, helping you to potentially build a closer partnership with both your client and your client’s CPA. Ultimately, working together in a coordinated effort is in the best interest of the clients’ long-term goals. If you incorporate tax-managed investing into your investment approach, your common ground with CPAs will provide an opportunity for you to reach out to build relationships with additional CPAs, potentially increasing referral business.

The bottom line

In our recently released Value of an Advisor study, helping clients reduce the impact of taxes is one of the greatest value-adds advisors may bring to the client relationship. Tell your clients what you are doing to improve their after-tax outcomes.

Taxes on an investment portfolio are like the taxes on your paycheck: they reduce the amount that goes in your pocket. When you help your clients protect their investments from the impact of taxes, you have increased your value to them as an advisor. And we believe the opportune time to discuss taxes and do something about it is now, while the sting of taxes may still be new for some of your clients.

Don’t miss this time of year to turn the sting of tax pain into a productive relationship and business-building strategy focused on what you and your clients can control right now. At Russell Investments, we have the right tools, analysis, subject-matter experts and dedicated sales/service teams to help you be successful in this space.