7 sources of assets that could benefit from a tax-managed approach

You will never get the answer if you don’t ask the question.

When we talk with financial advisors about business solutions and business challenges, the discussion often leads to individual retirement accounts (IRAs), 401(k) and 403(b) rollovers, and other items related to tax-advantaged or tax-deferred qualified accounts. Too often, this is the primary and sometimes only focus of a financial practice. I will start by asking a question: Is this really the best way to help your clients and grow your business?

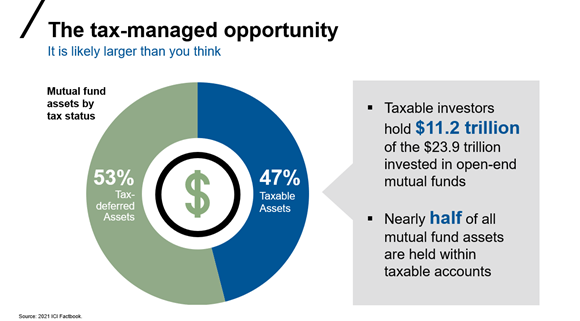

The reality is that non-qualified assets—where the investment income is taxed annually—are arguably the biggest opportunity for growth that you may have. Just looking at the mutual fund universe, the split of assets between qualified and non-qualified is nearly even. You can see the details in the chart below: out of the $23.9 trillion invested in open-ended mutual funds today in the U.S., $11.2 trillion is classified as taxable/non-qualified assets.

Click image to enlarge

This is your core opportunity. But there is more.

What about other investor holdings that are directly held securities like separately managed accounts (SMAs), savings accounts, certificates of deposit (CDs) and direct bond holdings? When you start considering the total picture of holdings and assets by investors, you can very quickly conclude that non-qualified assets arguably make up the majority of investor assets.

Why is this the case? Well, it’s simple. Most advisors are generally comfortable managing rollovers, working with IRAs and other qualified accounts. But not all advisors are comfortable addressing non-qualified—or taxable—accounts. These accounts and the questions the clients may ask about them may seem daunting at first glance but shouldn’t be. Gaining expertise in this area can help you grow your assets under management and differentiate your value proposition.

The other challenge that occurs is many advisors often treat non-qualified accounts the same as qualified accounts, despite significant differences in the end results of these and the different parameters that apply due to the tax impact. This is usually due to two factors:

- Advisors don’t know and don’t have the tools to see the impact on returns and after-tax wealth.

- It’s often hard to know where the taxable assets are, and what are the questions to ask to find these hidden assets that are hiding in plain sight.

So, how do you become the go-to expert for taxable accounts? How can you uncover these non-qualified assets? And where can you go to get the resources to help with taxable investing know-how?

Where to focus: The types of clients and assets where tax management really matters

To begin, it’s best to focus efforts where help can be applied specifically—to specific clients. This is a list of the seven top sources of taxable assets we see through our work. Using this list, we believe advisors can focus their efforts on the clients and situations that need tax management the most.

The top 7 sources of taxable assets

- The sale of real estate

- The sale of a business

- Deferred compensation

- Inheritance

- Insurance proceeds

- Trusts

- Current taxable assets

1. The sale of real estate or other assets due to downsizing

For many investors who are downsizing—either due to becoming empty nesters or moving into permanent remote work—the sale of a house likely results in a sizable capital gain from the price paid many years ago. Even after the primary home deduction, more often than not the sale of a long-time residence results in a sizable cash event. Moving to a new smaller residence and getting the benefit of time and leisure is exciting, but at the same time carefully thinking through how to invest the sale proceeds (taxable assets) is critical for many investors to have a comfortable and relaxing retirement.

Even if the sale relates to a vacation property, a farm or pastureland, or other real estate holdings, the proceeds in the vast majority of cases become taxable investment dollars.

We believe tax-managed investment solutions should be given strong consideration for these events.

2. Sale of a business

Business owners often make large sacrifices in order to dedicate themselves to their business venture. And they make a large commitment to growing and managing the business. Many expect and plan for the business to be their source of retirement security. But do they realize that the sale of their ownership in it (i.e., monetization of their business stake) is a taxable event? And that this is likely to be the largest tax bill they may see in their lifetime? The result may be less retirement savings than they expected. Advice from a tax-smart advisor could be extremely important in these situations. Consider how helping business owners better plan for retirement and reduce their tax bill can add significant value to your relationship with them.

3. Proceeds from stock grants and deferred compensation plans

For many senior-level professionals, stock grants and other forms of equity participation are a major part of their compensation and their retirement savings. And senior sales/product professionals with a high but variable income often use the available deferred compensation plan to protect some income from taxes as a way to save for retirement.

The reality of these events plays out nearly daily somewhere in the country. The common thread with both is the taxman cometh. The shock of having to pay the tax all at once (which happens quite often with these events) can be overwhelming for even the most educated investors. This is an opportunity to help the client understand that the outcome of this scenario may be a sizeable tax bill.

More importantly, it’s an opportunity to lay out the next steps of what to do with the proceeds going forward. You can help the client place these assets into a tax-smart solution that actively works to reduce capital gains taxes and minimize excessive tax exposure. In this way, the investor enjoys a solution that is both tax-managed and liquid.

4. Inheritance

While a death is a sad time for families, an inheritance likely provides an opportunity to plan for the future. In most cases, an inheritance is all in non-qualified assets. A tax-managed portfolio, diversified across stocks, bonds and real assets, can provide the beneficiary with instant liquidity, the potential for growth and the ability to withdraw assets on a systematic basis.

5. Insurance payouts

Similar to an inheritance, it is typically a sad event that generates an insurance or death-benefit payout. However, in many cases this payment comes tax -free. Through the use of a tax-smart approach and active tax management, a disciplined investment plan for this payout can result in a beneficial retirement nest egg.

6. Trust accounts

Trust accounts are created for a variety of reasons. In many cases they are created to support the ongoing needs of a specific individual or organization. Trusts that aren’t pass-through entities—meaning trusts that have their own tax identification number and file their own tax return—have a unique tax situation. Once taxable income exceeds $12,950, these trusts are most often taxed at the highest tax level possible. Today that rate is 37%, in addition to the 3.8% net investment income tax (NIIT), for a total top marginal tax rate of 40.8%.

The use of a tax-smart approach to the management of these underlying assets can make a significant difference to long-term returns.

7. Current taxable assets with an unwanted tax bill

Most investment products are not managed to maximize after-tax returns. More often than not, the objective is to maximize the pre-tax return, while the after-tax return is secondary, if considered at all.

In many instances, these return-seeking products are fine to use within tax-advantaged accounts, where taxes are exempt or deferred, but these same products can cause great tax costs within taxable accounts. We have seen numerous examples where investors have bought income funds, not understanding the tax cost of that income, how much less of it they would keep after-tax and whether they actually needed that income in the first place.

Placing tax-inefficient products within a taxable account can have a potentially significant impact. Take the time to analyze the accounts of your current clients to make sure the investments in them make sense for the tax status of the account (qualified vs. non-qualified). We believe you can use this as a major point of differentiation, as many advisors don’t do this for their clients. Lastly, give thoughtful consideration to how to transition a client from tax-inefficient investments to ones that are tax-managed and help put the investor’s best after-tax foot forward!

The bottom line

Taxes matter. Investment portfolios can and do generate taxable events for clients. And the cost of those taxes can be significant for investors. Taxes on investments offer nothing to portfolios but wasted potential. So it’s important that the management of these assets take the cost of taxes into consideration. By focusing on after-tax outcomes, you can help your clients find the solution before it becomes a problem.