The perils of not discussing taxes with clients

In February of this year, a colleague and I were meeting with a financial planner who runs a sizable and well-respected business. After we exchanged pleasantries, we discussed the impact taxes can have on client accounts. Capital gain distributions, on average, were sizable in 2018—11%.1 We asked if she had reviewed her clients’ 1099s. She nodded and said they had started to come in—and agreed they were higher than years past. We asked, What do you do differently on taxable accounts compared to qualified accounts? The response was one I hear all too frequently: Nothing.

How is this possible? Why use a strategy designed for qualified accounts in the non-qualified space? Taxable accounts are a different animal and need to be treated as such. This is similar to putting diesel fuel in a Ford Explorer. Sure, it may work for a little while, but eventually, it’ll erode the engine and potentially cost a lot of money in the long run.

When it comes to taxable accounts, it’s unfortunate that corrective steps aren’t being taken to reduce unnecessary capital gain distributions and the tax implications that follow. The need to educate clients on proper taxable account investing is often overlooked—despite being an important part of a financial planner’s duties.

But my clients don’t ask about taxes

When asked why she doesn’t do anything differently, the aforementioned financial planner’s response was, my clients don’t ask about taxes.

In other words, knowing that there was a need to manage her clients’ money differently on non-qualified accounts, she chose to do nothing simply because her clients didn’t ask. This was a hard pill for me to swallow. As we demonstrate below, an advisor and financial planner can play many roles, each of which has significant value and may ultimately help clients reach their long-term financial goals—and that includes finding solutions to problems, regardless of whether clients know they exist or not.

Click image to enlarge

Five most detrimental words: That’s what we’ve always done

Traditional mutual funds have tax implications that may be significantly detrimental to taxable account performance. So why do they get used so often in a place they aren’t designed for? Because … that’s what we’ve always done!

As we exited the financial planner’s office and returned to the car, my colleague was visibly frustrated. My clients don’t ask about taxes! They don’t ask! That’s why you’re losing them money!? he exclaimed. As a CFP and CPA, he understood all too well the position she was putting her clients in—and that they were unwillingly participating simply because they didn’t know the questions to ask.

Many investors rationalize taxes as part of life. Most have heard the famous words spoken by Benjamin Franklin: “In this world, nothing can be said to be certain except death and taxes.” Sure, these words might be a common saying among CPAs—who, after all, spend much of their time immersed in taxes—but can you imagine a doctor ever saying such a thing to a patient? We strongly believe this holds true for advisors as well. Advisors can—and should—take proactive measures to help clients minimize their tax liability, rather than just ignoring it outright.

Unfortunately, there’s a tendency to focus on taxes only after the die has been cast. Historically, in November or December, many advisors scour portfolios for potential tax-loss harvesting opportunities. They see what has occurred, and then try to offset the impact by harvesting losses as a last-ditch effort to reduce their clients’ tax bill for the year.

The problem with this approach is that markets do not always cooperate at the specific time when investors need them to. Despite this, many advisors still wait to do this at the end of each year because that’s what they’ve always done. Full stop! The five most detrimental words we hear in this line of work are: That’s what we’ve always done. At Russell Investments, we believe active loss harvesting is more rewarding—and that trades should be executed in a tax-smart way, day in and day out.

T is for Tax-smart planning and investing

Investors hire financial professionals for many potential benefits, including managing portfolios through different life changes, retirement and estate planning and for guidance on the potential tax implications of their investments. As a financial professional, we believe it’s your job to do what’s best for your client and to put their assets in a position to grow as effectively and as efficiently as possible to meet their desired outcome. If you are a fiduciary there is an even higher level of responsibility. We believe wise advisors don’t just focus on returns. They focus on after-tax returns. It is our conviction that providing a more tax-smart approach can have a substantial impact on the size of those after-tax returns.

Tax-talk avoidance: What’s at stake

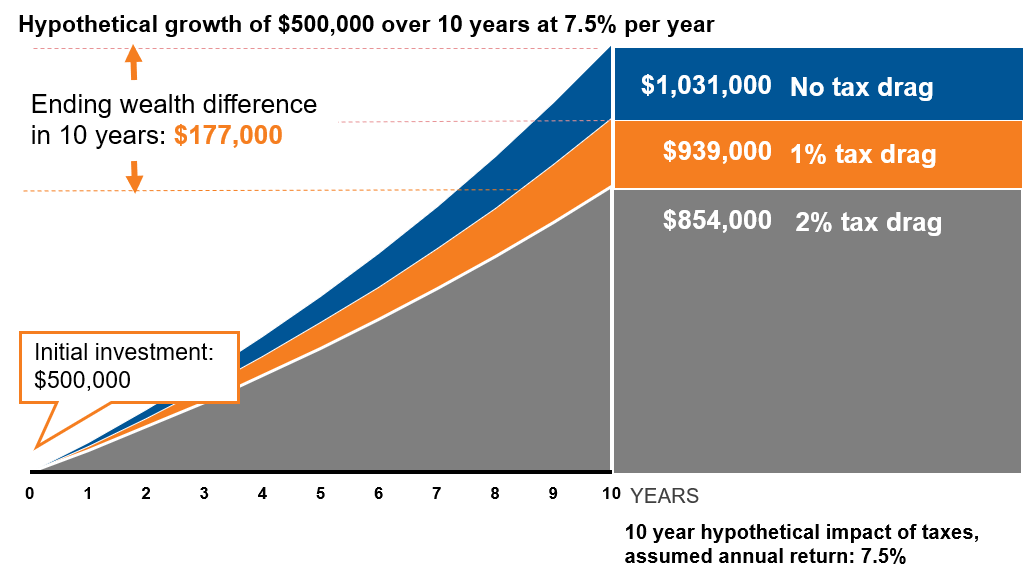

The long-term impact of not managing taxes is tangible. A $500,000 account with a 2% tax drag over 10 years (the drag on portfolio performance due to taxes on capital gain distributions and dividends) could cost your client almost $200,000 in their accounts:

Click image to enlarge

This is a hypothetical illustration and not meant to represent an actual investment strategy. Tax drag is the reduction of potential investment returns due to taxes. Taxes may be due at some point in the future and tax rates may be different when they are. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

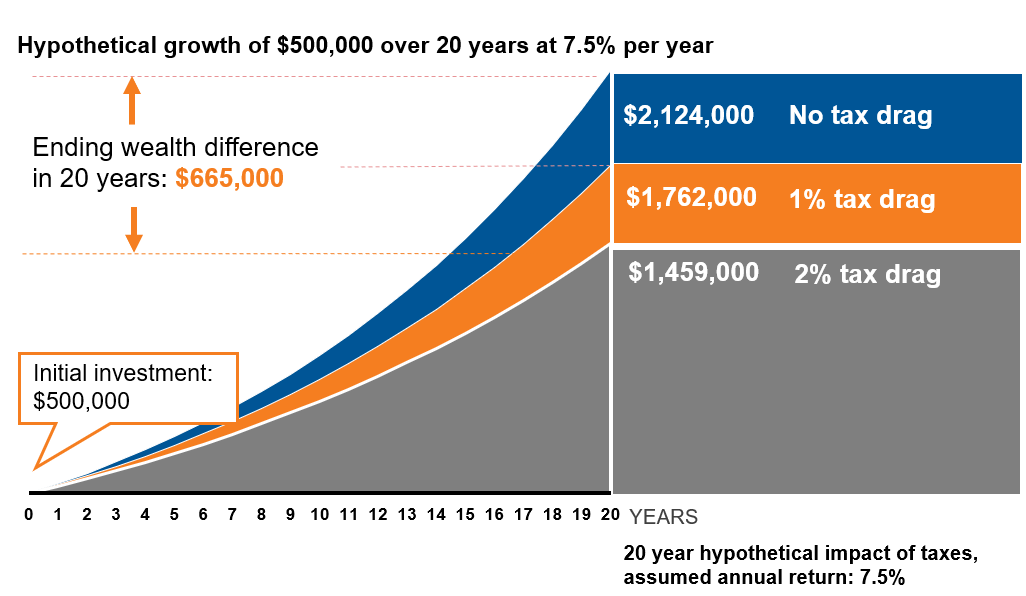

Over 20 years that same inefficiency loses your client more than $600,000. That’s money that’s out of their account and out of your business:

Click image to enlarge

This is a hypothetical illustration and not meant to represent an actual investment strategy. Tax drag is the reduction of potential investment returns due to taxes. Taxes may be due at some point in the future and tax rates may be different when they are. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Bottom line

The simple illustrations above demonstrate how taxes can have a massive drag on long-run returns. Think how hard you work to generate a few more basis points in return for your clients. If your clients aren’t asking you about taxes, ask them. It’s likely costing them money and likely costing you business.

The good news is there are steps you can take to help manage the impact of taxes. Start by having your clients share their annual state/federal tax return. Then, review solutions specifically designed for their taxable accounts. A successful relationship with your client requires engagement—on both sides. If you’re not asking, someone else probably is!

So, don’t continue doing things a certain way because that’s what you’ve always done. That’s usually an excuse to continue doing something that’s not working. Instead, choose to do things the way they NEED to be done!

1U.S. stocks represent the cumulative return for S&P 500 Index for Jan. 2009 through Dec 2018.

Morningstar U.S. OE Mutual Funds and ETFs. % = Calendar Year Cap Gain Distributions / Year-End NAV. For years 2001 through 2013, used oldest share class. 2014 forward includes all share classes. Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

Related articles:

T is for tax-smart planning and investing

Tax-managed investing 101: Understand the basics and slay the beast

2019 capital gain distributions: Are you letting history repeat itself?

Your words matter! Especially when it comes to TAXES.

A framework for switching to tax-managed investing

Five key ways advisors deliver value in 2019

Related podcasts:

The six questions advisors should ask about tax-smart investing