2019 capital gain distributions: Are you letting history repeat itself?

Taxes are going to cost you a lot this year. By how much, you're wondering? Let’s start first by looking back.

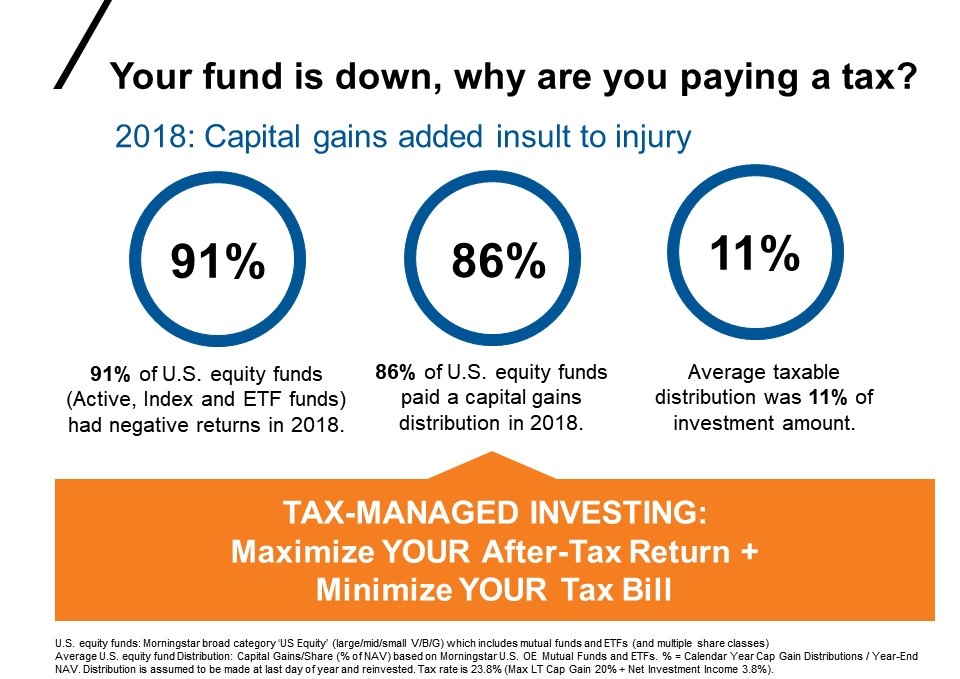

There are three numbers that we've been talking about all year to advisors and clients alike: 91, 86, 11.

- 91% - In 2018, 91% of U.S. equity mutual funds had a negative return.1

- 86% - Of all U.S. equity mutual funds, 86% paid out a capital gains distribution in 2018.2

- 11% - Of those that paid a distribution, the average capital gains distribution was 11%.3

Click image to enlarge

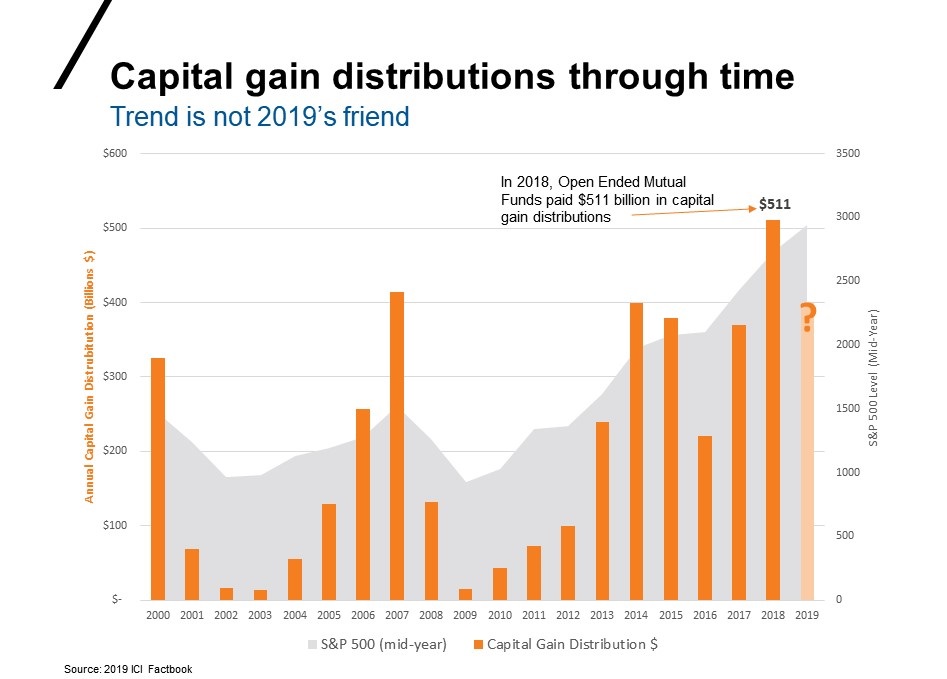

What do capital gain expectations look like for 2019?

Click image to enlarge

We can say with near-certainty that for 2019 the last number above will NOT be 0.0%!

Obviously, we don’t know where the market will finish for 2019, but year-to-date it has been another “up” year for most indices. That is good for when clients look at their statements and see that their account values have grown. But it also means, if history is any guide, that capital gain distributions could again be sizable.

Click image to enlarge

Options to limit the potential pain

Unless you are invested in a tax-smart or tax-managed solution, what options are going to be available for offsetting these taxable gains at year end? Tax loss harvesting accounts individually will be largely a no-go as there are very few losses to harvest in 2019!

In 2018, the markets finished lower, and the impact of unwanted taxes was felt especially hard. If the markets finish strong for 2019, investors may not feel the sting of taxes like they did last year, but the result will still be a large check written to the U.S. Treasury. This is not what investors want to do. They want to keep what they make.

Investors are very aware that it’s not just what you make anymore, but it’s what you get to keep that is most important.

For many investors faced with 2018’s final tax scenario, holding a $500,000 account, and receiving an 11% capital gain distribution, they would have written a check to the US Treasury for $14,850. Investors may not always understand what goes on in the markets and their accounts, but they certainly understand and remember writing checks to pay for taxes.

We are now officially two-thirds of the way through 2019. Being better educated about taxes must be front of mind as advisors look to help investors keep as much of their returns as possible. The time to help these investors begins now.

Here are some tips that you will likely find helpful when meeting with investors to help them plan for the best after-tax experience.

4 tips to help investors plan ahead

What can advisors be doing now to help clients where tax management really matters?

- Figure out what distributions might look like in 2019

As the year progresses, all mutual fund companies can and should provide updates on what they see as projected capital gains for their fund. Many share this information in September and October. While these are estimates, they will at least give you an idea as to what to possibly expect. At the very least, advisors who are focused on helping investors with their tax burdens likely need to be contacting fund companies now to learn what these funds could possibly be paying in capital gains, so they can begin to plan for ways in which to possibly reduce these upcoming taxes.

- Consider harvesting losses

If an advisor finds that there are funds that are in fact due to pay excessive capital gains, it may be wise to look to see if the client has losses from other investments to offset these gains, or to even consider an outright sale of that fund before the gains are realized and paid out to the client. Obviously, this should only be done after assessing what the gain on sale and taxes due might be and if it makes sense for that client.

- Know your client’s CPA (Certified Public Accountant)

Probably the one person who cares more about taxes than your clients is their CPA. Tax-managed investing helps you get on the same side of the table as the CPA, helping you to potentially build a closer partnership with both your client and your client’s CPA. We believe it would be wise for advisors to proactively contact their client’s accountant to see if he / she is aware of these taxes and to discuss ways in which they can work together to assist their mutual client. For these clients, thinking about how tax-smart and tax-managed solutions could help them in the future should be part of this process.

- Start transitioning…to a Tax-Managed Solution

Don’t delay – start transition planning now. We believe best first step is to acknowledge you don’t like paying these unnecessary taxes… and turn OFF automatic reinvestment of all distributions in the portfolios creating these tax issues. Consider using these distributions instead to fund a Tax-Managed Solution; one designed to better help mitigate these issues going forward.

Preparing for the inevitable conversation with your investors about taxes and capital gains

An advisor who takes time now to have proactive conversations with their clients about potential unwanted tax bills is providing key and valued service to that client. We believe helping clients understand how these gains become generated and the consequences to their returns is most important. The client needs to be focused on the fact that while gains in a portfolio are good, there are things that can be done to minimize the overall tax burden. This includes understanding where these gains came from, the consequences of not acting and what can be done to optimize this experience.

It also includes the harvesting of losses throughout the year (not just at the end of the year) to offset future gains, positioning the right investment product in the proper type of account (i.e., place highly taxable products into qualified accounts) and moving highly taxable products out of taxable accounts (also known as non-qualified accounts). Using strategies that are more tax efficient, such as tax-managed funds and solutions, should be part of this process. Having a plan to review the client’s overall portfolio to make sure that all efforts are being made to make it as tax-smart as possible is important.

The bottom line

We believe advisors who position themselves as true wealth managers need to take a more active role in helping clients understand and attain a better after-tax wealth outcome. Not only is it good for the client, but it is equally as good for the brand and value of the advisor.

Get started now. Don’t wait for the phone call from an unhappy client who was not expecting to write a taxes due check to the government. Because at the end of the day, it’s not about what you make. It’s what you get to keep that matters. And providing a more tax-smart approach can potentially have a substantial impact on the size of those after-tax returns.

Be sure to check-out these related podcasts:

Don’t be tax-lax: The value of tax management in 2019

The six questions advisors should ask about tax-smart investing