Investment taxes are more than just a federal tax problem

Taxes hurt. There are no two ways about that. Often when we think about or talk about taxes, we tend to focus on federal income taxes. Clearly, there are numerous other taxes that have an impact on our wallets and our wealth.

While we could discuss sales taxes, sin taxes, excise taxes and so on, I am going to focus here on a tax that impacts many investors and is often taken for granted. I’m talking about state income taxes.

Why are state income taxes important?

Many investors take the cost of taxes on their investment portfolio for granted. They generally focus on federal taxes, since Uncle Sam does represent the bulk of the tax bill for most investors. But what about state taxes? Should we not worry about them?

The answer is, at your own risk. Taxes are hard enough to understand as it is. As a result, investors tend to target their energy at addressing the federal tax problem, if they do anything at all. State taxes are another beast altogether. But there is a cost to them, and one investors should pay heed to.

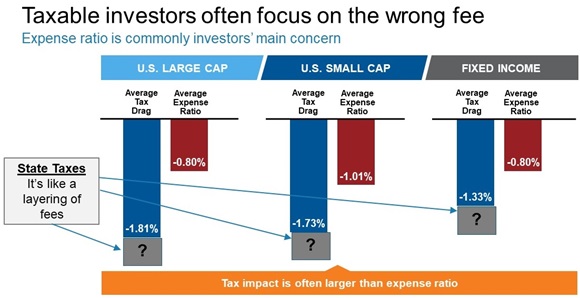

For three years ending December 2021. Source: Morningstar. U.S. Large Cap: Morningstar U.S. Large Blend Universes average, U.S. Small Cap: Morningstar U.S. Small Blend Universes average, Fixed Income: Morningstar Taxable Bond Universes average. Tax Drag: Morningstar Tax Cost Ratio. Morningstar’s tax cost ratio assumes the highest possible applicable tax rates, including the 3.8% net investment income tax. Many investors are not subject to the highest rates. Note that tax drag calculations only apply to taxable accounts.

Understanding the impact of state income taxes on investments

Think about how much pride, joy and time many people put into their garden, especially when it generates bountiful fruits and vegetables. The gardener works hard to protect the crop from insects and disease. They weed and feed and water their gardens regularly. We can call it a labor of love.

Imagine then that one morning the gardener comes outside with joy, looking forward to seeing and maybe even tasting the fruits of their labor. And there, in the middle of the garden, munching away: a family of bunnies. That is the effect of state income taxes on your retirement portfolio.

Income taxes across states

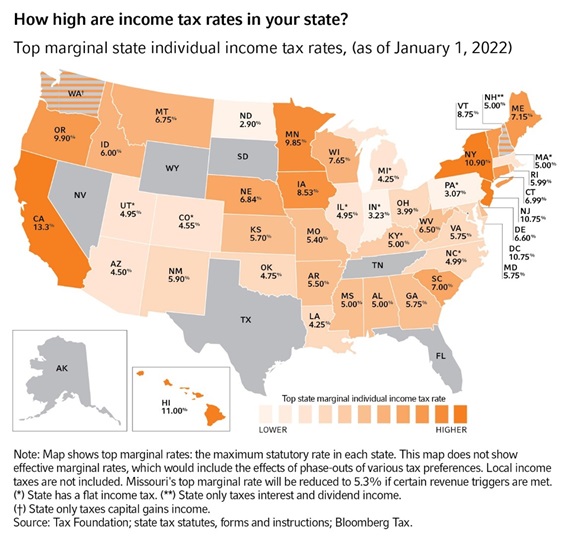

Almost all states have income taxes. There is only a small handful of states with a zero income tax rate. Take a look at the map below to see how taxes in your state rank against others.

Click image to enlarge

States with highest income taxes

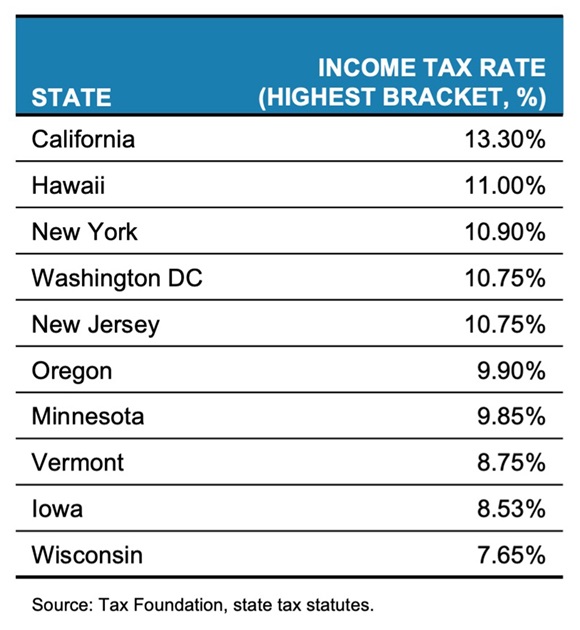

In talking about the impact of taxes, and state taxes, it’s helpful to home in first on which states have the highest income tax rates. Once you do that, you can better understand how large the problem may be and if it’s something you need to address.

Let’s look at the top 10 states by income tax rates:

Most readers will not be surprised to see some of the states named above. Many investors have heard about the high taxes borne by residents of California and New York. But what about the other states on the list? It may be useful to understand how large a tax bite is taken by the state where you live, and what impact that might have on your after-tax wealth.

State tax impact and your retirement savings

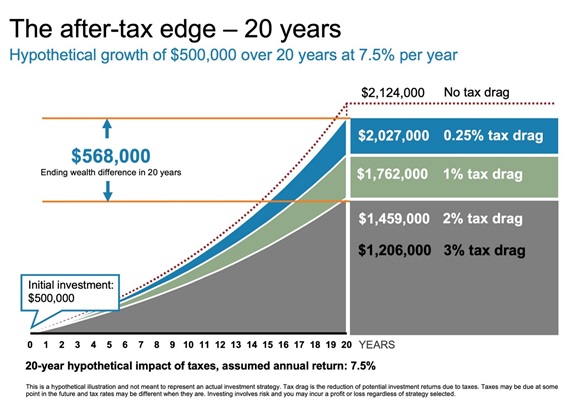

It’s one thing to list states in the order in which they tax their residents. It’s another to consider the combined impact of federal and state taxes on retirement savings. At the end of the day, dollars and cents is what matters. Let’s take a look at the impact of tax drag on a fictional portfolio. Assuming an average portfolio has a tax drag of 2% at the federal level, you can see that after 20 years this portfolio has lost $568,000 of value (from the cost of taxes and the impact of lost compounding) compared to a typical tax-managed portfolio.

Now let’s mimic the impact of taxes on an upper middle-class investor in one of the 10 top tax states. Let’s move the tax drag up a notch, to 3%. The cost now from the combined tax bill, federal plus state, is $821,000 on our hypothetical portfolio compared to a similar tax-managed portfolio. This is a pretty hefty sum of retirement savings to give up if you ask me. You can do your own analysis of the impact tax drag has on a portfolio by using our Value of Tax Management Tool.

Federal and state taxes: The tax drag adds up

Controlling the impact of taxes has to be planned and implemented at multiple levels. More than just federal income taxes matter to your personal bottom line. It’s similar to the gardening reference above: a single bunny passing through and nibbling on some lettuce might not be alarming to the gardener.But how did it get into the garden, and what happens when the visits become more frequent, and bunny-friends are invited to the feast? This is where what seems like a small problem can turn into a much bigger challenge!

Taxes on an investment portfolio are not that different from taxes on a paycheck. They reduce the amount that goes into your pocket. When you help your clients protect their investments from the impact of taxes, you have increased your value to them as an advisor. Tax drag is a burden that weighs on investments over time, but even more so it’s an indication that an investor’s portfolio has a tax problem.

If you reside in California or have clients who do and/or would like additional insights into understanding the impact of state taxes on a portfolio, click here.

If you reside in New York or have clients who do and/or would like additional insights into understanding the impact of state taxes on a portfolio, click here.