Tax increases are likely. What are you doing about it?

The taxman is coming. Or rather, tax increases are coming. The taxman is always coming, but now he is coming for more. We have been hearing about this prospect for a while now. But now the tax increases we have been hearing about are potentially right around the corner. The trillion-dollar question is: Are you ready?

What have you done to prepare for any potential tax increases, specifically the ones that may be aimed at investment portfolios? Have you made changes to minimize or even eliminate the strategies that generate investment-related tax bills every year? Are you transitioning out of higher tax-cost portfolios in preparation? As part of the planning and even discovery process, are you talking to your clients and prospects about what these potential tax increases could mean for their retirement plans, monetization events (such as the sale of a business, sale of real estate, liquidation of deferred compensation plans and stock options, inheritances and so on), as well as the potential that either their working years may be prolonged or they may need to adjust retirement expectations?

If you are like many people we know, there is a good chance you have been complacent. Many people today think being prepared means gathering as much information as possible and then waiting for the ball to drop. We often call it research, and while doing the research we don’t take action. I have heard many people say and use the excuse but nothing has passed yet, so we don’t know, so I can’t do anything. This is, in my opinion, flawed reasoning.

Tax increases are likely coming. What are they?

So, what are these tax increases that are likely to pass—and how will they impact us? The final details are yet to come as the budget reconciliation bill has yet to pass, but in the meantime, my colleague Frank Pape has provided his analysis of what might happen.

Regardless of which of these near-term tax proposals will pass, as well as what other ones may come in the future, because of the large stimulus packages created to help us get through the COVID pandemic, we can be fairly certain that tax increases are forthcoming.

The impact of the tax increases currently proposed are largely known at this point and already cost investors a lot of money. Specifically, the focus is on increasing the tax rates for many on interest, dividends and capital gains. These are items already well-known to you and your clients; these are items that generate a tax bill year in and year out, year in and year out. The tax bill today for you and your clients is real and for many it could be large, and it very well may go up for many.

What you should do today

You should be taking action today!

Start by looking at what is generating your clients’ tax-bills already—interest, dividends and capital gains. Then follow this easy three-step process:

Step 1 – Analyze and gather info

Dive into your clients’ portfolios and determine which ones have the highest levels of interest, dividends and capital gains. Need help figuring out how to do this or where even to start? Start with the latest 1099 Form. This document has a plethora of information if you know how to use it. At Russell Investments, we have tried to make it easy to get the most important facts out of Form 1099 by creating a Form 1099 guide. This will help you understand the document, which can help you hone in on how to solve your clients’ tax issues.

Step 2 – Take action

Now that you have identified the clients you should start with (hint: those who have the highest levels of either taxable interest, dividends of any sort—especially if non-qualified dividends—and capital gain distributions), determine which tax-smart solution will fit their needs.

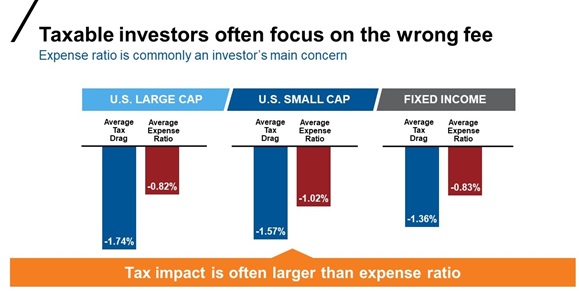

Next, consider if you want to transition only part of the account or if the whole account requires addressing. Remember, the cost of taxes is significant and is in many cases the largest fee investors pay. The cost of transitioning is often much less than an investor would pay in taxes over the lifetime of their account.

Click image to enlarge

For three years ending June 2021. Source: Morningstar. U.S. Large Cap: Morningstar U.S. Large Blend Universes average, U.S. Small Cap: Morningstar U.S. Small Blend Universes average, Fixed Income: Morningstar Taxable Bond Universes average. Tax Drag: Morningstar Tax Cost Ratio. Morningstar’s tax cost ratio assumes the highest possible applicable tax rates, including the 3.8% net investment income tax. Many investors are not subject to the highest rates. Note that tax drag calculations only apply to taxable accounts.

It often helps to see the numbers. Russell Investments can help by running payback period analysis. This can help both you and your clients see how quickly the tax cost of transitioning can be recovered through tax-cost savings.

It also can help to come up with a good transition plan. This is where running hypothetical analysis (financial professional login required) and a proposal can be instrumental in determining where you need to take action. Your Russell Investments team can run this analysis and the proposals and show you a side-by-side comparison to assist in the decision making.

Step 3 – Amplify your value and potentially grow your business

Amplify your value by taking these strategies to your prospects. Complacency with the proposed tax increases means you can potentially add value by taking action. It’s not just your clients who need help navigating through this, it’s many other investors as well. They are already paying taxes on their investments. How much more is it going to hurt when taxes go higher? This is a great time to not only demonstrate your value to current clients, but also to prospects by showing them how you can help them put their best investment tax foot forward!

The cost of doing nothing is too great

This is not a time to wait it out, especially since the tax bill that many investors have already is high and very likely to be going higher. Waiting to see the final details of the government’s tax bill does not help the fact that investors already have a costly tax burden. According to the 2021 ICI Fact Book, taxable investors hold $11.2 trillion of the $29.3 trillion invested in open-ended mutual funds. This is an opportune time to help your clients reduce their current tax cost and align their portfolios for potential tax increases to come. Russell Investments has numerous tools, calculators and analytical capabilities that can help you make a better decision for your clients’ taxable accounts and after-tax needs. Contact us to have your custom analysis run today.