T is for tax-smart planning. And the time is now.

For your tax-sensitive clients, taxes may be the largest fee they don’t know they’re paying when it comes to their investment portfolios. At Russell Investments, we call unnecessary taxes the government expense ratio.

How big is the fee? According to Morningstar, as a whole, U.S. equity funds (active, passive, ETFs) gave up on average 2% of returns to taxes every year in the three years ending June 2020.1 That means a mutual fund with a 10% pre-tax, three-year annualized return actually would have had an annualized return of only 8% on an after-tax basis. This tax fee of 2% is significantly larger than the total fee most advisors charge. If you think of it in terms of the power of compounding—or rather, the foregone opportunity of the power of compounding—you realize that smaller percentage numbers add up to be real money for real people living real lives.

So, taxes matter.

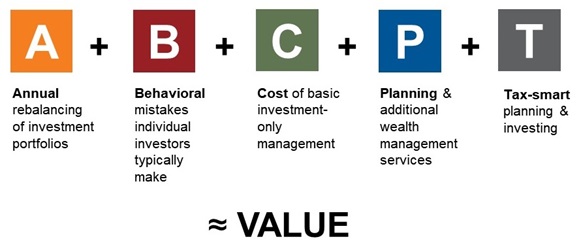

This is the fifth and last blog in our 2020 series, discussing why Russell Investments believes in the value of advisors, based on this easy-to-remember formula:

In this section, we’re talking about T, which stands for tax-smart planning and investing. Because it’s not about what the investors make. It’s about what they keep.

How much could tax management save your investors?

Taxes have the ability to seriously erode returns. While downward fee pressure can mean downward value trends in other areas, advisors who focus on tax-smart investing can distinguish themselves and demonstrate differentiating value.

Just how much return can be added with a tax-smart approach? You can find out right now. We’ve created a tax impact comparison tool. Just enter a ticker symbol and the tool will allow you to compare investment solutions on a tax-adjusted basis and quickly assess the tax implication between products and categories. You can also check out the chart below, which gives a quick visual of the opportunity size.

Click image to enlarge

Tax-managed: funds identified by Morningstar to be tax-managed.

Universe averages*: Created table of all U.S. equity mutual funds and ETF’s as reported by Morningstar. Calculated arithmetic average for pre-tax, post-tax return for all shares classes as listed by Morningstar.

Morningstar Categories included: U.S. ETF Large Blend, U.S. ETF Large Growth, U.S. ETF Large Value, U.S. ETF Mid-Cap Blend, U.S. ETF Mid-Cap Growth, U.S. ETF Mid-Cap Value, U.S. ETF Small Blend, U.S. ETF Small Growth, U.S. ETF Small Value, U.S. OE Large Blend, U.S. OE Large Growth, U.S. OE Large Value, U.S. OE Mid-Cap Blend, U.S. OE Mid-Cap Growth, U.S. OE Mid-Cap Value, U.S. OE Small Blend, U.S. OE Small Growth, U.S. OE Small Value.

$8.5 trillion opportunity is based on the 2019 ICI Factbook which states that taxable investors hold $8.5 trillion of the $18.7 trillion invested in open-ended mutual funds.

*Methodology for Universe Construction on Tax Drag chart: From Morningstar, extract U.S. equity and fixed income mutual fund and ETF’s for reported period. Averages calculated on a given category. For example, average after-tax return for the large cap category reflects a simple arithmetic average of the returns for all funds that were assigned to the large cap category as of the end date run. For funds with multiple share classes, each share class is counted as a separate “fund” for the purpose of creating category averages. Morningstar category averages include every type of share class available in Morningstar’s database. Large Cap/Small Cap/Municipal Bond determines based upon Morningstar Category. If fund is indicated Morningstar as passive or an ETF, the fund is considered to be passively managed. Otherwise, the fund is considered to be actively managed. Tax Drag: Pre-tax return Less After-Tax Return (pre-liquidation).

Are you a tax-smart advisor?

We’ve worked hard to educate advisors on the value of a tax-managed approach, both for the success of their clients and for the way a tax-smart approach can differentiate their practices. Many advisors already think they have taxes handled, so we encourage them to answer these five questions:

- Do you KNOW each client’s marginal tax rate?

- Do you PROVIDE intentionally different investment solutions for taxable and non-taxable assets?

- Do you EXPLAIN to clients the benefits of managing taxes?

- Do you PARTNER with local CPAs to minimize tax drag?

- Do you REVIEW your client’s 1099?

If you can answer yes to all five of these questions, then congratulations, you’re already a tax-smart advisor. If you answered no, then we’re here to help.

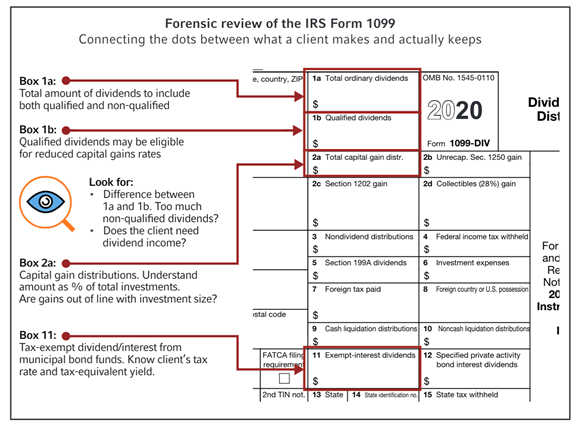

A forensic review of the 1099 form

While it’s important to always keep taxes in mind when investing, there are two key dates in the year that advisors should focus on to assess a client’s tax situation:

There are two dates that each advisor should think about in order to assess a client’s tax situation: 12/31 and 4/15. If all you look at is the total portfolio growth that happened at that year-end date, without thinking about the April 15 tax bill due date, then you may be missing a serious opportunity.

A forensic review of the 1099 can be really eye opening. Looking at the 1099 connects the dots between what a client makes and what a client actually keeps. The tax process sometimes buries that: Clients don’t necessarily connect what they are paying with what they are investing, because of the complex forms required by the IRS.

This is an opportunity for advisors to shine. Simply walking through the 1099 and discussing insights, implications, and income impact for clients can be truly beneficial. On their own, clients are unlikely to connect the dots between dividend distribution impact on their total wealth return. You, the advisor, can reveal what they may be sacrificing to taxes. And better yet, you can do something about it. A tax-managed approach may help you provide a significant reduction in tax drag between one year and the next.

Click image to enlarge

Now is the time to start managing taxes

In this year of historic government stimulus packages, the question we should all be asking is, “How are we going to pay for all this?” As I write this (before any further stimulus deals are agreed upon), the total new U.S. debt just from 2020 stimulus hovers somewhere around $3 trillion. I don’t have a crystal ball, but sure seems unlikely that taxes are going down.

So don’t wait to get tax-smart. I’ve often heard advisors who recently converted to a tax-managed approach say, “I wish I’d moved to tax-managed models five years ago.” Why? Because every year—even in down years—many mutual funds are hit by big capital gains distributions. At the same time, tax-managed models may pay close to zero percent in taxes—a significant savings.

Communicate your value

This is the final installment of our 2020 Value of an Advisor series. But all this proven value that we’ve discussed in this blog post, in the series, and in the full report, can go unnoticed by your clients without one vital action on your part: communication.

Advisors need to communicate the value they provide to their clients. Communication, as an academic discipline, is deceptive because everybody thinks they’re good at it. But for most advisors, we have found that the quality of their communication would benefit from greater effort and greater intentionality. After all, your value is only as good as the client experience that you are reliably delivering, clearly communicating, and constantly elevating.

So then, what are you going to do to elevate your value? A tax-smart approach might be your best place to start. We are ready for you. Are you?