The 4 A’s of preparing for capital gains season

Tax proposals and changes to the tax code are a near daily story right now. The number of proposals and quick takes are likely to increase as we head into the fall. We all know what that means: Client questions and conversations about what may, or may not, happen to tax rates—and more importantly—the potential impact on their portfolios, and what steps can be taken today to help manage that potential impact.

While investors wait for clarity on uncertain tax rates, there are actions advisors can take now to prepare for the certainty of capital gains and related taxable distributions. After all, fall/winter is the time of year when most mutual funds post their estimates for capital gains distributions and related taxable events. And it is not just capital gains that erode after-tax returns. Dividends and interest payments also reduce after-tax return of both passive and active strategies and they are paid throughout the year.

So, how can you prepare for these taxable events? Think of these four A’s:

Four A’s of preparing for capital gains season

1. Awareness

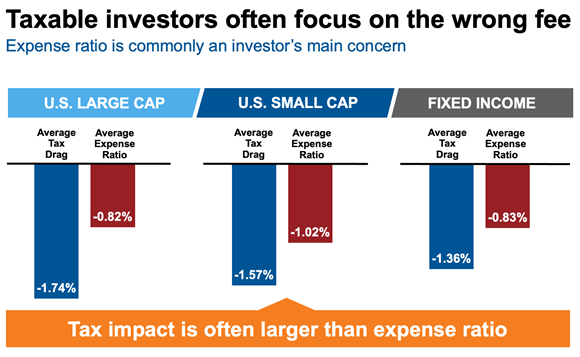

How big of a problem is tax drag? Looking at data across all investment products (active mutual funds, index funds and ETFs) reveals that the return lost to taxes is typically higher than the average net expense ratio. Another way to think of these lost returns is that they have been subjected to a government expense ratio. Awareness of the size of the tax drag can open your eyes to its pervasiveness across your clients’ accounts. We believe reducing this tax drag (financial professional login required) is one of the best ways to justify the fee you charge and demonstrate your value in working to improve after-tax outcomes.

Return lost to taxes versus fund fees – Three years ending Dec 2020

Click image to enlarge

Source: Morningstar. U.S. Large Cap: Morningstar U.S. Large Blend Universes average, U.S. Small Cap: Morningstar U.S. Small Blend Universes average, Fixed Income: Morningstar Taxable Bond Universes average. Tax Drag: Morningstar Tax Cost Ratio

2. Assessment

History may not repeat itself, but when it comes to investment returns lost to taxes, it sure is indicative of past tax efficiency.

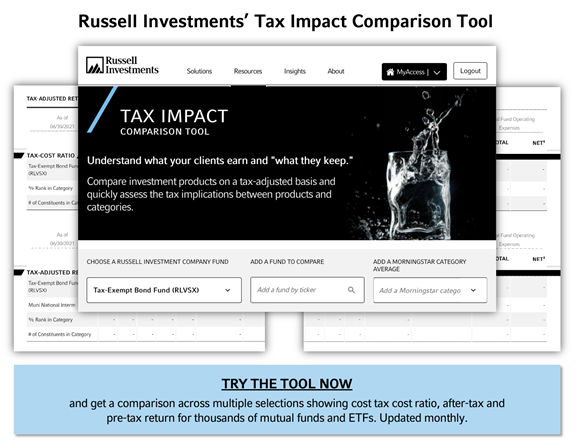

Reading about tax slippage is one thing, but seeing specific tax drag and after-tax return by product really helps in the Assessment. As we wrote last year, seeing Is believing to fully understand this issue for specific investment products. Our Tax Impact Comparison Tool, which uses Morningstar data, is a great way to assess the impact taxes have on investment returns to help make informed decisions for taxable accounts. This tool shows the amount of return lost to taxes (tax-cost ratio), after-tax return, and pre-tax return, and also shows their percentile rank within a peer universe.

3. Action

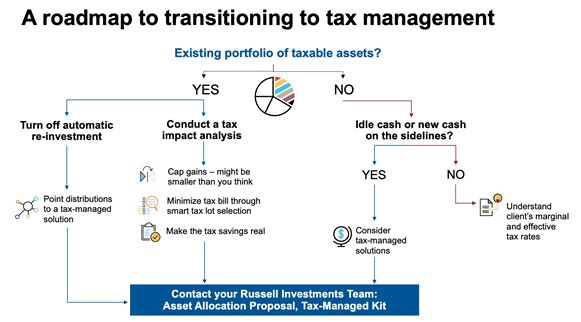

Once you have the awareness and accurate assessment of tax drag across your portfolios, it is time to take Action. Consider the following client scenarios:

- Cash or new money to invest?

With proper awareness and assessment, you should be well-positioned to make informed choices on after-tax return and tax drag for different investment options and the best tax-smart offerings. - Invested in a security or fund that is tax-inefficient or in which the client has lost conviction?

Russell Investments can help you conduct a break-even analysis to understand the possible tax impact of selling the asset and the potential return improvement of transitioning to a more tax-efficient alternative. The analysis can also help make an informed decision about whether executing the transition over time or ripping off the band-aid may make more sense. This may guide those considering pulling gains forward in advance of potential tax rate increases.

At least, for current investments that are not tax-efficient, consider turning off the automatic reinvestment of capital gains, dividends, and income. No reason to put new money into the same tax-inferior alternative.

Click image to enlarge

For illustrative purposes only

We believe tax-managed funds are a natural recipient of these scenarios.

4. Advocacy

In our annual Value of an Advisor study, helping clients reduce the impact of taxes is one of the greatest value-adds advisors may bring to the client relationship. Tell your clients what you are doing to improve after-tax outcomes.

Demonstrate Advocacyto clients and prospects by helping them understand how you work to improve their after-tax investment outcomes. Be sure to avoid using jargon, like basis points and percentage returns. Talk about dollars and cents when showing clients the difference between tax-smart and tax-agnostic investment options. That will resonate much more clearly with them. Your efforts to protect their investments from the impact of taxes have the potential to go a long way toward strengthening the relationship. Advocate for the great work you do on their behalf.

The bottom line

Don’t miss this opportunity to turn the headlines and debates about federal tax legislation into a productive relationship and business-building strategy focused on what you and your clients can control right now. Regardless of the outcome of the congressional debates in Washington, D.C., very strong capital market returns since March 2020 are expected to contribute to material capital gains recognition across many investment offerings this year. Addressing the potential tax impact of those gains on investment returns today can help make the capital gains distribution season this fall and winter a productive part of your client engagement. At Russell Investments, we have a series of tools, analysis, subject matter experts and dedicated sales/service teams to help you be successful in this space.