Capital gains taxes: Squeeze play on appreciated assets

Until April 28, there was no formal tax plan from the Biden administration—only what then-candidate Joe Biden campaigned on. That changed with the release of his American Families Plan and the tax proposals that will fund it.

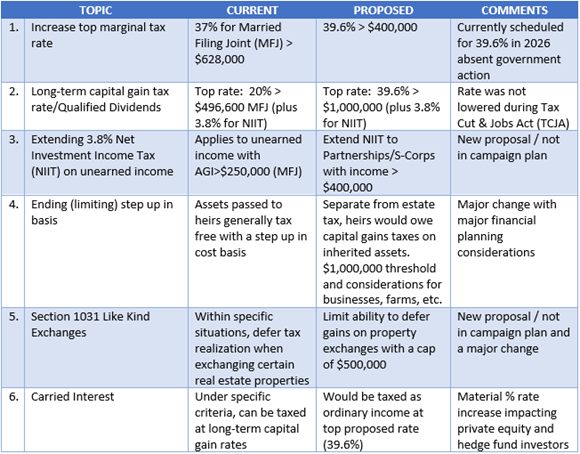

While many of the campaign proposals were included, there are new pieces and some notable items excluded. In this blog, I will focus on those topics that are more likely to impact investment portfolios and planning strategies.

What is in the plan?

Turning into law

President Biden cannot implement these changes alone. It seems highly unlikely this plan will receive the support of 10 Republican senators plus all 50 Democratic senators needed for a 60-vote passage. That means it will have to be taken to the budget reconciliation process. This process is not straightforward and will require support from 50 senators (with the tie-breaking vote from Vice President Kamala Harris).Getting 50 votes is not guaranteed. There will undoubtedly be much negotiation and horse trading to secure the necessary votes. It’s likely that whatever package passes will look quite different from this initial plan.

Additionally, clearing the House of Representatives is no sure thing. Prior to publishing this tax proposal, 20 Democratic House members stated they could not support any tax changes without the repeal of the SALT deductions. Recall these SALT (State and Local Taxes) deductions were part of the 2017 Tax Cuts and Job Act (TCJA), and limited the deductibility of property, income and local taxes. The SALT repeal is not included in the initial proposal.

When?

As the details and negotiations move along this spring and into summer (and fall?), making the effective date retroactive to Jan. 1, 2021, seems unlikely. Tax decreases are more likely to be implemented retroactively while increases have generally been the following year. If the new plan comes into force next year, the window is getting shorter for investors to take possible action in advance of possible increases.

Squeeze play: Increasing capital gains rate and removing the step-up in basis at death

The removal of the step-up in basis at death for appreciated assets will be a major change for financial planners. This is big. Why include it? If the Biden administration were to only increase the capital gains tax rate, investors may be inclined to not sell the appreciated asset to avoid the tax and lean into passing to heirs to get the tax-free step-up in basis. It may actually lead to a decrease in total revenues.

By taxing appreciated assets at death, investors will have fewer options in trying to avoid the capital gain tax. The belief is that by combining the two changes, overall tax revenues will increase. It is a one-two punch for holders for appreciated assets. There will undoubtedly be much discussion and debate over this change.

How to plan: Tax gain harvesting?

Tax-aware investors are very familiar with the concept of tax-loss harvesting. If you own a security that goes down to a price lower than the cost basis, by selling the security you can recognize the loss and apply it to offset against recognized gains. Done correctly, it can help lower tax bills in the current or future tax years.

But what if you think tax rates are going up? Investors may want to consider pulling gains forward while rates are lower—essentially harvesting the gain. Each situation will be different and requires analysis. Does the investor need the cash or intend to sell regardless?Does the investment still make sense in the context of the financial plan? Is there a more compelling investment alternative than the current holding? It definitely supports the case to sell an asset that might be out of favor and that the investor has been reluctant to sell because of the tax hit. And it may be a great opportunity to transition to a more tax-smart approach. No reason to repeat the same mistake. Be tax-smart at the outset of the investment.

Impact to markets

A natural question is the possible impact to equity markets on increasing the capital gains tax rate. In looking at the data, there is no instance in recent history where the increase nearly doubled (20% to 39.6%) and the increase was targeted to those with such high-income levels. No doubt you will see exhibits that attempt to show this—I’m just not sure the tax rates are the primary cause of the equity returns you might see. The tax environment no doubt factors in, but bigger drivers of equity returns are likely the economic cycle, equity valuations and wide array of inputs that make up the capital markets. The uncertainty on tax policy may have bigger short-term impact than investor certainty on what the rules will be. We know that equity markets have trended positively over time, with the S&P 500 Index posting an 11.6% annualized return over the last 45 years (as of March 31, 2021). This upward trend transpired during up, down and constant tax rates.

The bottom line

As broadly anticipated, the administration has put its tax proposal forward in the American Families Plan. Approval—as written—is no certainty and whatever might pass will likely look different than this initial proposal. The elimination of the step-up in basis at death for appreciated assets is a major change for financial planners, investors or anyone with appreciated assets greater than $1 million. There will be much debate and negotiation over this, and the other items included. Advisors will undoubtedly need to monitor and consider what actions make sense in advance of changes that may—or may not—happen. All of this change again demonstrates the value of a strong advisor and their ability to help investors navigate this changing tax landscape.