2020: Politics, elections and tax plans

As the last weeks of the U.S. presidential election campaign season heat up, you may find yourself fielding questions from clients about the potential impact both candidates’ tax plans might have on their investment portfolios. After all, taxes affect most voters.

One would be foolish to attempt to predict the outcome of the election, but it’s not foolish to look at what types of potential tax changes each candidate is proposing. For the sake of brevity, I’ll mainly focus this blog post on changes that could affect taxpayers with investments in mutual funds, ETFs, stocks, bonds and similar investments.

Of course, it’s worth noting a few caveats to this review:

- Campaigning on a tax plan and actually passing a tax plan are two different things. If we use recent history as a guide, it appears that the president needs control of both houses in Congress to pass major legislation. Depending on how the election in November goes, that may be challenging for both current candidates to achieve.

- Regardless of who wins the White House this November, most of the individual tax changes from the Tax Cuts and Jobs Act (TCJA) are set to expire after 2025 absent government action—meaning there may be tax changes on the horizon no matter who wins in November.

- Political candidates’ tax plans tend to be vague, brief and constantly revised during the campaign. The current campaigns don’t seem to be an exception.

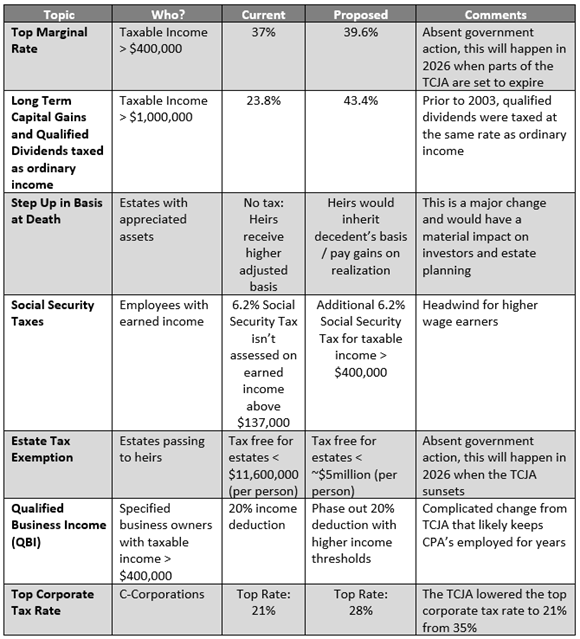

With that, let’s look at what Democratic candidate Joe Biden is proposing for individual tax changes.1

Democratic party proposed tax changes (all rates assume filing status of married filing jointly)

Click image to enlarge

Republican party proposed tax changes (all rates assume filing status of married filing jointly)

At the beginning of President Trump’s term, Congress passed the Tax Cuts & Jobs Act, reflecting one of the bigger changes to the tax code since 1985. For his second term, Trump’s campaign website mentions:

- Tax cut to boost take-home pay (no rates proposed yet)

- Made in America tax credit (no details offered yet)

- Expansion of opportunity zones that were part of the TCJA (no details offered yet)

In addition, President Trump has mentioned in some interviews that he is potentially interested in reducing capital gains taxes to 15%.2 I think it’s safe to say he would likely not be proposing any explicit tax increases for individuals.

Speaking with clients

As voters weigh the messages and proposals of this year’s two presidential candidates, and as you prepare for year-end tax planning with clients, taxes will likely filter into your conversations. It’s not clear yet exactly how each candidate’s platforms might impact tax rates.

But regardless of who wins in November, we believe it’s best to focus on long-term goals, realistic return expectations and strategies that can minimize taxes no matter what policies are in place. More times than naught we know that additional factors—such as where the economy is in the business cycle, where market valuations stand and exogenous events not yet factored into valuations (think 9/11, the Global Financial Crisis, COVID-19, etc.)—have a larger impact on near and long-term investment outcomes. Often the policy uncertainty is more damaging than any known policy. As more details and certainty emerge, we will continue to share tax-related perspective on this blog, so that you and your clients can make real plans and have meaningful conversations.

1 Source:

https://www.taxpolicycenter.org/taxvox/biden-would-raise-taxes-4-trillion-over-10-years-mostly-highest-income-households

2 Source: https://taxfoundation.org/president-trump-tax-plan-2020/