How low can you go: Monetary policy constraints and options for the next recession

This is the longest U.S. economic expansion ever. And while expansions don’t die of old age, it’s prudent for investors and central bankers to think now about the potential consequences of the next global recession.

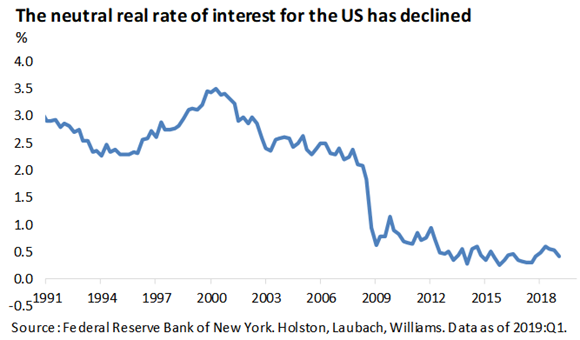

To put it bluntly, the next five years are likely to prove very challenging for monetary policymakers. Slowing demographic trends, lackluster productivity growth and other factors have conspired to depress the level of real interest rates relative to decades past.1

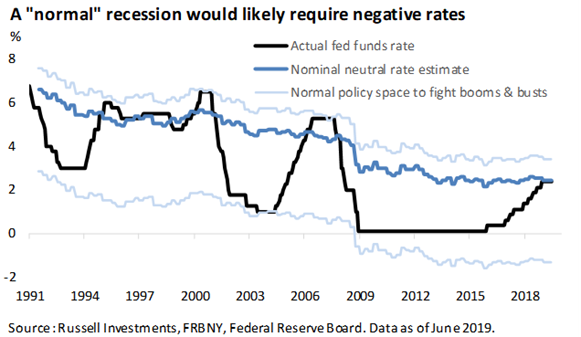

An immediate consequence of secularly lower neutral interest rates is that central banks are more likely to find themselves constrained by the zero-lower bound—which occurs when the short-term nominal interest rate is at or near zero—during an economic downturn. For example, if we overlay the policy space that has historically been required by the U.S. Federal Reserve (the Fed) to fight booms and busts, we find the Fed would likely need to cut rates below zero in the next recession to provide a normal degree of policy accommodation. In the chart below, you’ll see that the lower pale blue band of normal policy space is in negative territory.

Using more sophisticated econometric techniques, two researchers from the Federal Reserve Board in Washington, D.C.,2 have suggested that the effective lower bound on interest rates could bind 40 percent of the time going forward. That’s a big deal. It means that tools like zero interest rates, forward guidance and quantitative easing—often considered an extraordinary response to the Global Financial Crisis—are likely to be the new normal. Furthermore, the challenges of the zero-lower bound suggest that future economic recoveries, all else equal, are likely to be more protracted. And fiscal policy will need to play a larger countercyclical role.

This leaves us with three questions:

- How the Fed is approaching this important issue right now?

- What is the range and efficacy of the options global central banks have at their disposal, should the global business cycle roll over?

- What are the implications for investors?

In short, the answers are “they’re thinking about it,” “limited” and “big”.

The Fed’s approach—research!

The good news is that we aren’t raising anything in this note that central bank chiefs don’t already know. Vice Chair Richard Clarida is spearheading the Fed’s review of this issue. He’s highlighted three fundamental research questions:

- Should the Fed be satisfied with 2% inflation, or should it seek to also make up for past misses?

- Are existing policy levers adequate for the next recession? If not, how can the toolkit be expanded?

- How can the Fed’s communication with the public be improved?

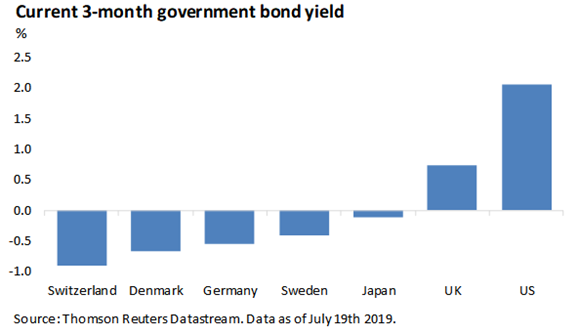

The first research conference on this topic was already held at the Federal Reserve Bank of Chicago on June 4 and 5. And an army of Ph.D. economists across the Federal Reserve System are doing their own homework in parallel to that. The Fed’s conclusions from this review are scheduled to be shared with the public in early 2020. If you’re a glutton for punishment, feel free to comb through the papers and speeches already published on this matter, such as these by Bernanke, Yellen and Williams. Our fingers are crossed that central bankers will get this problem sorted out before the next recession hits. And while the Fed faces challenges, the European Central Bank and the Bank of Japan are at even greater risk, should they go into the next recession with no scope to meaningfully cut overnight interest rates.

The monetary policy menu

Unconventional monetary policy tools are often misunderstood by the public. The basic idea is that when overnight interest rates have already been cut to zero, a central bank can still provide further accommodation by guiding longer-term interest rates down, too.3

So what unconventional ammo do central bankers have to fight the next recession? As a starting point, we would expect interest rates to be slashed to the effective lower bound across the developed markets. Forward guidance naturally comes next—an explicit commitment to keep interest rates at zero for an extended period of time. After that comes a battery of more extreme tools that either implicitly or explicitly target the longer-end of the yield curve. Quantitative easing (QE), maturity extension programs (such as Operation Twist) and yield curve control fall into this category.

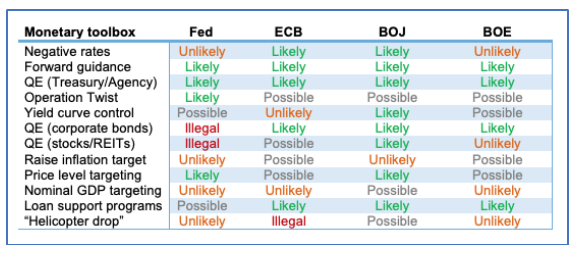

QE is a central bank’s large-scale asset purchase program. In theory, it can target a range of investment vehicles. But some jurisdictions explicitly forbid purchases of some securities. For example, the Federal Reserve Act does not allow4 the Fed to purchase corporate bonds or stocks. If you were wondering why the European Central Bank (the ECB), the Bank of Japan (BOJ), and the Bank of England (BOE) bought corporate bonds and the Fed didn’t, it was largely due to different legal constraints. Of course, with enough time, laws can be changed.

In the table below, we note in red tools that are Illegal under current law. The other characterizations in the table are based on our own assessment of the likelihood of a measure, based on its merits and on public statements from former and current leaders of the respective central banks.

Source: Russell Investments. July 2019.

- Negative rates are viewed unfavorably in the United States. In a series of internal memos—such as this one and this other one, the Fed staff estimated that rates could not be taken below -35bps without prompting significant cash hoarding. Further, the economic benefits of such cuts were not seen to be significant relative to the uncertainties surrounding impacts to money market funds and bank profitability. We suspect the mixed experiences with negative rates in Europe and Japan have not changed the Fed’s view.

- Forward guidance is a commitment to keep interest rates at the lower bound for an extended period of time. If the market believes this guidance, then the setting on overnight rates gets transmitted further out on the curve—closer to the tenors at which households and businesses actually borrow. This tool has been effective in the United States and globally and is very likely to be employed again.

- Quantitative Easing refers to any form of large-scale-asset-purchase program. The most intuitive form of QE involves the purchase of long-dated government bonds. Very simply, as a non-economic buyer, the central bank can raise the price (aka lower the yield) of government bonds. QE also serves to strengthen the central bank’s forward guidance, because investors will not expect a rate hike for the duration of the program. QE can also engender portfolio rebalancing effects, as low sovereign yields incentivize investors to buy riskier securities, which can then lead to a broader easing of financing conditions. Where allowed, central banks can directly purchase these instruments as well, in order to improve monetary transmission. Examples of this include the Fed’s purchase of mortgage-backed securities or the ECB’s purchase of corporate bonds. The efficacy of QE is subject to debate. What we can say is that the programs have generally coincided with strong periods for risk markets. This outcome was intentional. Central bankers hoped wealth effects would stimulate aggregate spending.

- Maturity extension programs are in many ways just a fine tuning of QE. The Fed’s Operation Twists are the most well-known example of this, where the central bank sells its short-term securities and invests the proceeds in longer-duration securities. Similar to other unconventional tools, the goal is to lower longer-term rates that are more impactful for the real economy. Considering the fact that the Fed minutes from May 2019 discussed this, it seems highly likely that these programs will be used again

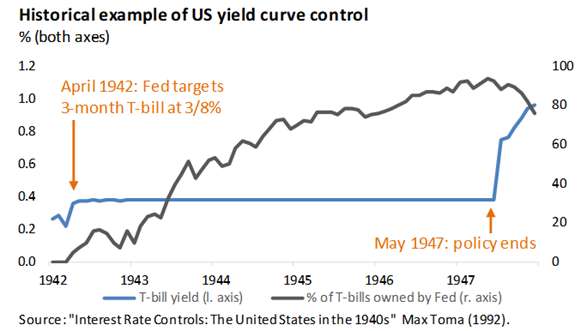

- Yield curve control is an extreme version of QE, in which the central bank commits to buy whatever it takes to achieve a targeted yield level. The Bank of Japan implemented a yield curve control policy in September 2016, with its decision to target the 10-year Japanese government bond yield at around 0%. There is precedent for yield curve control in the United States and United Kingdom as well, as both central banks capped yields in the 1940s to help finance World War II. While this action is a distant memory for most of us, Fed Governor Lael Brainard has renewed interest in the idea, proposing that the Fed could control yields out to the two-year-point of the curve. We see little value in such a proposal, given the efficacy of forward guidance at this horizon. Nevertheless, during a period of extreme stress—or for central banks like the ECB and BOJ that have very little conventional ammo—yield curve control could prove to be a valuable tool in the arsenal.

- A higher inflation target is a wonky-but-potential response to the effective lower bound on rates. The premise is that if nominal interest rates are constrained by zero, a central bank can push real interest rates deeper into negative territory if future inflation is expected to be higher. The problem with this proposal is twofold: First of all, in the United States, selling this to Congress would likely prove an uphill battle. Secondly and more importantly, with most central banks undershooting their inflation targets presently, raising those targets would likely lack credibility. And if inflation expectations did not rise, the announcement would prove useless. This is particularly true if the central bank were to try such a strategy during a recession, when the output gap was large and disinflationary pressures were at their strongest.

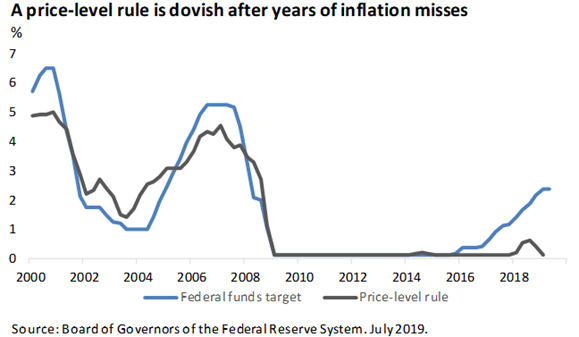

- Price level targeting and what are more broadly known as inflation make-up strategies appear to be an early front runner in the Fed’s policy review. The premise is that a central banker should not only be satisfied that inflation is currently running at 2%, but he or she should be committed to allowing temporary inflation overshoots to make up for past undershoots of the target. In effect, the goal is to achieve 2% inflation over the business cycle.

One of the worries in the market has been that the Fed and other central banks would snuff out the expansion as soon as inflation threatens 2%. After years of misses—and with such a strategy likely contributing to the next recession—markets can and have reasonably priced average future inflation of slightly less than 2%. The Federal Reserve is concerned about this dynamic, given how important inflation expectations are in the price formation process. In other words, if everyone thinks inflation will likely be slightly less than 2% then it will probably turn out to be less than 2%. While this may sound like a small policy shift, the implications are actually very significant. For example, in the most recent Monetary Policy Report to Congress, the prescription from a price-level rule suggested the federal funds rate should be only 0.13% (versus the current policy setting of 2.4%). If the Fed adopted this framework, operationally it wouldn’t necessarily cut interest rates on a dime, but it could mean a much more protracted hold than what was shown in the latest dot plot.

This framework is theoretically attractive, but again suffers from credibility problems. For one, it’s easier to say you are going to allow inflation to overshoot when it is low today than it is for a future FOMC to keep rates accommodative when inflation is actually overshooting. The complexity of the rule is also a challenge: How do you communicate it to the public? And where do you calibrate the normal price level to historically?

The possibility of cycle-ending asset bubbles is another challenge. More careful attention needs to be dedicated to this topic, but it looks like a viable and popular tweak to the current framework. On a side note, this idea is gaining international traction as well. Mario Draghi’s recent speech in Sintra, Portugal, expressed tolerance for above 2% inflation in the region. It will be interesting to see if Christine Lagarde shares these views when she takes the helm of the ECB later this year.

The above list of recession-fighting options is by no means exhaustive. I handed in my Fed security badge at the Eccles building in the Summer of 2009. A lot has changed since that time, and it’s entirely possible that other experimental methods are being discussed behind the closed doors at the Fed, the ECB or other central banks. But the bottom line is that the extraordinary monetary policy tools that were used to fight the GFC will be required again and should be judged as ordinary in a world of secularly lower interest rates. That means e all need to understand these tools and how they work. Tools like forward guidance and QE were considered the first-best options for delivering stimulus in the aftermath of the GFC, and these are likely to be the first ports of call when conditions sour again. To be clear, though, central banks are very low on ammo. And that means a heavier burden will be placed on fiscal policy in the next economic downturn—the topic of my next note.

1 Economic theory suggests that the neutral real rate of interest (r*) is determined, in part, by the economy’s trend growth rate. Trend growth, in turn, is a function of demographic trends (how many workers you have producing widgets) and productivity trends (how many widgets those workers produce in an hour). For a more detailed exposition see the appendix to this note or “The Future Fortunes of R-star: Are They Really Rising?” by John Williams (2018).

2 “Monetary Policy in a Low Interest Rate World”. Michael Kiley and John Roberts (2017).

3 What central bankers actually care about are real interest rates. Thus, they want to ensure that both nominal long-term rates come down AND that inflationary expectations remain anchored.

4 See, for example, here: https://www.federalreserve.gov/monetarypolicy/files/FOMC20050401memo01.pdf