Is a financial advisor worth the cost?

My grandfather came over to the U.S. from Ireland in the early 1900s. As a kid, I always remember him telling me, Nothing in this world is for free and if someone tells you otherwise, walk the other way. I was reminded of this when I recently saw online ads for free financial planning and free no cost ETFs.

Can something as important as wealth planning be offered for free? How could a company pay its employees when it offers free ETFs?

My grandfather believed in a good deal, but it becomes a problem when cost becomes the primary factor in decision making and when we don’t understand what we own nor the consequences that can lead to.

I believe it’s critically important to understand the price you pay, to know what you own and to understand why it’s important.

Understand the price you pay

The airline industry was deregulated in 1978. With deregulation comes competition and innovation. The airline industry continued to evolve, expanding with more airlines, more routes and cheaper pricing. Then came a tipping point in the late 1990s: The technology boom created an online real time marketplace for purchasing airline tickets. The race to the lowest price was underway. According to Capt. Sullenberger’s book, “Highest Duty: My Search for What Really Matters,” to stay price competitive, regional airline carriers began hiring college graduates at entry level wages and trained them to get their commercial pilots license. Prior to 2013, the FAA requirement to become a first officer in the cockpit was 250 hours of flight time. This was the only way for regional airlines to stay price competitive. In fact, overseas, commercial airline pilots still (in 2019) can fly today as a first officer with just 200 hours under their belt.

So, what are we paying for when we buy an airline ticket? When a flock of Canadian geese flew into the engine of U.S. Airways Flight 1549 on a cold January day in 2009, Capt. Sullenberger had already logged over 20,000 flight hours. I’d say we’re paying for the experience of the pilots and the quality of the aircraft. The FAA changed the required number of flight hours for a first officer from 250 to 1,500 in 2013 due to a tragic crash in Buffalo, New York, in 2009.2 Even though today’s planes benefit from technology and automatic pilot, I want an experienced pilot at the controls when I’m flying through a storm or a flock of birds fly into the engine. Understanding what you are getting for the price you pay is crucial for your safety.

In the last decade, the financial services industry has gone through a lot of change. Technology and modern business models have given more investors direct access to markets. Today, there are thousands of investment options for investors with even the most modest amount of assets. These solutions come in the form of robo-advisors. The robo solutions are getting many investors started at a younger age and are teaching them the importance of saving and being disciplined. However, robo-advisors are not a replacement for a full-service financial advisor. Robo-advisors provide the basic building blocks of investment management which are asset allocation, security selection and portfolio construction. Robo-advisors that deliver investment-only management and no financial plan, ongoing service, or guidance have set prices at approximately 0.33%—for annual statements, online access and a phone number to call in case of questions.3 In addition to the 0.33%, the investor is responsible for paying the underlying costs of the ETF investments.

Certified Financial Planner

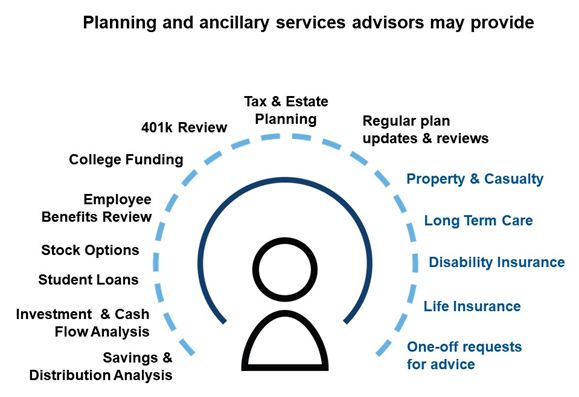

In the case of a full-service financial advisor, many focus on goals and objectives that take time, planning and ongoing coordination to accomplish.If a financial advisor is a Certified Financial Planner®, they must meet every requirement of the CFP board. To begin, a candidate must have 6,000 hours of professional experience or 4,000 hours of apprentice experience. The exam process can take up to seven years to complete. The exam spans over two days of testing.In 2018, the pass rate on the exam was 60%.4 It’s interesting to think that prior to 2013, the airline industry only required 250 hours of experience to fly a plane when the Certified Financial Planning board requires 24 times that amount to sit for their exam. Planning is a complex and specialized experience personalized for the individual. The following topics cover the various areas of planning:

How many hours of meetings, preparation and follow-up would it take to cover these topics appropriately? How could a company offer this for free? More importantly, what is the cost of not instituting an appropriate plan? In this regard, we believe a financial advisor is priceless.

How many hours of meetings, preparation and follow-up would it take to cover these topics appropriately? How could a company offer this for free? More importantly, what is the cost of not instituting an appropriate plan? In this regard, we believe a financial advisor is priceless.

Know what you own

It’s important to know what you are getting for the price you pay.In the investment world, many investors are buying low-cost investment solutions to save money on fees.

But before we get teased by free, there are a lot of questions that must be answered when it comes to investing …

- Do investors understand what they own?

- How much risk is in the investment they own?

- What is the return expectation?

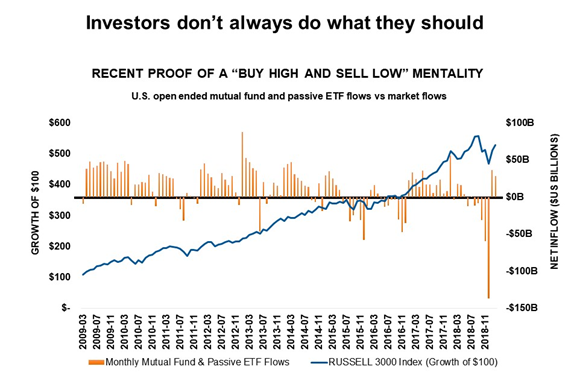

It may be fair to say that many investors don’t completely understand the amount of risk they are taking during given points in the market cycle.From December 2007 to December 2018, investors withdrew more money from U.S. stock mutual funds than they put in. All the while, a hypothetical $100 constantly invested in the Russell 3000® Index more than doubled in value. And those who chose to stay in cash during that period would have missed a cumulative return of more than 200%, based on the Russell 3000® Index. You can visually see a pattern of investors buying high and selling low. These mistakes can be very costly over time.

Data shown is historical and not an indicator of future results. Sources: Monthly mutual fund, passive ETF flows and Russell 3000® Index, Morningstar, Direct. Data as of February 28, 2019. Index performance is not indicative of the performance of any specific investment. Indexes are not managed and may not be invested in directly.

Data shown is historical and not an indicator of future results. Sources: Monthly mutual fund, passive ETF flows and Russell 3000® Index, Morningstar, Direct. Data as of February 28, 2019. Index performance is not indicative of the performance of any specific investment. Indexes are not managed and may not be invested in directly.

In 2018, we saw peak investment outflows of over $125 billion in assets at the bottom of the December market pullback, according to Morningstar Direct.. At the end of Q1 2019, the Russell 3000® Index was up 14%. These numbers reinforce the importance of knowing what you own and the importance of a financial advisor as a behavioral coach and risk manager. Helping clients avoid pulling out of markets at the wrong time and sticking to their long-term plan is one way we believe advisors provide substantial value.

Understand why it’s important

In Malcolm Gladwell’s book “Outliers,” he dedicates a chapter to what researchers have come to identify as the 10,000 hour rule. The rule states that for an individual to achieve a level of mastery, they must dedicate 10,000 hours of practice to the subject. To put 10,000 hours into perspective, most people only work 2,000 hours year. So, any professional working in a field for more than five years would be considered a qualified expert.In my mind, five years isn’t a lot of time—however, many investors are taking on the responsibility themselves with little to no experience.

And when it comes to delivering value, we see that planning, managing investor behavior and helping clients keep more of their after-tax wealth are key ways advisors are able to contribute value. We believe wise advisors educate investors on understanding the products and services they receive for the price they pay. We also believe it’s important for investors to understand the value they are receiving and the process you’re providing in helping them achieve their outcomes.

The bottom line

I’ve learned that goods and services are priced a certain way for a reason. The most important thing to discover is WHY they’re priced that way. Sometimes, a bad purchase based on price is a learning experience. However, some bad decisions based on the price of a good or a service can leave irreparable damage that cannot be undone. Next time a deal seems too good to be true, remember to do your due diligence. Spend extra time analyzing why the deal is so good and be sure that the consequences aren’t devastating.

Joe McNally, CFP®, AIF® is a Regional Director at Russell Investments.

2 Source: FAA.gov

3 Source: Based on the average fee charged for investment-only management by 10 robo advice offerings for a client portfolio of $135,205 as accessed on the companies’ websites on 3/11/2019.

4 Source: CFP.net