P is for Planning and Peace of Mind

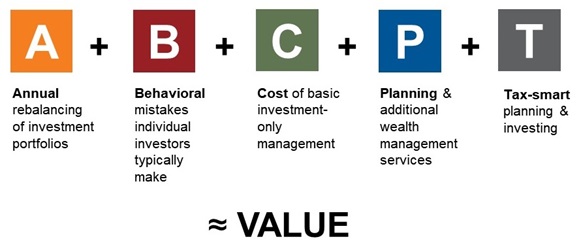

Russell Investments believes in the value of advisors, based on this simple formula:

In this part of this 2020 series, we’re talking about the value of planning. The good news for this year is that, when it comes to planning, this is an area where we’ve seen advisors grow and make significant improvements. If you’re one of those advisors who has worked hard to improve your planning process, you have a leg up on your competitors. If you’re not, then we believe your competitors are beating you.

An ongoing process provides ongoing value

Creating and managing a lifelong investment plan for your clients is not a one-time process. It is important that your clients clearly understand this. Planning is a continual service that the best advisors provide. Your plan will include milestones that you hope to reach, such as portfolio growth, tax efficiency, or income goals. As you accomplish these goals, make sure you remind your clients that you’ve worked with them to get these done. Your planning work is ongoing, so your value is ongoing, too.

Peace signs

We describe P as standing for Planning, but it might also stand for Peace of Mind. During the volatility of 2020, many of the advisors we’ve been speaking with have been stress testing, re-stress testing and updating their clients’ financial plans. They’ve been doing all that hard work so that they can tell their investors they’re OK—that they can still retire when they want to. That’s the peace of mind that planning may help deliver. And we believe, based on decades of practice management coaching, that when investors feel at peace, they are much more likely to stay invested. In other words, good planning is key to preventing investors from making behavioral mistakes.

Planning doesn’t mean predicting

In 2020, we’ve heard from some of our notable advisor clients how they’ve handled conversations about volatility. They might have said something like this: “Ms. or Mr. Client, I may not have predicted this market selloff. I may not have predicted the speed of the market recovery. I may not have predicted the timing, the severity, or the circumstances, but I did plan for these kinds of events. That’s why the plan we built for you is laid out the way it is—to handle the unexpected and keep you on track.”

What’s in the plan?

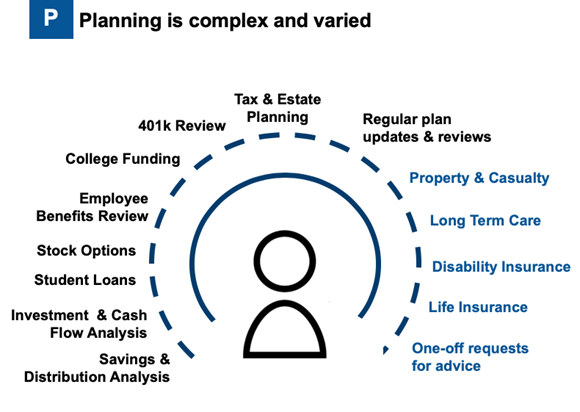

The items in the chart below are areas that are usually covered in a comprehensive plan from a quality advisor. Some advisors are only covering a handful of these areas, but we believe true wealth managers are creating more comprehensive plans that address at least all of the items shown in black on the chart. Per a recent financial study conducted by Michael Kitces, the average standalone fee for this type of comprehensive financial plan would cost about $2,080 per plan for a $400,000 account.* Beyond that level, the most comprehensive wealth managers may also include the blue items for their top clients. These listed items are all interconnected as well. We believe the increased complexity of that integration of these areas equals more delivered value.

Click image to enlarge

Planning is important to clients. Yet advisors sometimes minimize the value that planning provides. We believe that investors have a better shot at hitting their financial goals if they have a plan, if they have a process, and if they have a partner who can help them get to the places they want to go.

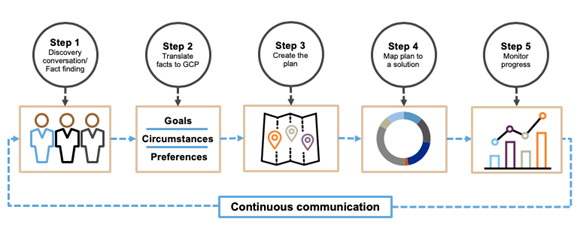

The planning cycle in five steps

Click image to enlarge

- Delivering wealth management begins with a deep client discovery conversation. This should be a conversation led by open-ended questions, where the advisor does more listening than talking. In some instances, for existing clients, this means going back and having a rediscovery conversation. Take the time to reflect with your clients by re-igniting a fact-finding process to ensure that all the activities and solutions are still driving toward the right outcomes.

- The next step is to translate that discovery conversation into goals, circumstances and preferences.

- Goals are the fundamental problems involving money and time that clients are trying to solve. The importance of goals must be defined by the client. Then it’s the advisor’s job to convert the stated goals into accumulation and spending milestones.

- Circumstances are the unavoidable facts that define a client’s current situation. Under the heading of circumstances, we might include a client’s investment-account balances and their tax status, along with their stage of financial life, marital status and ability to save more or spend less.

- Preferences are a bit more flexible. These are the things that clients desire rather than need in their investment solution. Often, advisors have simplified preferences down to a risk profile, to see what risk level an investor prefers. But clients may also care about their portfolio drawdown potential, cash flow consistency, and illiquidity. These days, more and more investors also approach investing from a values point of view, with preferences on portfolio holdings such as carbon, tobacco, munitions and other socially responsible issues. Advisors must always first meet goals. But we believe the best approach is still to try to align the goals with preferences. That will potentially lead to happier clients.

- The third step is to create the plan. In order to do so, we believe you must know where ALL of the money is located, including views into insurance, wills, trusts, mortgages, etc. We believe this holistic approach is in the best interest of investors. Without it, your plan could be operating at crossed purposes with other hidden aspects of your investor’s financial picture. We’ve seen this happen many times over the years with the advisors and investors we’ve worked with. It pays to get the complete picture so you can build the right plan the first time.

- Step four requires you to map the plan to a solution. Many of the top advisors I have coached use model portfolios for the majority of their investors, when appropriate to do so. They often use the same model portfolios as a core to build customized solutions for their suitable top clients, households and families. In addition, we observe that many of the top advisors treat taxable portfolios differently than non-taxable ones. Why? Because taxes can eat up a significant portion of your client’s return. It’s the right thing to do by the client and it can also help you generate more revenue from a larger, growing base of tax-sensitive investors.

- And finally, the framework should be wrapped in a process to monitor progress, with ongoing communication between the advisor and investor, as goals, circumstances and preferences evolve over time. As I said earlier, planning is an ongoing process, not a one-time thing. Make sure your clients know this. And then make sure you do it.

The bottom line

Have your plans and planning processes ever felt more valuable than they have in 2020? Then don’t make the mistake, as we’ve seen plenty of advisors do, and give planning away for free during the prospecting phase. Creating full plans, then handing them to prospects who then walk out the door without implementing, is a waste of your precious time. And it doesn’t do your clients any favors either. Having a robust plan might feel reassuring, but true peace of mind only comes with ongoing implementation.

To learn more about the 2020 Value of an Advisor Study, click here.

*The Kitces Report Volume 2, 2018 and the “How much does a comprehensive financial plan actually cost?” April 8, 2019 article from kitces.com.