Using private markets to target the biggest investment challenges

Private markets can support institutional investors dealing with the impacts of large macro issues such as combating inflation pressures, achieving desired levels of growth, making a social impact on their communities and effectively dealing with an uncertain world. In this blog post we'll consider some of the private asset strategies and techniques that investors can employ to help tackle the big issues.

Inflation

Given the surge in inflation and subsequent erosion in the value of investments, investors are seeking ways to insulate their portfolios from the negative impacts of inflation. We believe an allocation to private real estate and infrastructure assets can help reduce the strain on your portfolio.

REAL ESTATE

One of the reasons investors have historically been attracted to real estate is the inherent inflation protection it provides. Given the current inflationary environment, it is not surprising that private real estate is seeing increased attention. Real estate provides protection against inflation, because real estate revenue—which is derived from periodically resetting contractual rental payments—will adjust to changing external market conditions, such as rising price levels. Furthermore, in an inflationary environment, the replacement cost of real estate increases, therefore boosting the value of existing buildings. Replacement cost is the final cost to rebuild at current market prices, and incorporates such factors as land value, labor and materials—i.e., lumber and steel.

In the current environment, we believe positioning portfolios to sectors that are poised to enjoy strong net operating income (NOI) will serve investors well to help maintain the purchasing power of their assets.

Examples include:

- Industrial: Over the last several years, there have been multiple events, including trade tensions between the U.S. and China, the COVID-19 pandemic and the Russia-Ukraine war that have resulted in a severe disruptions in the global economy. As a result, companies are moving away from the just-in-time to just-in-case models, which in turn is driving strong demand for warehousing, fulfillment and logistics centers, and consequently pushing up rents

- Single family housing: This is poised to do well in an inflationary environment, given a combination of factors, including:

- Chronic levels of undersupply

- A highly attractive demographic profile, given significant demand for housing from the millennial cohort of the population

- Low vacancy rates

- Sharply increasing mortgage costs, which all contribute to strong embedded rental growth

In addition, leases in these sectors are shorter in duration and as such, have the ability to reset higher as we move through an inflationary environment.

INFRASTRUCTURE

Most infrastructure assets have an explicit link to inflation through regulation, concession agreements or contracts. This is also a reflection of the fact that many infrastructure assets operate in monopoly-like competitive positions and enjoy inelastic demand patterns. Namely, they can increase prices without destroying demand.

Achieving growth

A primary reason to invest in private markets is the potential to generate returns that are higher than those relative to the public markets. Given that private markets are a dynamic and ever-evolving opportunity set, we'll highlight below some secular trends that are posed to provide a pathway to growth.

ONSHORING OF SUPPLY CHAINS

Geopolitical events are driving a secular trend that focuses on the slowdown of globalisation, or slowbalisation, across economies, whereby both business and government are focused on establishing domestic supply chains across industries.¹

The quest to fortify supply chains is now underway and the U.S. industrial sector is poised to directly benefit from this trend. In turn, it will create opportunities to invest in privately held industrial businesses and create value through such avenues as operational improvement, strategic initiatives to drive EBITDA growth, and exit. It is also a large opportunity set, accounting for $2.3 trillion of GDP (gross domestic product) and driving 20% and 30% of U.S. capital investment and productivity growth, respectively.²

Another play on the supply chain theme is investments in short line railroads. These are smaller railroads that connect businesses with the larger freight rail network (otherwise known as Class I railroads). With U.S. manufacturing capacity set to expand, short line railroads will play a critical part in connecting manufacturers to the national rail network, as they serve as a distribution and feeder system across the entire freight rail infrastructure ecosystem.

ENERGY TRANSITION: NATURAL GAS REPLACING COAL FOR ELECTRICITY GENERATION

Liquid natural gas (LNG) is increasingly becoming an important component of the global energy system, particularly as it replaces coal for electricity generation. Given its lower emissions profile, we see it as a stepwise improvement along the road to decarbonisation.

The continued development of LNG infrastructure including pipelines, storage and shipping provides greater access to LNG across the globe. A decade ago, just 23 countries had access to LNG, but by 2019, the number of LNG-importing countries had reached 43.³ This improved access has directly helped to facilitate reductions in air pollution and emissions.

In addition, there is a looming LNG supply crisis as European countries grapple with energy insecurity in the aftermath of the Russia-Ukraine conflict. This is against a backdrop of global LNG demand, anticipated to be 436 million tons in 2022, which exceeds the available supply of only 410 million tons— creating an attractive environment for investment in LNG infrastructure projects.⁴

Impact

Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.⁵

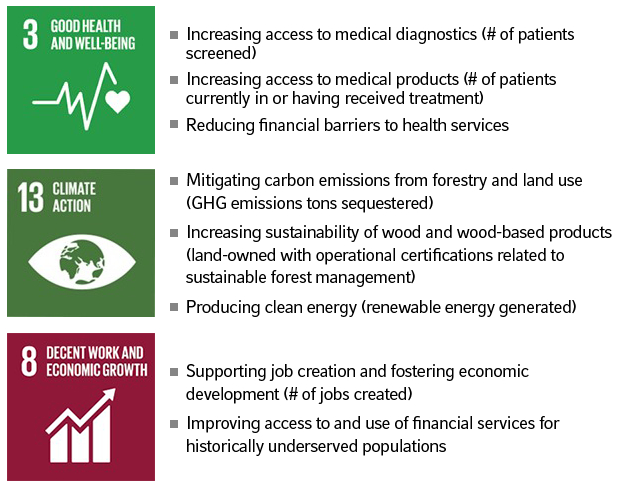

Today, impact investing is garnering increased attention from investors, given the opportunity to advance both their goals related to a better and more sustainable future for all, along with increasing the size of their asset pools. Indeed, organisations are seeing the benefit in participating and supporting initiatives with measurable outcomes. Typically made by closed-end private equity or venture capital funds, a key feature of impact investing is the obligation to measure and report on the outcomes associated with investment activities. While impact investment goals are broad in nature, they are often associated with the United Nations Sustainable Development Goals (SDGs). Established by the United Nations in 2015, the 17 distinct goals provide a blueprint to address global challenges including poverty, hunger, good health and wellbeing, clean water and sanitation, affordable and clean energy and climate action.

In Exhibit 1 below, we have highlighted how impact investors may track specific outcomes across a portfolio that is aligned with three of the UN SDGs.

Exhibit 1

An uncertain world

Considerable uncertainty remains about the global economic and financial market outlook. From geopolitics to inflation, interest rates, stock-market volatility, energy prices and central bank policy, there are a multitude of factors combining to make the range of potential outcomes much wider. Against this backdrop of an increasingly uncertain world, we believe exposure to private markets provides investors with structural advantages relative to the public markets. A key reason for this assertation is that private markets investors enjoy the benefit of being patient capital.

The lifespan of a typical private equity fund is generally 10 or so years, with the option of two one-year extensions at the discretion of the manager. In addition, on final close of the fund, the manager typically has a predetermined window of opportunity in which to make new investments, which usually lasts four years. The implication for investors is that under this structure, private equity managers can be patient with both the entry and exit of their underlying portfolio companies. Depending on market conditions, at any given time private equity managers can either slow down or accelerate capital deployment and exit activity. They can also be disciplined around exit path—e.g., initial public offering (IPO), strategic buyer or other private equity sponsor—and can exit at a time of their choosing to maximize value. In contrast, public equity owners can buy and sell investments on a daily basis, and some may be prone to chasing performance. Indeed, impatience can be more expensive if an investor locks in losses by selling assets at a lower price than originally acquired and uses those proceeds to invest in securities / funds that have enjoyed strong recent performance.

In addition, in periods of financial market volatility characterized by rising interest rates and declining equity markets, private markets have inherent structural benefits relative to traditional equities and fixed income. For example, as interest rates rise in response to higher inflation, private credit investments benefit investors, given that these typically are in floating rate debt, which helps to both protect capital and provide a superior return as the relevant base rate increases.

The bottom line

It is not surprising that as investors seek to address today's major issues, including inflation, achieving desired levels of growth, making an impact on their communities and effectively dealing with an uncertain world, they are increasingly turning to private markets to improve their investment outcomes.

Ultimately, we believe partnering with firms that have the requisite scale and demonstrated access to top-tier investment opportunities, along with specialist investment and portfolio management expertise, can maximize the probability of success and deliver the benefits that private markets have to offer in a total portfolio.

Footnotes

¹ Morgan Stanley, Remodeling the Global Political Economy, May 2022

² McKinsey and Company, US Manufacturing: The next frontier for sustainable, inclusive growth, April 2022

³ The Future of Liquified Natural Gas: Opportunities for Growth, McKinsey & Company, September 2020

⁴ Rystad Energy, A perfect and unavoidable storm: LNG supply crisis will make landfall in winter 2022

⁵ Global Impact Investing Network, What is Impact Investing, https://thegiin.org/impact-investing/need-to-know/#what-is-impact-investing