Step One: Investment objectives - Lay the right foundations from the start

Setting investment objectives may seem relatively easy or even obvious. But this is one area where there is more than meets the eye. If overlooked, or ill considered, it can steer the steps that follow of your investment program in the wrong direction from the very start.

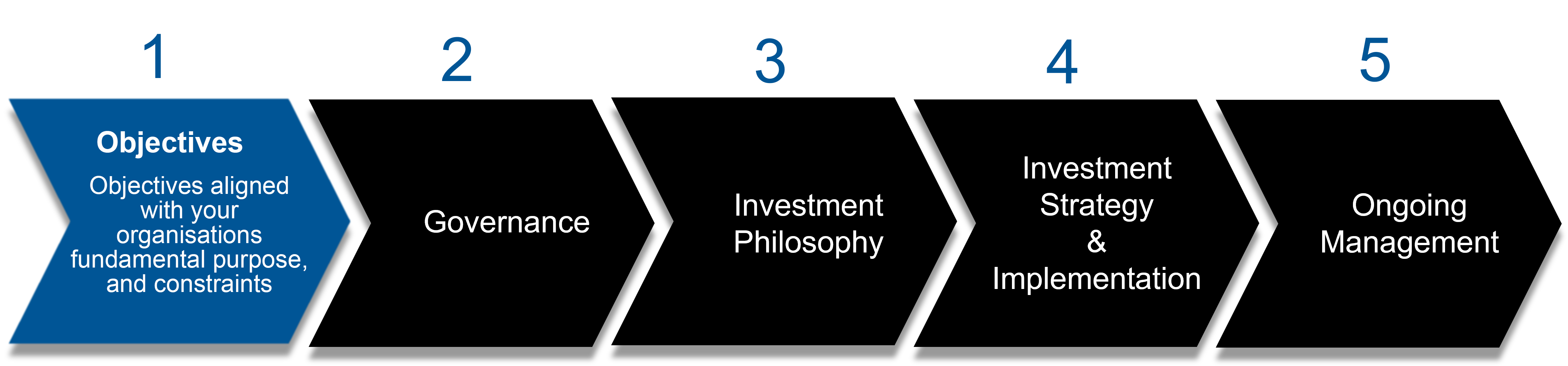

The five essential steps of an investment program

Click image to enlarge

Here are some important aspects to consider.

1. Have a clear purpose

As a first step, your investment objectives must be aligned with the fundamental purpose and mission of your organisation. A mission statement is critically important, and it spells out your organisation's reason for being. Are all of your key stakeholders clear on your purpose? Clearly articulating your purpose and reviewing it periodically are vital to ensuring everyone knows and understands why you exist.

2. Define your spending policy

A spending policy sets the pattern of distributions from the investment program over a specified period of time. Not-for-profit organisations seek to balance the needs of their communities today with the desire to maintain and expand support for their communities in the future. The spending policy they select plays a key role in managing current distributions and planning for future ones.

An effective spending policy can provide a steady anchor for not-for-profit investors to guide their actions in today’s uncertain, volatile and evolving markets. Creating a clear and well-defined spending policy is critical, as it not only helps ensure strategic alignment with an organisation’s mission, but also is an important means to creating fiscal discipline and consistency across volatile market environments.

3. Know your Liquidity needs

This requires managing liquid and illiquid assets to ensure they align with broader organisational goals. Start by asking the question, what are you trying to accomplish? Are you more driven by the long-term sustainability of your endowment or by your short-term spending needs? And then, make your risk and liquidity decisions based on those answers.

When determining your investment risk and liquidity appetite, a brutally honest assessment is in order—assessing both the pattern of your cash demands and how strong of a stomach you have for illiquidity and market volatility.

Some organisations tend to think of liquid and illiquid as two distinct buckets, but liquidity is really more of a spectrum. If you need to liquidate an equity fund, it might only take a day or a week. Hedge funds, on the other hand, might need notice periods. And illiquid private markets funds generally do not have options to redeem.

4. Set your risk tolerance

Ultimately, an organisation needs an investment approach designed to deliver the returns they need within a level of risk they can tolerate. One of the benefits to come out of the global financial crisis is many not-for-profit boards and finance/investment committees are now better able to articulate how much loss they can tolerate. An organisation needs to ask themselves two questions.

- What is our capacity to tolerate loss?

- What is your willingness to tolerate loss?

5. Know your investment constraints

It is important to know the limitations or constraints (such as the regulations and tax laws) under which your organisation operates. In addition, constraints such as fees that may drive the decision to incorporate passive management for part of an allocation and/or passive or smart beta may be used to provide certain exposures in a more cost-effective way than active management.

Defining goals and objectives is the first critical step of your investment program. As we have addressed, this means:

- clearly defining the goal you are trying to achieve

- agreeing on a spending policy with which you are comfortable

- deciding how much liquidity you need

- determining how much risk you are comfortable taking

The bottom line

Each step of an investment program is closely intertwined with each other, which means that decisions made about one will influence decisions made about the others. Taking the time to formalise objectives and constraints will lead to a portfolio that is better aligned to an organisations’ needs and mission goals.