Not-for-profit organisations can ensure that their financial resources are directed toward investments that reflect their mission and contribute to a more sustainable and responsible future. There are many strategies that can be implemented across your portfolio to achieve this. Please visit our responsible investing solutions for more information

Not for profit organisations we work with

For more than 30 years, Russell Investments has provided investment advice and management services to non-profit organisations.

Our collaborative experience with clients gives us a solid understanding of, and appreciation for the challenges you face in balancing your public interest activities with the preservation and distribution of assets.

Lay the right foundations from the start

This is one of five essentials step of an investment program learn more.

Benefit from our tailored non-profit OCIO solutions

We have been providing OCIO services to NFP organisations for over 30 years. In that time, we have built a suite of products and capabilities which will allow you to:

- Refocus your attention on the strategic decisions which drive most of your portfolio returns

- Benefit from daily portfolio management, reducing the need to spend significant time reviewing past performance in quarterly meetings

- Make certain that short-term market shifts are managed, monitored, and mitigated in real-time

- Take non-investment issues such as reporting, administration, audit support, and accounting off your plate

Our comprehensive solution builds on our award-winning manager research, global team of investment professionals, in-house implementation and administrative expertise, and our willingness to act as a co-fiduciary for your assets. Our entire solution is designed to help you increase returns and reduce risk – all at a competitive price.

Explore more with these related links:

- Materiality matters: Targeting the ESG issues that can impact performance

- Elements of a clearly defined investment policy statement for non-profits

- How do your investment committee meetings measure up?

Looking for more non-profit related research? Visit our Insights library for the latest research.

Looking to include ESG in your outsourced CIO solution?

We believe institutional investors can incorporate ESG factors into their investment solution without sacrificing potential returns. And we also believe it's more crucial than ever before.

Reviewing your investment program?

Our collaborative experience with clients gives us a solid understanding of, and appreciation for the challenges you face in balancing your public interest activities with the preservation and distribution of assets.

Not for profit investment handbook

Designed to provide practical advice, planning tools and best practice information, our handbook steps through key areas needed to successfully run an investment program.

Online not for profit investment guide

Our handbook steps through key areas needed to successfully run an investment program.

Frequently asked questions

Russell Investments delivers expert guidance in developing a tailored investment strategy for NFP goals

Let's help demonstrate the value of advice

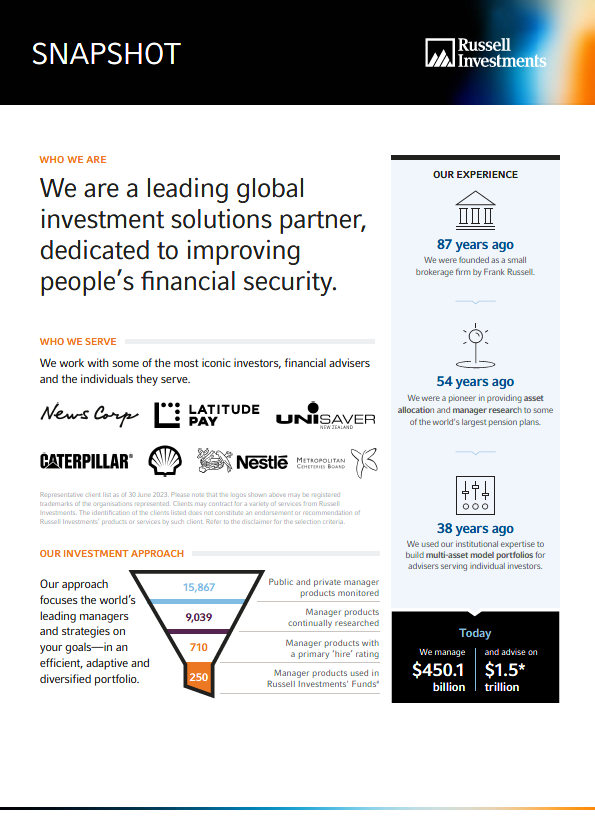

Who we are

Russell Investments is a leading global investment solutions partner, dedicated to improving people's financial security.

Our investment approach

Focusing the world's leading managers and strategies to help your clients achieve their goals.

Neil Rogan

Managing Director, Head of Distribution

P: +61 2 9229 5131

E: nrogan@russellinvestments.com