C is for cost: What is the cost and value of basic investment management from advisors?

Once more, I want to say that Russell Investments believes in the value of advisors. And we believe communicating that value to your clients is more important than ever. That’s why we keep sharing this easy-to-remember formula:

Click image to enlarge

In the first blog post in this five-part series, we discussed the value of annual rebalancing. Then we covered behavioral mistakes. In this post, we’ll tackle the cost of basic investment-only management.

We’re talking about basic investment-only management because we all know quality investments are important. We believe services such as asset allocation, security selection and portfolio construction are the building blocks of any successful investment strategy. All three are critical for hitting a client’s financial goals.

We also recognize that robo-advisors are making these three building blocks more accessible and affordable than ever. For good and ill, robos have taken this industry by storm over the last decade, commoditizing whatever aspects of wealth management they can commoditize, most typically in the form of basic investment vehicles and approaches.

But here’s the thing: Investments are only one component of a comprehensive financial strategy. Wealth managers do so much more. Robo-advisors may be great at taking in large amounts of available numeric data and creating if/then criteria for specific, predictable problems. Human wealth managers, on the other hand, still have the advantage of taking in many additional sources of information, including the personalities of clients, the surprising life events clients face, and the other non-numeric aspects of a real person’s investment journey. A skilled wealth manager can then craft a comprehensive, real-world financial plan that addresses the unique needs that every individual client faces.

The human factor

When the stakes are high, humans want to work with humans. If you don’t believe me, remember the last time the cable service went out on your TV during a big football game or a big soccer game or a big NASCAR race. You had to call your cable company and dial in to that robotic call-center phone tree to get assistance. And you dreaded doing it. So what did you do? If you’re like me, you immediately punched the number zero on your phone, hoping to bypass the artificial intelligence of the phone tree and connect to a human. That was for a football game. Now replace that relatively trivial incident with the lay-awake-at-night issue of life savings. When the stakes are high, I believe we all long for humans—not robots—to get us through.

This is why I worry about investors. When markets are going well—when we’re still in the glow of a long bull market—then inexpensive robo-advisors sound great. But what happens when markets turn downward? What happens when volatility strikes? If the bumpy single month of February of 2018 was any kind of indicator, then volatility still makes investors clamor for guidance—for direct responses to their feelings of uncertainty. Last February, you may have seen the headlines about robo websites and phone trees crashing when markets got a little rocky. Imagine what might happen when the bull really turns bearish.

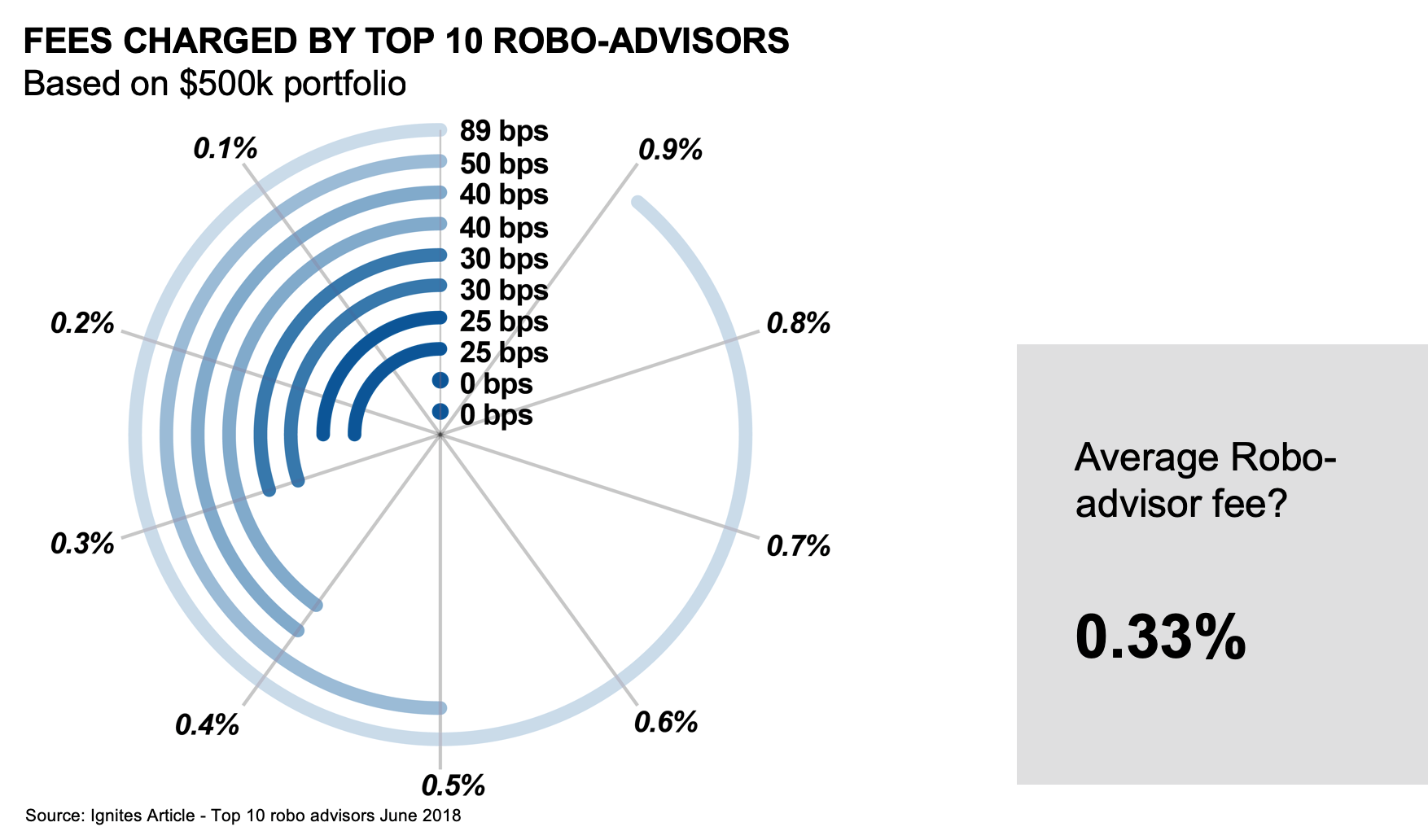

I also worry that investors may think that all robos are basically the same. They’re not. Even among the top five robo-advisors, they still offer varied experiences, sometimes for very different pricing. And sometimes, I suspect that when investors pay for a robo service, they assume they will get a service similar to a human advisor, only to find out during troubling markets that that’s simply not the case. Robos, by definition, are data driven. We believe in data and the value of data. But data doesn’t always tell you the entire picture, especially when it comes to humans. The business model of robos is not designed to deliver the personalized guidance that many investors require to stay on course during tough times. In fact, if you read my recent blog post on behavioral mistakes, you’ll see that our research makes us believe that preventing those mistakes by investors is the greatest value that advisors provide.

All that said, basic investment-only management is not only worthwhile, it is necessary. 33 basis points is the average cost of the top ten robo-advisors as of December 31, 2018. That number is significant, but it should be a warning sign as well. If your value proposition is based on your investment management prowess, keep in mind how much that’s worth, especially when compared to other more potentially valuable services you may provide. This is why we advocate for model strategies where suitable. By outsourcing your investment management, you can free up your time to focus on the highest value services.

Click image to enlarge

Don’t fear the robot

While robos continue to commoditize, helping your clients with their investment decisions is a vital part of what you do. And robo-like technology is here to stay. Don’t fear it. We believe embracing the benefits of this technology—and there are benefits—is the best way forward, both for you and for your investor clients.

Ironically, I believe robos have built their business since 2008 by learning from human advisors. Humans are what robos intend to emulate. They learn from you. But let’s set irony aside and see what we can learn from them.

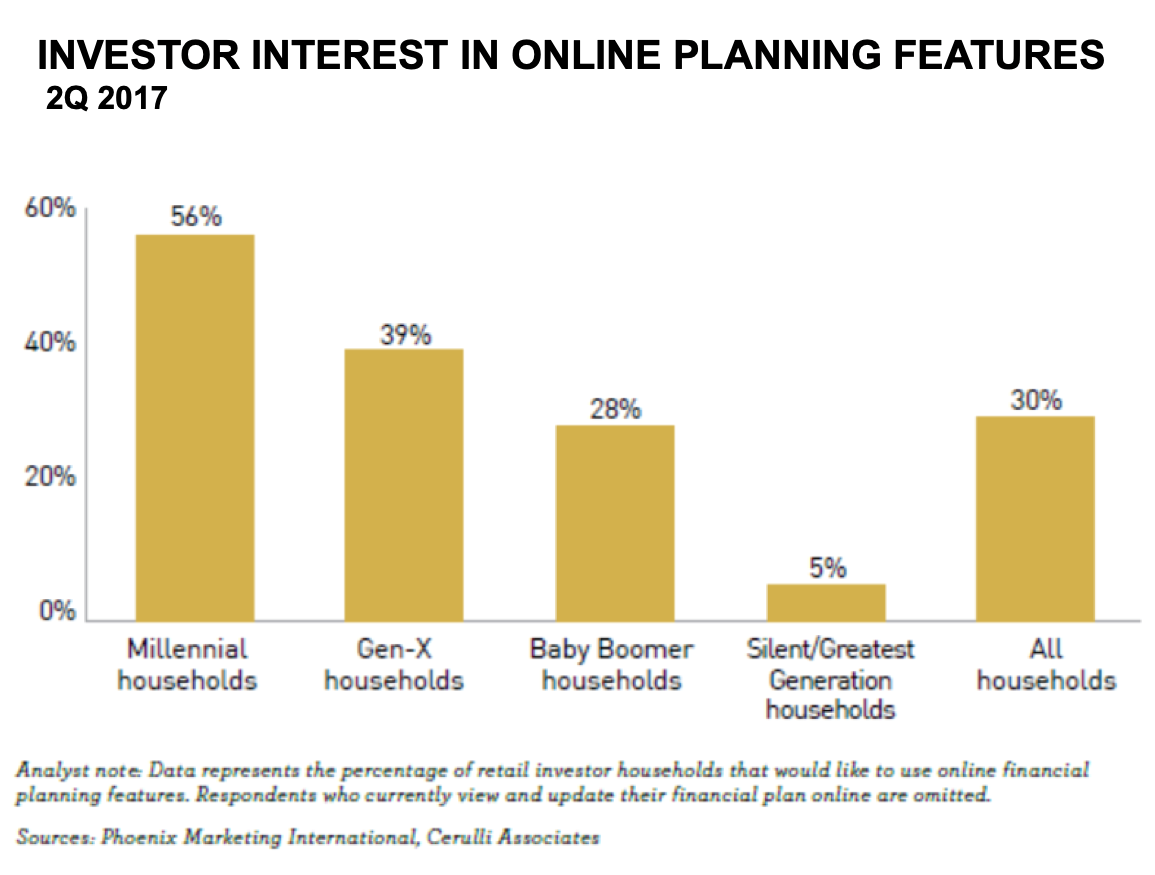

First of all, it’s important that advisors recognize that technology has become a vital medium for millennials, generation Xers and their cohorts. The Gen Xers and millennials talk through technology. It is often their first communication preference. So then, are you talking to your younger clients, in their preferred language? As the chart below shows, there is generationally growing interest in online planning tools and technology. How are you incorporating these tools into your practice?

Click image to enlarge

Click image to enlargeTechnology can also help you prioritize your time, so that you, the human advisor, are focused on the highest value deliverables. Which internal processes within your practice can be automated? I know many advisors have started down that path, but you can likely do more. How are you using technology to automate low-value tasks and shift your saved minutes to more client-facing time?

Do you have an online presence and social media support that drives your brand. Don’t just think in terms of your website. Think of your online presence as your 24/7 team member that plays an increasingly vital role with prospects that perhaps you’ve never even met. If these prospects can get a good feel for what you offer—including not just your expertise and your services, but also your personality and the personality of your team—then these prospects have a higher likelihood of making a valuable connection.

Finally, how can you leverage technology to support your inventory strategies and the customer experience of your existing clients? This is another place where technology can be used to shift time to more client-facing tasks.

The bottom line

In the formula of advisor value, C is for the cost of basic investment-only management. This basic service is not only worthwhile, it is necessary. We encourage advisors to explore how both robos and skilled outsourcing partners can make you more effective and efficient in this area, so that you can spend your precious minutes where they add the most value, both for you and your clients.

To learn more about the 2019 Value of an Advisor Study, click here.