Concentrated stock positions: The consequence of forgetting to spring clean a portfolio

Executive summary:

- Spring cleaning is essential to a cleaner home, just like rebalancing is essential to keeping an investor on track.

- When rebalancing hasn’t been done regularly, the portfolio can become unbalanced with potentially large concentrated stock or sector positions.

- Using Direct Indexing can help whittle down those concentrated holdings while managing the potential tax bill

My wife and I waited until mid-June to get around to our annual Spring Cleaning but are we ever glad we got it done. Spring Cleaning can be a cumbersome task but it’s also an amazing reset.

I started in the garage where I keep my toys, and my wife started in her closet where she keeps her prized possessions – her wardrobe. I was able to get rid of a pair of skis that were 15 years old, and she was able to donate many formal business suits, blazers and skirts worn daily in her former career in New York. Now working for a tech company in California, her wardrobe is a bit more casual.

Spring Cleaning is a great way to do an inventory check of items that may have treated us well in the past but are no longer necessary or need to be updated. The result for us was a cleaner home and more storage space, which made us feel accomplished and much calmer in our everyday activities and routines.

Spring and summer can also be a great time for an inventory check of your clients’ investment portfolios. Diversification is not a new concept for investors and financial advisors. We’ve all heard the phrase “don’t put all your eggs in one basket.” But in a decade of looking at investment portfolios, I’ve found that is often what investors do. Whether it’s a single concentrated stock position, an overweight to a certain asset class, industry or geography, investors often end up with a portfolio that’s a little lopsided, which may expose them to more risk than initially intended.

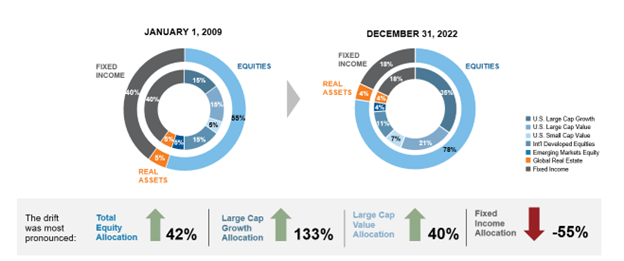

Take a look at this chart from our Value of an Advisor study that shows what happens to a well-diversified portfolio when it isn’t regularly rebalanced, which I see as the equivalent of an annual Spring Cleaning.

Just like letting my stuff accumulate in the garage, the hypothetical balanced portfolio of 2009 below would have accumulated a lot more equity (especially U.S. large cap growth) and morphed into a growth portfolio by the end of 2022, if it hadn’t been rebalanced. This may become a problem if there is a sudden and serious drawdown in that asset class.

Click image to enlarge

Portfolio: U.S. large cap = Russell 1000® Index; U.S. small cap = Russell 2000 Index; non-U.S. developed = MSCI EAFE Index; Emerging markets equity = MSCI Emerging Markets Index; REITs = FTSE NAREIT All Equity REITs Index; and fixed income = Bloomberg U.S. Aggregate Bond Index. For illustrative purposes only. Not intended to represent any actual investment.

Your clients who haven’t done any portfolio Spring Cleaning in some time may have much more of a certain stock or asset class in their portfolio than they think. That may make their portfolio riskier than they had intended. This is why an annual inventory check (like a purge of your closet) is so valuable.

Concentrated Stock Position & Unintended Risk

Just like that old pair of skis that once had the best technology and were a great fit for me on the mountain, many investors hold onto a concentrated stock position that may no longer fit their risk appetite or goals. A concentrated stock position is when an investor holds more than 10% of their portfolio in a single name. Often they have amassed this position either as a form of compensation from their job, they bought in early at a company that saw incredible growth (like Apple or Amazon) or they inherited the stock from a family member.

Are there risks to holding a concentrated position? Well, consider how much impact a downturn in the price of that individual stock could have on the investor’s overall wealth and future or current retirement.

Reducing a concentrated stock position isn’t always easy. There may be emotional ties to the name (like the ship in a bottle your Uncle Frank gave you before he died. You know it takes up valuable space, but it’s hard to part ways with it because it reminds you of your favorite uncle). There may also be serious tax implications to divesting if the holding has experienced substantial gains – which contributed to making it such a large holding in the portfolio. If that stock has been in the portfolio for some time, the original cost of the shares could be a small fraction of the current price, which would trigger a massive capital gain and a massive tax bill.

Direct Indexing can be a versatile tool to clean up that portfolio and minimize the tax impact of doing so. It allows the investor to hold a basket of stocks that replicate an index. Since the investor directly owns the stocks in a separately managed account, they can offset the capital gains from selling the concentrated stock position with capital losses generated from other securities held in the portfolio. The gains can be taken over a determined period, and the losses can be taken from any of the equities held within the separately managed account. The investor can even hold onto a portion of the shares in the concentrated position, which could help mitigate some of the emotional distress of divestment. Direct indexing is also helpful if the investor has a significant weighting to one sector and wants to pare it down.

The bottom line

Spring cleaning is a great way to clear up space in your garage or closet and it can also help you find items you may have misplaced, haven’t seen for a while, or completely forgotten you owned.

Spring Cleaning, or rebalancing an investment portfolio, can have the same impact. Our annual Value of an Advisor study includes rebalancing as one of the key value-added activities that advisors offer their clients. It’s an essential activity that can help keep your clients on the investment journey that best fits their risk profile and return goals. When your clients don’t rebalance regularly, they could end up with overweights to a specific stock or sector. Direct indexing can help you keep them on their journey while managing the potential tax bite from reducing a concentrated holding.